Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

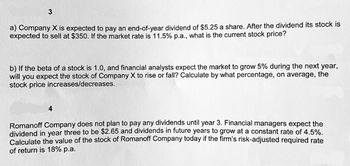

Transcribed Image Text:a) Company X is expected to pay an end-of-year dividend of $5.25 a share. After the dividend its stock is

expected to sell at $350. If the market rate is 11.5% p.a., what is the current stock price?

b) If the beta of a stock is 1.0, and financial analysts expect the market to grow 5% during the next year,

will you expect the stock of Company X to rise or fall? Calculate by what percentage, on average, the

stock price increases/decreases.

Romanoff Company does not plan to pay any dividends until year 3. Financial managers expect the

dividend in year three to be $2.65 and dividends in future years to grow at a constant rate of 4.5%.

Calculate the value of the stock of Romanoff Company today if the firm's risk-adjusted required rate

of return is 18% p.a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year (D1 = $1.50) and has a beta of 0.9. The risk-free rate is 5.7%, and the market risk premium is 4.0%. Justus currently sells for $28.00 a share, and its dividend is expected to grow at some constant rate, g. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years?arrow_forwardYou are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $2.00 a share at the end of the year (D1 = $2.00) and has a beta of 0.9. The risk-free rate is 3.7%, and the market risk premium is 4%. Justus currently sells for $33.00 a share, and its dividend is expected to grow at some constant rate, g. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is P3) Do not round intermediate calculations. Round your answer to the nearest cent. Only typing answer Please explain step by steparrow_forwardABC Inc. is expected to pay a dividend of $1.01 at the end of the year (year 1). The stock has a beta of 1.64. The risk-free rate is 2.9%. The expected return on the market is 7.2%. The stock's dividends are expected to grow at a constant rate. The stock price today is $30.66. If the market is in equilibrium what does the market believe the stock price will be in 3 years? ABC Inc has an outstanding preferred share. The preferred share just paid a dividend of $0.99. Dividends are paid quarterly. The price of stock today is $52.18. What is the effective annual rate of return?arrow_forward

- You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.75 a share at the end of the year (D1 = $1.75) and has a beta of 0.9. The risk-free rate is 4.6%, and the market risk premium is 5.5%. Justus currently sells for $31.00 a share, and its dividend is expected to grow at some constant rate, g. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is ?) Round your answer to two decimal places. Do not round your intermediate calculations. $ fill in the blank 2arrow_forwardA stock is expected to pay a dividend of $1.99 at the end of the year. The required rate of return is rs = 13.82%, and the expected constant growth rate is g = 8.0%. What is the stock's current price?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. A. $39.61 B. $29.71 C. $34.14 D. $42.68 E. $35.51arrow_forwardYou are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $2.75 a share at the end of the year (D1 = $2.75) and has a beta of 0.9. The risk-free rate is 5.1%, and the market risk premium is 6%. Justus currently sells for $41.00 a share, and its dividend is expected to grow at some constant rate, g. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is ?) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- You are considering an investment in the common stock of Keller Corp. The stock is expected to pay a dividend of $2 a share at the end of the year (D1=$2.00). The stock has a beta equal to 0.9. The risk-free rate is 5.6 percent, and the market risk premium is 6 percent. The stock’s dividend is expected to grow at some constant rate g. The stock currently sells for $25 a share. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is P3?)arrow_forwardA company currently pays a dividend of $3.8 per share (D0 = $3.8). It is estimated that the company's dividend will grow at a rate of 25% per year for the next 2 years, and then at a constant rate of 6% thereafter. The company's stock has a beta of 1.4, the risk-free rate is 9.5%, and the market risk premium is 4.5%. What is your estimate of the stock's current price? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardYou are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.75 a share at the end of the year (D1 = $1.75) and has a beta of 0.9. The risk - free rate is 5.2 %, and the market risk premium is 5%. Justus currently sells for $28.00 a share, and its dividend is expected to grow at some constant rate, g. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is ?) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- A share of stock with a beta of 1.20 now sells for 55. Investors expect the stock to pay a year-end dividend of 2.90. The T-bill rate is 7 percent, and the market risk premium is 8 percent. If the stock is perceived to be fairly priced today,What must be investors’ expectations of the price of the stock at the end of the year?arrow_forwardA company currently pays a dividend of $3.2 per share (D0 = $3.2). It is estimated that the company's dividend will grow at a rate of 23% per year for the next 2 years, and then at a constant rate of 8% thereafter. The company's stock has a beta of 1.3, the risk-free rate is 9.5%, and the market risk premium is 4.5%. What is your estimate of the stock's current price? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardA company currently pays a dividend of $2.2 per share (D0 = $2.2). It is estimated that the company's dividend will grow at a rate of 25% per year for the next 2 years, and then at a constant rate of 5% thereafter. The company's stock has a beta of 1.1, the risk-free rate is 9.5%, and the market risk premium is 6.5%. What is your estimate of the stock's current price? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education