Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

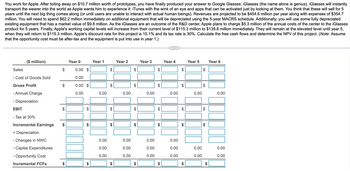

Transcribed Image Text:You work for Apple. After toiling away on $10.7 million worth of prototypes, you have finally produced your answer to Google Glasses: iGlasses (the name alone is genius). iGlasses will instantly

transport the wearer into the world as Apple wants him to experience it: iTunes with the wink of an eye and apps that can be activated just by looking at them. You think that these will sell for 5

years until the next big thing comes along (or until users are unable to interact with actual human beings). Revenues are projected to be $454.6 million per year along with expenses of $354.7

million. You will need to spend $62.2 million immediately on additional equipment that will be depreciated using the 5-year MACRS schedule. Additionally, you will use some fully depreciated

existing equipment that has a market value of $9.8 million. As the iGlasses are an outcome of the R&D center, Apple plans to charge $5.3 million of the annual costs of the center to the iGlasses

product for 5 years. Finally, Apple's working capital levels will increase from their current level of $115.3 million to $139.8 million immediately. They will remain at the elevated level until year 5,

when they will return to $115.3 million. Apple's discount rate for this project is 15.1% and its tax rate is 30%. Calculate the free cash flows and determine the NPV of this project. (Note: Assume

that the opportunity cost must be after-tax and the equipment is put into use in year 1.)

Year 2

Year 3

Year 4

Year 5

Year 6

$

($ million)

Year 0

Year 1

Sales

$

0.00 $

$

- Cost of Goods Sold

0.00

Gross Profit

$

0.00 $

$

0.00

0.00

0.00

- Annual Charge

Depreciation

EBIT

- Tax at 30%

Incremental Earnings

+ Depreciation

- Changes in NWC

A

EA

A

SA

EA

SA

0.00

EA

EA

A

0.00

ᏌᏊ

0.00

SA

EA

0.00

0.00

0.00

0.00

0.00

- Capital Expenditures

0.00

0.00

0.00

0.00

0.00

0.00

- Opportunity Cost

0.00

0.00

0.00

0.00

0.00

0.00

Incremental FCFs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Similar questions

- You work for Apple. After toiling away on $9.9 million worth of prototypes, you have finally produced your answer to Google Glasses: iGlasses (the name alone is genius). İGlasses will instantly transport the wearer into the world as Apple wants him to experience it: Tunes with the wink of an eye and apps that can be activated just by looking at them. You think that these will sell for five years until the next big thing comes along (or until users are unable to interact with actual human beings). Revenues are projected to be $448.4 million per year along with expenses of $349.4 million. You will need to spend $59.6 million immediately on additional equipment that will be depreciated using the 5-year MACRS schedule. Additionally, you will use some fully depreciated existing equipment that has a market value of $10.7 million. As the iGlasses are an outcome of the R&D center, Apple plans to charge $4.8 million of the annual costs of the center to the iGlasses product for four years.…arrow_forwardA New App Development Team from the Global MBA Program at Universidad Rey Juan Carlos of Spain is working on an apparel shopping tool that can scan your body using your cell phone and find the best fitting clothes for you, which are then modeled by your own dynamic image right there on the screen. Being high-tech, the term is limited to one year, as innovations will be necessary to keep it from being copied or rendered obsolete. EBITDA for the end of year one is expected to be $50,000,000, while developing costs and investments amount to $ 10,000,000. The IRR applicable to IT projects is 57%, as indicated by S&P's sector ROI today. Which of the following is the correct NPV of their project if conceived for one year only? Limit to 2 decimals O $31,847,133.75 O None of the above is correct O $10,284,798.57 O $21,847,133.75arrow_forwardI need the answer as soon as possiblearrow_forward

- How in the world do I solve this one with my HP 10bll calculator? Do I use IRR/YR? What do I use? I feel like I am missing informationarrow_forwardYou and a few of your classmates decided to become entrepreneurs. You came up with a great idea for a new mobile phone application that you think will make lots of money. Your business plan won second place in a local competition, and you are using the $10,000 prize to support yourselves as you start your company. Required: Identify the key decisions you need to make to be successful entrepreneurs Your company will need to exchange information with various external parties. Identify the external parties, and specify the information received from and sent to each of them.arrow_forwardSuppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 9. What is block ownership? How does it affect corporate governance?arrow_forward

- Suppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 4. Suppose your company raises funds from outside lenders. What type of agency costs might occur? How might lenders mitigate the agency costs?arrow_forwardSuppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 3. Suppose you need additional capital to expand, and you sell some stock to outside investors. If you maintain enough stock to control the company, what type of agency conflict might occur?arrow_forwardSuppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 6. What is corporate governance? List five corporate governance provisions that are internal to a firm and under its control. What characteristics of the board of directors usually lead to effective corporate…arrow_forward

- Suppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 2. If you expanded and hired additional people to help you, might that give rise to agency problems? Explain your answerarrow_forwardSuppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 5. Suppose your company is very successful, and you cash out most of your stock and turn the company over to an elected board of directors. Neither you nor any other stockholders own a controlling interest (this is the…arrow_forwardA friend told you that she was scrolling through her Twitter feed and found out that three days ago, Hertz Corporation (rental car company) ordered 100,000 Tesla cars to build out its rental fleet of electric vehicles. The cars will be delivered to Hertz throughout 2022 and Hertz will rent them to travelers. Aside from the revenue from the Hertz sale, Tesla likes the deal since more people will be exposed to the Tesla brand. They think this could boost future sales. Your friend said that this was her lucky day since she can buy Tesla stock and make some easy money when the stock price rises due to the increased sales of the cars. What do you think of this situation and to the extent you are being asked for free advice what do you tell her?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning