Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

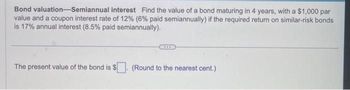

Transcribed Image Text:Bond valuation-Semiannual interest Find the value of a bond maturing in 4 years, with a $1,000 par

value and a coupon interest rate of 12% (6% paid semiannually) if the required return on similar-risk bonds

is 17% annual interest (8.5% paid semiannually).

The present value of the bond is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Current Yield for Annual Payments Heath Food Corporations bonds have 7 years remaining to maturity. The bonds have a face value of 1,000 and a yield to maturity of 8%. They pay interest annually and have a 9% coupon rate. What is their current yield?arrow_forwardBond valuation-Semiannual interest Find the value of a bond maturing in 5 years, with a $1,000 par value and a coupon interest rate of 11% (5.5% paid semiannually) if the required return on similar-risk bonds is 18% annual interest. The present value of the bond is $ (Round to the nearest cent.) Carrow_forwardBond valuation—Semiannual interest Find the value of a bond maturing in 5 years, with a $1,000 par value and a coupon interest rate of 11%(5.5% paid semiannually) if the required return on similar-risk bonds is 16% annual interest (8% paid semiannually). The present value of the bond is $________arrow_forward

- Bond valuation: Semiannual interest Find the value of a bond maturing in 6 years, with a $1,000 par value and a coupon rate of 10% (5% paid semiannually) if the required return on similar-risk bonds is 14% per year (7% paid semiannuallyarrow_forwardBond valuation—Semiannual interest Find the value of a bond maturing in 6 years, with a $1,000 par value and a coupon interest rate of 14% (7% paid semiannually) if the required return on similar-risk bonds is 13% annual interest (6.5% paid semiannually).arrow_forwardBond valuation—Annual interest Calculate the value of the bond shown in the following table, assuming it pays interest annually. Par Value: $500 Coupon interest rate: 8% Years to maturity: 19 Required return: 12% The value of the bond is: $(enter your response here) (round to the nearest cent)arrow_forward

- Required to show your work:Bond ABC:Coupon rate(%): 4.5% (annual payment)Current market:??Tenior:15 YearsSuppose the yield to maturity of bond E is 3.7% and face value equals to $1,000,calculate the current market price of bond ABC.arrow_forwardFace Value of Bond: 1,000 Annual Coupon Rate: 5% Required Return: 8% Years to Maturity: Payment Frequency: semiannually I need help to find the present value of bond using excelarrow_forwardthe following features: • Coupon rate of interest (paid annually): 10 percent • Principal: $1,000 • Term to maturity: 8 years a. What will the holder receive when the bond matures? |-Select- b. If the current rate of interest on comparable debt is 7 percent, what should be the price of this bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. Would you expect the firm to call this bond? Why? -Select- v, since the bond is selling for a-Select- v. c. If the bond has a sinking fund that requires the firm to set aside annually with a trustee sufficient funds to retire the entire issue at maturity, how much must the firm remit each year for eight years if the funds earn 7 percent annually and there is $80 million outstanding? Use Appendix C to answer the question. Round your answer to the nearest dollar.arrow_forward

- Bond valuationarrow_forwardFind the redemption value of a bond with the following info: Term: 10 Years Yield Rate: 4.5% compounded annually Purchase Price: 875.26 Coupon Rate: 3.7% payable annually Face Value: 1000.arrow_forwardBond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have a 6% coupon rate, payable semiannually. The bonds mature in 8 years, have a face value of $1,000, and a yield to maturity of 5.5%. What is the price of the bonds? Round your answer to the nearest cent. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT