ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

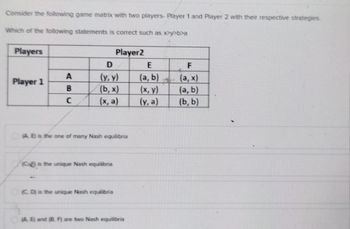

Transcribed Image Text:Consider the following game matrix with two players- Player 1 and Player 2 with their respective strategies.

Which of the following statements is correct such as x>y>b>a

Players

Player2

Player 1

A

B

C

D

(Y, Y)

(b, x)

(x, a)

(AE) is the one of many Nash equilibria

(C) is the unique Nash equilibria

(C. D) is the unique Nash equilibria

(A. E) and (B. F) are two Nash equilibria

E

(a, b)

(x, y)

(y, a)

F

(a,x)

(a, b)

(b, b)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 13 Rhodri has a lottery ticket which will pay £80 with probability 0.5 and zero otherwise. He is willing to exchange the lottery ticket for a certain £25. What is the risk premium of the lottery ticket for Rhodri? Round your answer to 2 decimal places. Add your answerarrow_forwardAa4arrow_forward**Practice** In order to alleviate their risks, they are considering a risk-sharing agreement. Carol would buy one CC and David would buy one DD. Six months from now, they would sell their coins, add up the total amount of money, and split it equally between them. Thus, if only one of the coins is successful, they would both still have some positive amount of money at the end. Assume that they can verify whether the other really made the investment. They know whether the investment is successful, since the price of the coin is public information, and they trust that the other will pay them as promised. Which of the following statements is accurate?A. They will not make that risk-sharing agreement.B. Carol is willing to take the risk-sharing agreement, but David is not.C. They may be willing to make that risk-sharing agreement, but it depends on information not given in the question.D. They will surely make the risk-sharing agreement.E. None of the statements above is correct.arrow_forward

- If the current price of a bond is greater than its face value: A) There is no right answer. B) the yield to maturity must be larger than the current yield. C) the coupon rate must be equal to the current yield.arrow_forward4) You are a financial professional working in a corporate loan department. A company named Mitch Hedberg Inc. (MH) comes to you for a loan. MH has debt from a previous loan (given by a different firm than yours) of 200. Your company analysts say that MH is likely to earn either 180, 240, or 300 this year - each with a probability of 1/3. MH wants you to lend them 100. MH could use this borrowed 100 to do either project X or project Y. Project X has a guaranteed return of 125 if the 100 is put there. Project Y may return either 0 or 210; each has probability of 1/2 and also costs 100 to do. a) Which project, X or Y, has the larger expected value? b) If you lend MH the 100, what will they do with the money? Why? Show your math. c) Should you lend MH the money or not? Show your math. d) Why did I choose the letters "MH" for this problem? What financial economic concept with initials "MH" is important in this problem?arrow_forwardYou want to travel to Las Vegas to celebrate spring break and your "A" in your microeconomics class! You are trying to figure out if you should drive or fly. A round trip airline ticket from Riverside to Las Vegas costs $350 and flying there and back takes about 5 hours. Driving roundtrip to Las Vegas costs about $50 in gas and takes about 10 hours. Other things constant, what is the minimum amount of money that you would have to expect to make by gambling in Las Vegas to induce you as a rational individual to fly rather than drive? O $10 an hour $60 an hour O $70 an hour O $300 an hourarrow_forward

- please answer the question below as soon as possible, please!arrow_forwardMicroeconomics Wilfred’s expected utility function is px1^0.5+(1−p)x2^0.5, where p is the probability that he consumes x1 and 1 - p is the probability that he consumes x2. Wilfred is offered a choice between getting a sure payment of $Z or a lottery in which he receives $2500 with probability p = 0.4 and $3700 with probability 1 - p. Wilfred will choose the sure payment if Z > CE and the lottery if Z < CE, where the value of CE is equal to ___ (please round your final answer to two decimal places if necessary)arrow_forward9. Problems and Applications Q9 Dmitri has a utility function U = W, where W is his wealth in millions of dollars and U is the utility he obtains from that wealth. In the final stage of a game show, the host offers Dmitri a choice between (A) $4 million for sure, or (B) a gamble that pays $1 million with probability 0.4 and $9 million with probability 0.6. Use the blue curve (circle points) to graph Dmitri's utility function at wealth levels of $0, $1 million, $4 million, $9 million, and $16 million. Utility (Thousands) 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0 0 2 4 8 6 10 12 14 Wealth (Millions of dollars) 16 18 20 V Utility Function ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education