ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

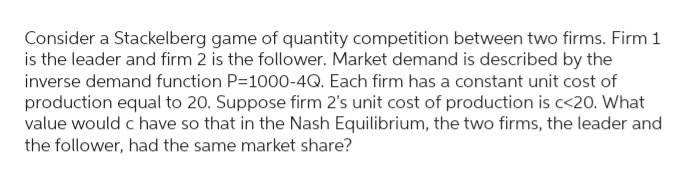

Transcribed Image Text:Consider a Stackelberg game of quantity competition between two firms. Firm 1

is the leader and firm 2 is the follower. Market demand is described by the

inverse demand function P=1000-4Q. Each firm has a constant unit cost of

production equal to 20. Suppose firm 2's unit cost of production is c<20. What

value would c have so that in the Nash Equilibrium, the two firms, the leader and

the follower, had the same market share?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Two firms X and Y compete with each other. Firm X can produce one of three products X1, X2, or X3. Similarly, firm Y can produce one of three products Y1, Y1, and Y3. Each firm's profit depends on its own and its competitor's decision about which product to produce. These profits are given in the table below where each cell presents profits corresponding to a pair of chosen strategies with the first number being the profit of firm X and the second being the profit of firm Y. For example, if X chooses to produce X3 and Y chooses to produce Y1, the profit of X will be $15 and the profit of Y will be $20. The firms make their product choice decisions simultaneously and independently of each other. Y1 Y2 Y3 X1 0, 0 12, 8 16, 16 15, 20 18, 9 20, 15 8, 12 18, 18 9, 18 X2 X3 11) Does this game have any equilibrium in dominant strategies? If yes, find all of them. 12) In addition to the equilibria (if any) you found in the previous question, does this game have any other equilibria? If yes,…arrow_forwardWe can see from the payoff matrix that there are no pure strategy Nash equilibrium in this game because at least one firm would always have an incentive to change its behavior. From Nash's theorem, we know there must be at least one Nash equilibrium so there must be a mixed strategy Nash equilibrium for this game. Find the mixed strategy Nash equilibrium by first deleting all dominated strategies in the game What's the expected payoff to Firm 1 in the equilibrium?arrow_forwardSuppose two firms A and B compete against each other in a Cournot fashion by choosing their quantities. What is the Nash Equilibrium of the game if both firms have a constant marginal cost of 2 and the price in the market is: p(qa + qB) = 20 – 2(qA + qB). O (3, 3) O (2, 2) O (4, 4) None of the other answers are correct (5, 5)arrow_forward

- Can a strategy be dominant for one player in a Nash equilibriumarrow_forwardImagine that there are two snowboard manufacturers (FatSki and WideBoard) in the market. Each firm can either produce ten or twenty snowboards per day. The table below (see attached) shows the profit per snowboard for each firm that will result given the joint production decisions of these two firms. Draw the game payoff matrix for this situation. Does either player have a dominant strategy? If so, what is it? What is the Nash equilibrium solution and how many boards should each player produce each day? Since FatSki and WideBoard must play this game repeatedly (i.e. make production decisions every day), what strategy would you advise them to play in order to maximize their payoff over the long term?arrow_forwardWe can see from the payoff matrix that there are no pure strategy Nash equilibrium in this game because at least one firm would always have an incentive to change its behavior. From Nash's theorem, we know there must be at least one Nash equilibrium so there must be a mixed strategy Nash equilibrium for this game. Find the mixed strategy Nash equilibrium by first deleting all dominated strategies in the game What's the expected payoff to Firm 2 in the equilibrium?arrow_forward

- Imagine a small town with three car repair shops competing for a limited number of customers. Explain why the three shops working together to keep their prices high is unlikely to be a Nash equilibrium.arrow_forwardO Cell A O Cell C O Cell E O Cell I None of the abovearrow_forwardQUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forward

- In the game above, what is/are the EFFICIENT sub-game perfect Nash equilibrium?arrow_forwardWhile game theory predicts non-cooperative behavior for a one-shot Prisoner's dilemma. By repeating the game, say 20 rounds, it becomes possible to adopt more complex strategies that allow cooperative play as a Nash Equilibrium in at least some rounds of the game. True Falsearrow_forwardTwo players F and C obtain the payoffs described in the matrix below when playing strategies F1, F2 and F3 (for player F) and strategies C1, C2 and C3 for player C. Select the CORRECT statement C1 C2 C3 F1 8,2 1, 1 4,0 F2 0,2 5,1 1,0 F3 1,3 0, 100 9,0 Select one: The Nash equilibrium in pure strategies is [F1, C1] ○ b. There is no Nash equilibrium in pure strategies c. Player C dominant strategy is C1 ○ d. Player F dominant strategy is F1 e. The Nash equilibrium in pure strategies is [F3, C2]arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education