Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

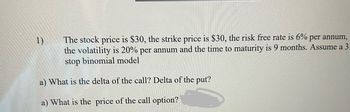

Transcribed Image Text:1)

The stock price is $30, the strike price is $30, the risk free rate is 6% per annum,

the volatility is 20% per annum and the time to maturity is 9 months. Assume a 3

stop binomial model

a) What is the delta of the call? Delta of the put?

a) What is the price of the call option?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2. Derive the single - period binomial model for a put option. Include a single - period example where: u = 1.10, d = 0.95, Rf = 0.05, SO = $100, X = $100. 3. Assume ABC stock's price follows a binomial process, is trading at SO = $100, has u 1.10, d = 0.95, and probability of its price increasing in one period is 0.5 (q = 0.5). a. Show with a binomial tree ABC's possible stock prices, logarithmic returns, and probabilities after one period and two periods. . b. What are the stock's expected logarithmic return and variance for 2 periods and 3 periods? c. Define the properties of a binomial distribution.arrow_forwardThe risk-free rate is 5.6%, the market risk premium is 8.5%, and the stock’s beta is 2.27. What is the required rate of return on the stock, E(Ri)? Use the CAPM equation.arrow_forwardGiven the following information, predict the put option's new price after the stock's volatility changes. Initial put option price = $6 Initial volatility = 25% Vega = 13 New volatility = 18% (required precision 0.01 +/- 0.01) Greeks Reference Guide: Delta = ∂π/∂S Theta = ∂π/∂t Gamma = (∂2π)/(∂S2) Vega = ∂π/∂σ Rho = ∂π/∂rarrow_forward

- Assume that the risk-free and rate is 5.50% and the market risk premium is 7.75%. What is the expected return for the overall stock market (rm)?arrow_forwardH2. Using the Black-Scholes model (BSOPM), compute the standard deviation that is implied by the following call option data as: the time to the option's maturity is 0.25 years, the price of the underlying option asset is RM30, the continuously compounded risk-free interest rate is 0.12. the exercise or striking price is RM30, and the cost or premium of the call is RM1.90.arrow_forwardYou have observed the following returns over time: Assume that the risk-free rate is 6% and the market risk premium is 5%. a. What are the betas of Stocks X and Y? b. What are the required rates of return on Stocks X and Y? c. What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y?arrow_forward

- Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…arrow_forwardSuppose risk-free rate of return = 2%, market return = 7%, and Stock B’s return = 11%. a. Calculate Stock B’s beta. b. If Stock B’s beta were 0.80, what would be its new rate of return?arrow_forwardConsider an asset with a beta of 1.2, a risk-free rate of 4.3%, and a market return of 12%. What is the reward-to-risk ratio in equilibrium? What is the expected return on the asset?arrow_forward

- A. An option is trading at $5.03. If it has a delta of -.56, what would the price of the option be if the underlying increases by $.75? What would the price of the option be if the underlying decreases by $.55? B. What type of option is this and how? C. With a delta of -.56, is this option ITM, ATM or OTM and how?arrow_forwardsuppose a risk free rate is 6% and the market premium is 7%. D1 is 1.25 per share and stock beta is 1.15. What is the required return?arrow_forward6) Stock ABC has a market beta of 1.2. The risk-free rate is 3%, and the market risk premium equals 4%. a. Compute the expected return for stock ABC. b. Assume the true expected return is 6%. What is stock ABC's alpha? (Assume that the CAPM is the correct asset pricing model.) c. Is stock ABC fairly priced, underpriced, or overpriced? Please explain your answer for full credit. E Focus MacBook Proarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning