Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

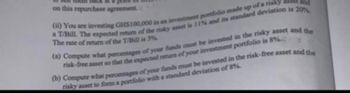

Transcribed Image Text:on this repurchase agreement.

(a) You are investing GHS100,000 in an investment portfolio made up of a risky ass and

a T/Bill. The expected return of the risky asset is 11% and its standard deviation is 20%

The rate of return of the T/Bill is 3%

(a) Compute what percentages of your funds must be invested in the risky asset and the

risk-free asset so that the expected return of your investment portfolio is 8%

(b) Compute what percentages of your funds must be invested in the risk-free asset and the

risky asset to form a portfolio with a standard deviation of 8%.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- You invest $100 in a risky asset with an expected rate of return of 15% and a standard deviation of 15% and a T-bill with a rate of return of 5% and E (U)= E(r) - 0.5Ao. Suppose your risk aversion factor is 5. What weight would you assign to the risk-free asset? A) 0.8889. B) 0.1111. C) 0.2457. D) 0.2111. . Which of the following statements is true regarding the optimal risky portfolio: A) It is designated by the point of tangency with iso-utility curve and the capital allocation line. B) It is designated by the point of highest Sharpe ratio in the opportunity set. C) It is designed by the point of tangency with the opportunity set and the securities market line. D) This portfolio gives the highest standard deviation risk per unit of risk premium in the opportunity set.arrow_forwardThe investor has R60,000 to invest. R15,000 will be invested into the market portfolio, R10,000 into asset A and R25,000 into asset B. The balance will be invested into the risk-free asset. The beta for asset A and asset B is 0.90 and 1.2 respectively. What is the portfolio beta? What is the correct answer? A. 0.09 B. 0.90 C. 0.91 D. 0.92arrow_forwardYou invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04.What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.11? A. 62.5% and 37.5% B. 53.8% and 46.2% C. Cannot be determined. D. 75% and 25% E. 46.2% and 53.8%arrow_forward

- An investment has the following cash flow profile. For each value of MARR below, what is the minimum value of X such that the investment is attractive based on an internal rate of return measure of merit? a. MARR is 12%/yr.b. MARR is 15%/yr. c. MARR is 24%/yr. d. MARR is 8%/yr. e. MARR is 0%/yr.arrow_forwardTelluride Tours is currently evaluating two mutually exclusive investments. After doing a scenario analysis and applying probabilities to each scenario, it has determined that the investments have the following distributions around the expected NPVS. Probability NPVA NPVB 10% -$39,780 -$14,918 20% -9,945 2,486 40% 19,890 19,890 20% 49,725 37,294 10% 79,560 54,698 Several members of the management team have suggested that Project A should be selected because it has a higher potential NPV. Other members have suggested that Project B appears to be more conservative and should be selected. They have asked you to resolve this question. Calculate the expected NPV for both projects. Can the question be resolved with this information alone? а. b. Calculate the variance and standard deviation of the NPVS for both projects. Which project appears to be riskier?arrow_forwardou invest $1000at time t=0 and an additional $5000 at time t=1/2. At time t=1/2 you have $1300 in your account and at time t=1 you have $6100 in your account. Find the dollar-weighted rate of return rd and the time-weighted rate of return rt on this investment.arrow_forward

- You are evaluating five different investments, all of which involve an upfront outlay of cash. Each investment will provide a single cash payment back to you in the future. Details of each investment appears here: Calculate the IRR of each investment. State your answer to the nearest basis point (i.e., the nearest 1/100th of 1%, such as 3.76%). The yield for investment A is The yield for investment B is The yield for investment C is The yield for investment D is The yield for investment E is %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) C Data table Investment A B с D E Initial Investment $1,600 $10,000 $600 $3,400 $5,200 Future Value Print $3,120 $15,775 $2,923 $4,526 $8,789 End of Year 10 11 16 Done 3 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 12 D Xarrow_forwardYou invest $1000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. Assume the T-bill’s rate doesn’t change over your investment horizon. What percentages of your money must be invested in the risky asset to form a portfolio with an expected return of 0.11? (Hint: a value between 0 to 1).arrow_forwardSuppose the risk-free rate is 5%. The expected return and standard deviation of a risky asset are 10% and 20%, respectively. a. What is the slope of the capital allocation line (CAL) constructed using the risk-free asset and the risky asset? A. 0.30 B. 0.15 C. 0.25 D. 0.20 b. If an investor has a risk aversion coefficient of A=2, what is the optimal fraction of the money that she invests in the risky asset? A. 62.5% B. 42.5% C. 30% D. 20% c. If an investor invest 25% of her money in the risky asset, which is the investor’s risk aversion coefficient? a. 5 b. 1 c. 3 d. 4arrow_forward

- i need your solution wit explain...arrow_forwardThe expected return for the investment is ??? The standard deviation is ??? While the expected return for the risk-free assets, Treasury Bills, is ??? The standard deviation is ???arrow_forwardFind the expected portfolio return and standard deviation if you were to invest 50% of your portfolio in Asset B, 50% in Asset C, with no allocation to Asset A. Compute your answers to the nearest tenth of a basis point. (See attached data file) We know that Asset A: B: C: expected return: 1.16 1.35 1.38 expected standard deviation: 2.88 1.58 2.19arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education