Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

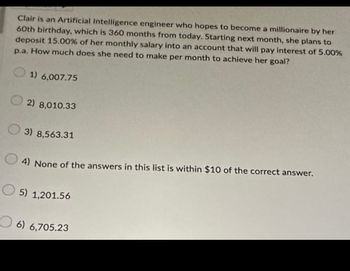

Transcribed Image Text:Clair is an Artificial Intelligence engineer who hopes to become a millionaire by her

60th birthday, which is 360 months from today. Starting next month, she plans to

deposit 15.00% of her monthly salary into an account that will pay interest of 5.00%

p.a. How much does she need to make per month to achieve her goal?

1) 6,007.75

2) 8,010.33

3) 8,563.31

4) None of the answers in this list is within $10 of the correct answer.

5) 1,201.56

6) 6,705.23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Holly Krech is planning for her retirement, so she is setting up a payout annuity with her bank. She wishes to receive a payout of $1,900 per month for twenty years. (a) How much money must she deposit if her money earns 7.8% interest compounded monthly? (Round your answer to the nearest cent.)___________ $ (b) Find the total amount that Holly will receive from her payout annuity. Thank you!arrow_forwardChad is an engineer who hopes to have $1,000,000 in his retirement account by his 60 ^ (th) birthday which is 421 months from today. Starting next month , he plans to deposit 20% of his monthly salary into an account that will pay interest of 5.00% pa How much does he need to make per month ( ie., what salary per month ) to achieve his goal ? Note that he makes 421 total deposits . 1) $4,378.95 2 ) $2,919.30 3 ) None of the answers in this list is within $ 0.20 of the correct answer . 4 ) $ 4,170.32 5 ) $ 3,203.40arrow_forwardMargaret Moore expects to need $44,000 for a down payment on a house in six years. How much would she have to invest today in an account paying 8.25 percent in order to have $44,000 in six years? (Round answer to 2 decimal places, e.g. 52.75.)arrow_forward

- 12) What annual rate of return would Jia need to earn if she deposits $20,000 per year into an account beginning one year from today in order to have a total of $1,000,000 in 30 years?arrow_forwardLaura has decided that she wants to build enough retirement wealth that, if invested at 6.50% per year (compounded monthly), will provide her with $3,500 of monthly income for 25 years. To date,she has saved nothing, but she still has 30 years until she retires. How much money does Laura need to contribute per month to reach her goal? $468.60 $536.90 $415.65 $573.10 $390.86arrow_forwardJeni has decided that she needs to start saving for her retirement. She can afford $100 a month deducted automatically from her paycheck. She deposits it into an account that earns 4.5% interest compounded monthly. How much will she have in her account when she retires 42 years later? A. $ 14,922.70 B.$ 50,400.00 C. $132,213.00 D. $149,226.96arrow_forward

- Lily has an account that pays 3.48% simple interest per year and wants to accumulate $4,000 in interest from it over the next 12 years. How much money should Lily invest in this account to meet her goal? (Use I = Prt) a. $2,000.00 b. $1.670,40 $9.578.54 d. $6,030.27arrow_forwardSuppose that between the ages of 22 and 32, you contribute $8000 per year to a 401(k) and your employer contributes $4000 per year on your behalf. The interest rate is 7.67.6% compounded annually. (a) What is the value of the 401(k) after 10 years? (b) Suppose that after 10 years of working for this firm, you move on to a new job. However, you keep your accumulated retirement funds in the 401(k). How much money will you have in the plan when you reach age 65? (c) What is the difference between the amount of money you will have accumulated in the 401(k) and the amount you contributed to the plan?arrow_forwardStarling wants to retire with $2, 110,000 in his retirement account exactly 41 years from today. He will make annual deposits at the end of each year to fund his retirement account. If he can earn 9.73 percent per year, how much must he deposit each year? ** PLS EXPLAIN HOW TO SOLVE USING A FINANCIAL CALCULATORarrow_forward

- 6. If you desire to have $80,000 for a down payment for a house in 7 years, what amount would you need to deposit each year for these 7 years? Assume that your money will earn 10 percent per year. 7. Kate deposits $9,900 each yearinto her retirement account. If these funds have an average earning of 11 percent over the 40 years until her retirement, what will be the value of her retirement account?arrow_forwardJasmine has decided that she wants to build enough retirement wealth that, if invested at 6 percent per year, will provide her with $3,000 of monthly income for 30 years. To date, she has saved nothing but she still has 25 years until she retires. Jasmine believes that she can earn 6 percent on her investments until she retires. How much money does she need to contribute per month to reach her goal? O $512.93 O $863.49 O $616.27 O $722.05arrow_forwardAmy Johnson wants to retire on $75,000 per year for her life expectancy of 20 years after she retires. She estimates that she will be able to earn an interest rate of 10.1%, compounded annually, throughout her lifetime. To reach her retirement goal, Amy will make annual contributions to her account for the next 30 years. One year after making her last deposit, she will receive her first retirement check. How large must her yearly contribution be? (Solve with Presents Values with Annuities or Loans and Amortization)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning