Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

not use ai please

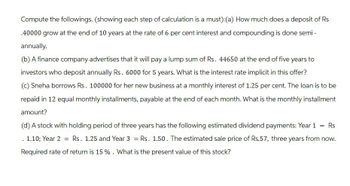

Transcribed Image Text:Compute the followings. (showing each step of calculation is a must): (a) How much does a deposit of Rs

.40000 grow at the end of 10 years at the rate of 6 per cent interest and compounding is done semi-

annually.

(b) A finance company advertises that it will pay a lump sum of Rs. 44650 at the end of five years to

investors who deposit annually Rs. 6000 for 5 years. What is the interest rate implicit in this offer?

(c) Sneha borrows Rs. 100000 for her new business at a monthly interest of 1.25 per cent. The loan is to be

repaid in 12 equal monthly installments, payable at the end of each month. What is the monthly installment

amount?

(d) A stock with holding period of three years has the following estimated dividend payments: Year 1 = Rs

==

1.10; Year 2 = Rs. 1.25 and Year 3 = Rs. 1.50. The estimated sale price of Rs.57, three years from now.

Required rate of return is 15 %. What is the present value of this stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What lump sum of money must be deposited into a bank account at the present time so that $500 per month can be withdrawn for five years, with the first withdrawal scheduled for six years from today? The interest rate is 0.75% per month.arrow_forwardI hope you could write the formula and process more clearly. Thank youarrow_forward1.-What is the size of 60 monthly payments and 5 annuities that result from the purchase of land with a value of $ 500,000, if the interest rate is 18% per year, and the payment conditions are 10% down payment and the rest is distributed equally in monthly payments and annuities? 2.-A person deposits an annual amount in a savings account that decreases at a constant rate of $ 500 per year. The size of the first deposit made is $ 10,000 and the last one is $ 5,500. If 15% per year is earned in the savings account, how large must a constant annual deposit be for the same time, so that the accumulated amount is the same?arrow_forward

- Ten Thousand dollars is deposited into a savings account at 1.8% interest compounded monthly. How many months are required for the balance to reach $10,665.74? After how many months will the balance exceed $11,000? Do not solve by formula ONLY TVM SOLVER. I need to know which numbers to plug into the TVM solver and where.arrow_forward1.) An amount of R1 500 is deposited in a bank paying an annual interest rate of 4.3%, compounded quarterly. Find the balance after 6 years. 2.) Your goal is to accumulate R30 000 after 17 years from now. How much must you invest now to have, at an interest rate of 8% compounded semi-annually? 3.) If R500 accumulated to R700 in 5 years with a certain interest compounded quarterly, what is the rate of interest? 4.) A debt of R5000 is to be amortised by 5 quarterly payments made at 3 month intervals. If interest is charged at the rate of 12% convertible quarterly, find the period payment and construct an amortisation schedule. Round the payment up to the nearest cent. 5.) Raees Braai Ltd has the following capital structure: Equity, 2000000, R2, ordinary shares, market price R2, 50 Preference, 1000000, 12%, R1 preference shares, market price R1,20 Reserves R1500 000 Bank loan R500 000, 15% bank loan Debentures R 1750000,16% debentures, market price R110 (issued at R100). The current and…arrow_forwarda. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal comes from deposits and how much comes from interest? Periodic Deposit Rate Time $? at the end of each year 5% compounded annually 14 years Financial Goal $130,000 Click the icon to view some finance formulas. a. The periodic deposit is $ ☐. (Do not round until the final answer. Then round up to the nearest dollar as needed.) b. S of the $130,000 comes from deposits and $ comes from interest. (Use the answer from part (a) to find these answers. Round to the nearest dollar as needed.)arrow_forward

- These are 2 subsections of the same question, please answer both questions. Please round the answer up to TWO decimal places. A) You make a loan of R100 000, with annual payments being made at the end of each year for the next 5 years at a 10% interest rate. How much interest is paid in the second year? R B) How long in years would it take you to double the amount of money you have in your bank account if you can invest at 7%, compounded monthly?arrow_forwardFind the equivalent present worth of the cash receipts in the accompanying diagram, where i = 8% compounded annually. In other words, how much do you have to deposit now (with the second deposit in the amount of $1,000 at the end of the first year) so that you will be able to withdraw $600 at the end of the second year through the fourth year, and $800 at the end of the fifth year, where the bank pays you 8% annual interest on your balance?arrow_forwardFind the equivalent present worth of the cash receipts in the accompanying diagram, where i = 8% compounded annually. In other words, how much do you have to deposit now (with the second deposit in the amount of $1,000 at the end of the first year) so that you will be able to withdraw $600 at the end of the second year through the fourth year , and $ 800 at the end of the fifth year , where the bank pays you 8% annual interest on your balance ?arrow_forward

- You have a bank deposit now worth $5000. How long will it take for your deposit to be worth more than $8000 if a. The account pays 5 percent actual interest every half-year and is com- pounded every half-year? b. The account pays 5 percent nominal interest, compounded semiannually?arrow_forwardYou deposit $4,000 today in a bank that promises to pay an annual interest of 8%? What is future value of this sum at the end of 12 years? b. What if the bank pays 8% interest compounded monthly? What if the bank pays 8% interest compounded quarterly? What interest will the bank have to pay if the future value has to be $12,000 at the end of 12 years? d. Using information from (la) only, what quarterly compounded interest rate should the bank quote in order to provide the same interest as the 10% annual rate? What should be the quoted continuously compounded rate if it is to be the same as the 10% annual rate? Provide the rates per annum. What is the APR? Do we use APR or EAR when we are calculating the present а. с. е. value of an investment?arrow_forwardYou plan to deposit $700 in a bank account now and $900 at the end of one year. If the account earns 2% interest per year, what will the balance be in the account right after you make the second deposit? There will be $ in the account right after the second deposit. (Type an integer or a decimal.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education