Personal Finance

13th Edition

ISBN: 9781337669214

Author: GARMAN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

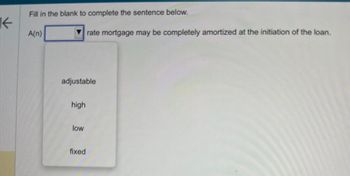

Fill in the blank to complete the sentence below.

A(n)

rate mortgage may be completely amortized at the initiation of the loan.

adjustable

high

low

fixed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An important application of -Select- loans. Each loan payment consists of interest and repayment of principal. This breakdown is often developed in an amortization schedule. Interest is -Select- v in the first interest involves amortized loans. Some common types of amortized loans are automobile loans, home mortgage loans, and business period and -Select- over the life of the loan, while the principal repayment is | -Select- v in the first period and it | -Select- thereafter. Quantitative Problem: You need $11,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 5 years, with the first payment to be made one year from today. He requires a 8% annual return. a. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much of your first payment will be applied to interest and to principal repayment? Do not round intermediate…arrow_forwardWhich of the following is subject to change over the life of an adjustable-rate mortgage loan? a.Initial rate b.Margin c.Note rate d.Annual and life of loan capsarrow_forwardWhich of the following is true when the mortgage loan is an amortizing loan? a. At the beginning of the term of the loan the largest part of the payment is a paydown of principal, but a payments progress a rising portion is applied to interest payments. b. Interest payments and paydown of principal remain constant during the loan. c. At the beginning of the term of the loan the largest part of the payment is interest, but a payments progress a rising portion is applied to the paydown of principal. d. Paydown of principal occurs at the end of the loan. e. None of the above.arrow_forward

- All of these have a balloon payment due at the end of the loan term EXCEPT a.a fully amortized loan. b.a term/straight loan. c.a partially amortized loan. d.an interest-only loan.arrow_forwardA "mortgage" is a loan contract and is actually made up of which two contracts: O Index & Margin O Note & Deed Fixed & Adjustable O Amortized & Interest-Onlyarrow_forward7. Time Value of Money: Amortized Loans An important application of -Select- interest involves amortized loans. Some common types of amortized loans are automobile loans, home mortgage loans, and business loans. Each loan payment consists of interest and repayment of principal. This breakdown is often developed in an amortization schedule. Interest is -Select- in the first period and -Select- over the life of the loan, while the principal repayment is -Select- in the first period and it -Select- thereafter. Quantitative Problem: You need $15,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 5 years, with the first payment to be made one year from today. He requires a 6% annual return. a. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much of your first payment will be applied to interest and to principal…arrow_forward

- It is a method of paying a loan (principal and interest) on installment basis, usually of equal amounts at regular intervals. * O Bond O Mortgage O Amortization O Loanarrow_forwardWith a Fixed-Rate Mortgage, the bears the interest rate risk and with an Adjustable Rate Mortgage or ARM, the bears the interest rate risk. O A. borrower; lender O B. borrower; borrower O C. lender; lender O D. lender; borrower OE. federal government; pool organizerarrow_forwardA Collateralized Mortgage Obligation (CMO) allows you to create some AAA rated tranches from a pool of subprime mortgages by ordering the tranches by payback precedence. Question 36 options: True Falsearrow_forward

- At the maturity of a note payable, a borrower will pay ________. A. the interest amount only B. the principal plus interest C. the principal amount only D. the principal minus interestarrow_forwardIn the amortization of loans, interest must be paid at the beginning of each period calculated on the balance of the principal amount due (unpaid balance). TRUE OR FALSE?arrow_forwardPls help on this question. pls do all of the question pls i beg. Pls do all three parts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning