Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

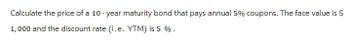

Transcribed Image Text:Calculate the price of a 10-year maturity bond that pays annual 5% coupons. The face value is $

1,000 and the discount rate (i.e. YTM) is 5 %.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the price of a 10-year maturity bond that pays annual 5% coupons. The face value is $1,000 and the discount rate (i.e. YTM) is 5%-arrow_forwardSuppose that a 5-year 6% bond is purchased between the issuance date and the first coupon date. The days between the settlement date and the next coupon period is 60. There are 90 days in the coupon period given that the coupons are paid quarterly. Suppose the discount rate is 4%. What is the dirty price, clean price, and accrued interest?arrow_forwardCalculate the present value of a 15-year bond having the following parameters: face value: PLN 500; coupon rate (p.a.): 4%; coupon payable quarterly; YTM: 10%.arrow_forward

- A 5-year treasury bond with a coupon rate of 8% has a face value of $1,000. What is the semi-annual interest payment?arrow_forwardCalculate the price of a 5-year bond that has a coupon of 6.5 per cent and pays annual interest. The current market rate is 5.75 per cent and the bond has a face value of $1000.arrow_forwardCalculate the duration ( Macaulay ) of a 2 - year bond that pays 3 % coupon annually , has a YTM of 10 % and a face value of $ 1,000 Roum decimal places .arrow_forward

- Consider a bond selling at its par value of $1000. The coupon rate is 6% and 5 years to maturity. Consider annual interest payments, calculate the bond's duration.arrow_forwardFind the duration of a 6% coupon bond making annual coupon payments if it has three years until maturity and has a yield to maturity of 6%. Note: The face value of the bond is $1,000. Specify the unit as well.arrow_forwardBond C has a $1,000 face value and provides an 8% annual coupon for 30 years. The appropriate discount rate is 10%. What is the value of the coupon bond?arrow_forward

- A 10-year bond with a face value of $10,000 pays a 5% annual coupon and has a yield (annual interest rate) of 3%. What is the current price of the bond?arrow_forwardA bond has 10 years until maturity, a coupon rate of 8.9%, and sells for $1,110. Interest is paid annually. (Assume a face value of $1,000.) What will be the rate of return on the bond?arrow_forwardA 5-year bond with 5% coupon rate and P1000 face value is selling for P852.10. Calculate the yield to maturity of the bond. (Assume annual interest payments.) Use 5 decimal places in your computation Format: 1.11%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT