You are considering an investment that is expected to pay 5 percent in year 1, 7 percent in years 2 and 3 and 9 percent in year 4. If you invest $2,000 today, what will this investment be worth at the end of the fourth year? A. $2,620.68 B. $2,693.71 C. $2,713.04 D. $2,501.42

Q: The following financial information belong to the Avatar Inc. that is currently listed on the stock…

A: Required rate of return = 20% Earnings per Share (EPS) = RM 6 per share Dividend payout ratio = 45%…

Q: In 2022, a makeup company cash flow from assets was $8,980, cash flow to creditors was $890, and…

A: A common financial statement that details a company's sources and uses of cash over a given time…

Q: d) A person invests $50,000 in an investment that earns 6 percent. If $6,000 is withdrawn each year,…

A: Step 1 The idea of the time value of money (TVM) holds that a quantity of money is worth more now…

Q: 1. Marcos Pizza needs $2,224 in 2 year and can earn 3.75% during the period. How much does he need…

A:

Q: 1. Consider a one period binomial model. Suppose So = 1 at t = To; and Su = 2 and Sa = at time T₁.…

A: Three question appear on screen. First two are related, hence they have been solved in entirety.…

Q: An investor pays £100 for an asset. Exactly one year later, the investor sells the asset for £X.…

A: Present value of the Assets = pv = £100 Time = t = 1 years Real yield = y = 8.7% + 3% = 11.7%…

Q: Kingston Development Corp. purchased a piece of property for $2.79 million. The firm paid a down…

A: Monthly payment refers to an amount that is paid at every month including principal and interest…

Q: Cinqua Terra Incorporated issued 10-year bonds three years ago with a coupon rate of 8.50% APR. The…

A: We know that the bond has a face value of $1,000, a coupon rate of 8.50% APR, and pays coupons…

Q: Suppose an investor is considering a corporate bond with a 6% before-tax yield and a tax-free…

A: Before tax rate = 6% To determine the marginal tax rate at which an investor would prefer the…

Q: Name the Price James Bond bought a 100,000 par value bond from MI Inc. with a term of 5 years and a…

A: A bond reveals a debt instrument that obliges the issuer to pay and the holder to receive a set of…

Q: The gaming commission is introducing a new lottery game called Infinite Progresso. The winner of the…

A: Net present value shows the difference between the net cash inflows and outflows during the year.…

Q: A portfolio consists of 175 shares of Stock C that sells for $37 and 140 shares of Stock D that…

A: Number of shares of stock C = 175 Price per stock = $37 Value of stock C in portfolio (C) = 175*37 =…

Q: You are looking to invest in your company's 401(k) for your retirement. Their conservative plan…

A: The concepts of TVM will be used and applied here. TVM refers to time value of money.

Q: A savings plan requires an investor to pay 10 installments, each one of $500, due at the end of…

A: A series of financial payments made at regular intervals over a limited amount of time make up an…

Q: What would be more valuable, receiving $600 today or receiving $900 in four years if interest rates…

A: TVM computation refers to time value of money computation. We will need to find the present value…

Q: i want accurate answer with proper explanation please no handwriting only typed answer a. Make a…

A: Tesla, Inc. is an American electric vehicle and clean energy company based in Palo Alto, California.…

Q: Find the savings plan balance after 32 months with an APR of 2% and monthly payments of $393.

A: Future value is the estimated value of the asset at a future date on an assumed growth rate.…

Q: Identify the matrix A as a square matrix, column matrix, row matrix, or neither and determine the…

A: The given matrix is a 3x3 square matrix. What is a square matrix? A Square matrix is a matrix where…

Q: The risk-free rate of return is 5.8 percent and the market risk premium is 13 percent. What is the…

A: To calculate the expected rate of return on a stock we will use the below CAPM formula Expected…

Q: 11. Which of the following forms part of working capital? Select one: Long-term debt Machinery…

A: Working capital is the capital available for the day-to-day operations of a business and is used to…

Q: Funds are embezzled from a company, what type of fraud was committed and describe the symptoms of…

A: Funds embezzlement refers to the act of dishonestly withholding or misappropriating funds that have…

Q: The following table lists several corporate bonds. Treat these as zero coupon bonds, as in Example…

A: Step 1 Maturity Value Maturity value is the sum that will be paid on a loan's due date or the sum…

Q: Exercise 3: Assume you have the following quotes, calculate how a market trader at Citibank with USD…

A: No. 1 We will use the following steps to calculate profit from arbitrage. #1 : Convert USD to Euros…

Q: Ludwig borrowed $8,000 on July 20, at 11% interest. If the loan was due on October 17, what was the…

A: Step 1 A percentage of the principal, or the amount loaned, is what a lender charges a borrower as…

Q: Calculate the Theoretical Ex-Rights price (in pence)? Calculate the price each right is likely to…

A: First, we need to determine the number of shares that is going to be issued under the rights issue…

Q: The first amount was inccorect

A: Solution:- When equal amount is paid each period at end of period, it is called ordinary annuity.…

Q: Which of the following statements are true? Select the two correct answers. Responses A) credit…

A: E) You can never use a store credit card anywhere else. Store credit cards can only be used at the…

Q: Required: 1. Analyzed the financial condition of the company using different techniques in Financial…

A: Financial statement analysis refers to the evaluation and assessment of the financial statement.…

Q: Pay day loans are short term loans that you take out against future paychecks: The company advances…

A: Payday loans are short-term loans that can be used to cover emergency expenses or make ends meet in…

Q: 2. Emphasis Plc is an all-equity financed firm that has a cost of capital of 10%. The firm is…

A: Given the following: Unlevered cost of equity, rU = 10% Debt-equity ratio, D/E = 1/2 Levered cost…

Q: Donald Foster owes $68,400 on an 8%, 140-day note. On day 15, he pays $17,100 on the note. On day…

A: A loan maturity value is the sum that is owed and due to be paid to the holder on the day of the…

Q: Twelve years ago, Mr. Lawton rolled a $19,000 retiring allowance into an RRSP that subsequently…

A: The concept of time value of money will be used here. Money deposited today will earn interest and…

Q: You put half of your money in a stock that has an expected return of 14% and a standard deviation of…

A: Weight of Stock and bond = 50:50 To calculate the variance of the portfolio, we need to use the…

Q: Which statement is true about an annual percentage rate (APR)? A) it is of little interest to the…

A: APR The yearly percentage rate is referred to by this phrase. The annual percentage rate can be…

Q: Q3-1 What are the five groups of financial ratios? Give two or three examples of each kind. Q3-2…

A: Step 1 Financial Ratio Financial ratios are calculated using numbers collected from financial…

Q: Select one: When the person managing the business for an owner, acts in accordance with the owner's…

A: The principal agent relationship is a type of relationship between the agent will be acting on…

Q: Under which process might you not have to pay off all your debts in full? A) chapter 7 bankruptcy B)…

A: Under Chapter 7 bankruptcy, however, you are required to liquidate your assets to pay off your…

Q: You own a stock that had returns of 10.09 percent, −7.08 percent, 23.22 percent, and 15.73 percent…

A: Stock return in Year 1 (R1) = 10.09% Stock return in Year 2 (R2) = -7.08% Stock return in Year 3…

Q: You just won the lottery! As your prize you will receive $2,500 a month for 10 years. If you can…

A: To calculate the prize worth today we will use the below formula Prize worth today =…

Q: What is the principal objective of the production budget? Forecast cost of goods sold to…

A: A production budget spells out the quantum and timing of production. It's a statement of what to…

Q: On June 30, 2018, Blue, Inc. leased a machine from Large Leasing Corporation. The lease agreement…

A: Present Value (PV) is a financial concept that represents the current value of a future sum of money…

Q: TJMaxx (TJX) stock is currently selling for $805.02. You are thinking about buying it and you hope…

A: The amount of money invested over a period of time with the assumption of investment growth at a…

Q: Sampson and Jaqueline had $2,500 in domestic adoption expenses in 2020, $2,500 in adoption expenses…

A: The adoption Credit is a benefit available for an individual for the adoption expenses borne to…

Q: Which of the following statements is false for convertible debt? * None of the below In the U.S.,…

A: In the U.S., convertibles tend to be issued by smaller firms.: Yes, that statement is true. In the…

Q: Only typed answer You buy a TIPS at issue at par for $1,000. The bond has a 3% coupon. Inflation…

A: Coupon Payment The annual interest rate paid on a bond from the date of issuance to maturity is…

Q: With a present value of $130,000, what is the size of the withdrawals that can be made at the end of…

A: Present value of annuity PV = (PMT / i) x [1 - (1 + i)^(-n)] where PV is the present value of the…

Q: The fields of accounting and finance are broad and are divisible into many sub-fields: (a)…

A: Hi student Since there are multiple questions, we will answer only first question. Accounting means…

Q: Defined capital budgeting. What are the capital budgeting methods used by managers?

A: Capital budgeting is the process of making investment decisions in long-term assets such as…

Q: Define an inverted yield curve. What does it indicate?

A: A yield curve is a graph that shows the yields of bonds with different maturities. Normally, a yield…

Q: A client has $400,000 in an account that earns 10% per year, compounded monthly. The client's 35th…

A: Here, Present value of the savings account PV” = $400000 Interest rate = 10% Rate per month “r” =…

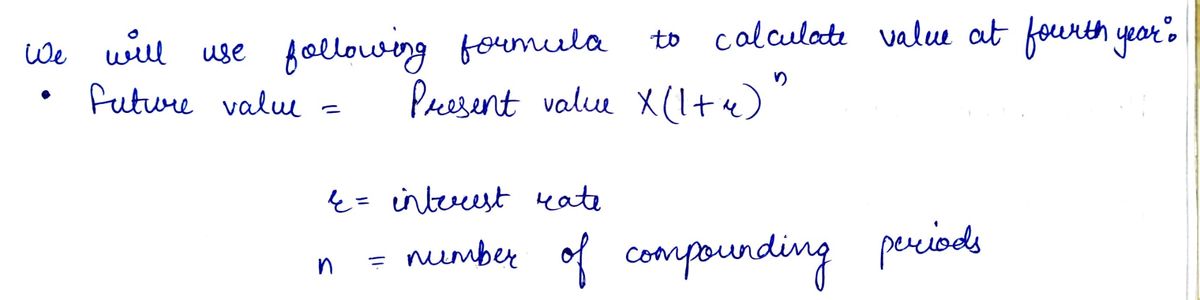

You are considering an investment that is expected to pay 5 percent in year 1, 7 percent in years 2 and 3 and 9 percent in year 4. If you invest $2,000 today, what will this investment be worth at the end of the fourth year?

A. $2,620.68

B. $2,693.71

C. $2,713.04

D. $2,501.42

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- If you invest $15,000 today, how much will you have in (for further instructions on future value in Excel, see Appendix C): A. 20 years at 22% B. 12 years at 10% C. 5 years at 14% D. 2 years at 7%If you invest $12,000 today, how much will you have in (for further Instructions on future value in Excel, see Appendix C): A. 10 years at 9% B. 8 years at 12% C. 14 years at l5% D. 19 years at 18%How much would you invest today in order to receive $30,000 in each of the following (for further Instructions on present value In Excel, see Appendix C): A. 10 years at 9% B. 8 years at 12% C. 14 years at 15% D. 19 years at 18%

- An investment will pay $600 at the end of each of the next 2 years, $700 at the end of Year 3, and $1,000 at the end of Year 4. What is its present value if other investments of equal risk earn 6 percent annually? a. $1,821.82 b. $1,913.83 c. $2,297.07 d. $2,479.86 e. $2,735.85You want to have $3.5 million in real dollars in an account when you retire in 50 years. The nominal return on your investment is 8 percent and the inflation rate is 3.5 percent. What real amount must you deposit each year to achieve your goal? A. $20,569.90 B. $6,100.00 C. $21,598.40 D. $21,392.70 E. $19,541.41Assume you invest $1 000 at the end of this year, at the end of the second year, and at the end of the third year. How much will you have at the end of the fourth year if interest rates are 5% p.a.? Select one: a. $3,405.54 b. $3,310.12 c. $3,215.41 d. $3,100,21

- An investment pays $200 at the end of Year I. $250 at the beginning* of Year 2. $387 at the end of Year 4. and $500 at the beginning of Year 6. If other investments of equal Mk earn 7.5% annually. what will be this investments present value and future value?A new investment opportunity for you is an annuity that pays $1,100 at the beginning of each year for 3 years. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? Select the correct answer. a. $3,141.25 b. $3,130.95 c. $3,120.65 d. $3,110.35 e. $3,100.05How much will you pay for an investment if you expect to receive $7.000 end of each years for 5 years and if the appropriate interest rate is 4.5%? $27,831.47 $29,851.84 O $29,083.89 O $30,729.84 $38,294.97 O $8,723.27

- How much would you be willing to pay today for an investment that would return P1,250 each year for the next 10 years, assuming a discount rate of 12 percent? A. P4,062.75B. P5,062.75C. P6,062.75D. P7,062.75E. None of the aboveYou are offered an investment that will pay you GH¢ 200 in one year, GH¢ 400 the next year, GH¢ 600 the next year and GH¢ 800 at the end of the next year. You can earn 12 percent on very similar investments. What is the most you should pay for this one? A. Ghc 508.41 B. GHC 1,432.93 C. Ghc 2,000 D. Ghc 1,300If you invest $9,400 per period for the following number of periods, how much would you have received at the end? ( Use a Financial calculator to arrive at the answers. Round the final answers to the nearest whole dollar.) a. 12 years at 6 percent. Future value $ b. 18 years at 8 percent. Future value $ c. 25 periods at 16 percent. Future value $