EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Oll option information and correct answer

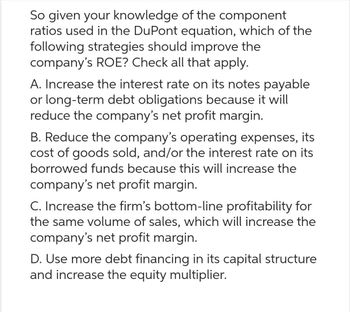

Transcribed Image Text:So given your knowledge of the component

ratios used in the DuPont equation, which of the

following strategies should improve the

company's ROE? Check all that apply.

A. Increase the interest rate on its notes payable

or long-term debt obligations because it will

reduce the company's net profit margin.

B. Reduce the company's operating expenses, its

cost of goods sold, and/or the interest rate on its

borrowed funds because this will increase the

company's net profit margin.

C. Increase the firm's bottom-line profitability for

the same volume of sales, which will increase the

company's net profit margin.

D. Use more debt financing in its capital structure

and increase the equity multiplier.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following is true regarding a company assuming more debt? Select one: a. Assuming more debt is always bad for the company b. Assuming more debt reduces leverage c. Assuming more debt can be good for the company as long as they earn a return in excess of the rate charged on the borrowed funds d. Assuming more debt is always good for the companyarrow_forwardJolie Corp.is looking into the following transcations to change its risk profile. Which of the following transcations will for sure increase the risk-estimate of the company (and increase the borrowing interest rate) from the z-score perspective. Mark all that apply; more than one answer could be correct. Sold held-to maturity investments for a profit Write-off some obsolete inventory Collect cash from accounts receivable Buy long-term investments withcasharrow_forwardWhich one of the following statements is correct? A. If a firm decreases its inventory period, its accounts receivable period will also decrease. B. The longer the cash cycle, the more cash a firm typically has available to invest. C. A firm would prefer a negative cash cycle over a positive cash cycle. D. Decreasing the inventory period will also decrease the payables period. E. Both the operating cycle and the cash cycle must be positive values.arrow_forward

- Which of the following would increase risk? a. Raise the level of working capital b. Increase the amount of equity financing c. Increase the amount of short term borrowing d. Decrease the amount of inventory by formulating an effective inventory policyarrow_forwardWhich of the following statements is not correct? Group of answer choices A)Purchasing fixed assets using cash decreases the current ratio. B)Accruing a commission expense will affect the net profit margin ratio. C)Increasing the financial leverage ratio guarantees the net profit margin ratio will increase. D)Purchasing treasury stock results in a decrease in the current ratio. E)All of the above are correctarrow_forwardWhich of the following actions should Reece Windows take if it wants to reduce its cash conversion cycle? a. Take steps to reduce the DSO. b. Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock. c. Increase average inventory without increasing sales. d. Sell common stock to retire long-term bonds. e. Start paying its bills sooner, which would reduce the average accounts payable but not affect sales.arrow_forward

- When considering the discount rate to use for discounting cash flows of an entire company, we can use either the overall WACC or just the cost of one security (e.g., debt). True or False?arrow_forwardIf we hold all other factors the same, an increase in interest rates will: a. Decrease the present value of a stream of constant payments we expect to receive. b. Increase the present value of a stream of constant payments we expect to receive. c. Decrease the interest revenue that a company will earn on its funds that it holds in its interest-bearing checking account. d. No impact on how much a company should be willing to pay for factory equipment that is expected to significantly reduce the factory electricity costs.arrow_forwardWhat is the definition of “opportunity cost” as it relates to the time value of money? It is the loss of a potential gain choosing one alternative over another, particularly ignoring the time value of money. It is the benefit side of the cost/benefit ratio. It is the price of selling an asset. It is the amount of money invested in saving bonds. exoplain your answer give correct answerarrow_forward

- Which of the following is an advantage of the average accounting return (AAR)? Multiple choice question. It is based on cash flows and market value. It accounts for the time value of money. Its input data are easily available. It uses an arbitrary benchmark cutoff rate.arrow_forwardWhich of the following methods can NOT be used to improve the firm’s cash conversion cycle? Decrease the firm’s inventory conversion cycle. Decrease the firm’s receivables collection period. Decrease the firm’s payables deferral period. Increase the firm’s payables deferral period.arrow_forwardWhich one of the following is minimized when the value of the firm is maximized? A- WACC B- Return on equity C-Debt D-Taxes E- Bankruptcy costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning