ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

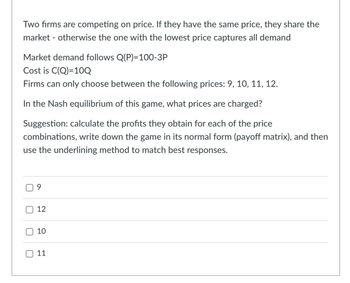

Transcribed Image Text:Two firms are competing on price. If they have the same price, they share the

market otherwise the one with the lowest price captures all demand

Market demand follows Q(P)=100-3P

Cost is C(Q)=10Q

Firms can only choose between the following prices: 9, 10, 11, 12.

In the Nash equilibrium of this game, what prices are charged?

Suggestion: calculate the profits they obtain for each of the price

combinations, write down the game in its normal form (payoff matrix), and then

use the underlining method to match best responses.

U

ப

U

9

12

10

110

11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer to image?arrow_forwardThere are three players in this simultaneous move game. Player-3 chooses between game A and game B. Player-1 chooses between U, M and D. Player-2 chooses between L and R. The payoffs are given below: P-1 U M D A P-2 L R 5,5,0 1,4,0 6,4,5 2,5,3 3,1,2 3,3,1 Find all pure strategy N.E. of this game. P-1 U M D L 4,8,0 4,1,3 3,5,1 B P-2 R 2,1,0 3,3,3 0,3,0arrow_forward2 firms are engaged in Cournot competition; firm A faces the cost curveCA(yA)=40yAand firm Bfaces the cost curveCB(yB)=40yB. The inverse market demand curve isP(y)=100y, whereyrepresents market level of output. a)Define the Cournot game. b)In 1 or 2 sentences explain why a firm has no incentive to deviate from the Cournot Nash equilibrium(holding their opponent’s strategy constant). c)Find the Cournot Nash Equilibrium. d)Now suppose instead of playing their strategies at the same time, firm A moves first and then firm B moves second(sequentialgame).Does firm A earn higher profits in this game or the game in part c)?arrow_forward

- Solve the attahment.arrow_forwardAnswer the following questions: 1.What is the Nash Equilibrium of this game? 2. Does Starbucks have dominant pricing strategy, given these predicted payoffs? Does Dunkin' Donuts have a dominant pricing strategy, given these payoffs? Explain. 3. Is this game an example of a prisoner's dilemma? Why or why not?arrow_forwardFor problem 1 and 2, consider the following game : с D A (0,5) (5,-5) B (3, 1) (1, 0) 1. Show that the game above doesn't have a pure Nash equilibrium. 2. Show that the game above has a unique mixed Nash equilibrium, and describe the playing strategy.arrow_forward

- We can see from the payoff matrix that there are no pure strategy Nash equilibrium in this game because at least one firm would always have an incentive to change its behavior. From Nash's theorem, we know there must be at least one Nash equilibrium so there must be a mixed strategy Nash equilibrium for this game. Find the mixed strategy Nash equilibrium by first deleting all dominated strategies in the game What's the expected payoff to Firm 1 in the equilibrium?arrow_forwardFind the subgames, convert them into Normal-Forms, find the Subgame Perfect Nash Equilibrium step-by-step.arrow_forwardFind the Nash equilibrium strategy and payoff in this simultaneous game. Show your work. Firms can collude (C) or not collude (NC) and their profits in millions are as follows. Please see attached.arrow_forward

- Suppose two firms A and B compete against each other in a Cournot fashion by choosing their quantities. What is the Nash Equilibrium of the game if both firms have a constant marginal cost of 2 and the price in the market is: p(qa + qB) = 20 – 2(qA + qB). O (3, 3) O (2, 2) O (4, 4) None of the other answers are correct (5, 5)arrow_forwardWe can see from the payoff matrix that there are no pure strategy Nash equilibrium in this game because at least one firm would always have an incentive to change its behavior. From Nash's theorem, we know there must be at least one Nash equilibrium so there must be a mixed strategy Nash equilibrium for this game. Find the mixed strategy Nash equilibrium by first deleting all dominated strategies in the game What's the expected payoff to Firm 2 in the equilibrium?arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education