Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

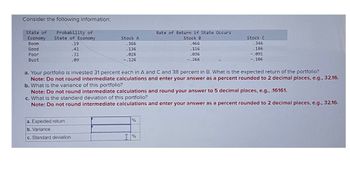

Transcribed Image Text:Consider the following information:

State of

Probability of

Rate of Return if State Occurs

Economy State of Economy

Stock A

Stock B

Stock C

Boom

.19

.366

.466

.346

Good

.41

.136

.116

.186

Poor

Bust

.31

.09

.026

-.126

036

-.266

-.091

-.106

a. Your portfolio is invested 31 percent each in A and C and 38 percent in B. What is the expected return of the portfolio?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

b. What is the variance of this portfolio?

Note: Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.

c. What is the standard deviation of this portfolio?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

a. Expected return

b. Variance

c. Standard deviation

%

I1%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider the following information: Rate of Return if State Occurs Probability of State- State of Economy of Economy Stock A Stock B Stock C Boom .15 .31 .41 .21 Good .60 .16 .12 .10 Poor .20 -.03 -.06 -.04 Bust .05 -.11 -.16 -.08 a. Your portfolio is invested 30 percent each in A and C, and 40 percent in B. What is the expected return of the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-1. What is the variance of this portfolio? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What is the standard deviation? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardConsider the following information: Rate of Return if State Occurs Probability of State State of Economy of Economy Stock A Stock B Stock C Boom .20 .35 .45 .25 Good .45 .20 .16 .09 Poor .25 -.02 -.05 -.03 Bust .10 -.16 -.20 -.12 a. Your portfolio is invested 24 percent each in A and C, and 52 percent in B. What is the expected return of the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-1. What is the variance of this portfolio? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What is the standard deviation? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Expected return b-1. Variance b-2. Standard deviation % %arrow_forwardConsider the following information: Rate of Return if State Occurs State of Economy Probability of State of Economy Stock A Stock B Stock C Boom .15 .35 .45 .27 Good .55 .16 .10 .08 Poor .25 -.01 -.06 -.04 Bust .05 -.12 -.20 -.09 a) Your portfolio is invested 40 percent each in A and C, and 20 percent in B. What is the expected return of the portfolio? b) What is the variance of this portfolio? The standard deviation? Stock C .45 .27 .10 .08 -.06 -.04 -.20 -.09arrow_forward

- State ofEconomy Probabilityof State Return on AssetDin State Return on AssetEin State Return on AssetFin State Boom 0.35 0.060 0.310 0.25 Normal 0.50 0.060 0.180 0.20 Recession 0.15 0.060 -0.210 0.10 An investor builds up his portfolio with 40% in Asset D, and the rest isAsset F. What is his expected portfolio returns?arrow_forwardNikularrow_forwardThe following portfolios are being considered for investment. During the period under consideration, RFR =0.07 Porfolio Return Beta P 0.15 1.00 0.05 Q 0.20 1.50 0.1 R 0.10 0.60 0.03 S 0.17 1.10 0.06 Market 0.13 1.00 0.04 Compute the Sharpe measure for each portfolio and the market portfolio Compute the Treynor measure for each portfolio and the market portfolio Rank the portfolios using each measure explaining the cause for any differences you find in the rankings.arrow_forward

- Consider the following information for four portfolios, the market, and the risk-free rate (RFR): Portfolio Return Beta SD A1 0.15 1.25 0.182 A2 0.1 0.9 0.223 A3 0.12 1.1 0.138 A4 0.08 0.8 0.125 Market 0.11 1 0.2 RFR 0.03 0 0 Refer to Exhibit 18.6. Calculate the Jensen alpha Measure for each portfolio. a. A1 = 0.014, A2 = -0.002, A3 = 0.002, A4 = -0.02 b. A1 = 0.002, A2 = -0.02, A3 = 0.002, A4 = -0.014 c. A1 = 0.02, A2 = -0.002, A3 = 0.002, A4 = -0.014 d. A1 = 0.03, A2 = -0.002, A3 = 0.02, A4 = -0.14 e. A1 = 0.02, A2 = -0.002, A3 = 0.02, A4 = -0.14arrow_forwardPortfolio theory with two assets E(R1)=0.15 E(01)= 0.10 W1=0.5 E(R2)=0.20 E(02) = 0.20 W2=0.5 Calculate the expected return and the standard deviation of the two portfolios if r1,2 = 0.4 and -0.60 respectively.arrow_forwardConsider a single-index model economy. The index portfolio M has E(RM ) = 6%, σM = 18%.An individual asset i has an estimate of βi = 1.1 and σ2ei = 0.0225 using the single index modelRi = αi + βiRM + ei. The forecast of asset i’s return is E(ri) = 12%. rf = 4%. a) According to asset i’s return forecast, calculate αi. (b) Calculate the optimal weight of combining asset i and the index portfolio M . (c) Calculate the Sharpe ratio of the index portfolio M and the portfolio optimally combiningasset i and the index portfolio M .arrow_forward

- Consider the following information: Rate of Return if State Occurs State of Probability of State of Economy Stock A Stock B Stock C Economy Boom 0.15 0.32 0.42 0.33 Good 0.45 0.19 0.13 0.12 Poor 0.30 -0.05 -0.08 -0.06 Bust 0.10 - 0.16 -0.28 0.09 a. Your portfolio is invested 30 percent each in A and C, and 40 percent in B. What is the expected return of the portfolio? (Round your answer to 2 decimal places. (e.g., 32.16)) Expected return % b-1What is the variance of this portfolio? (Do not round intermediate calculations and round your answer to 5 decimal places. (e.g., 32.16161)) Variance b-2What is the standard deviation? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) Standard deviation %arrow_forwardWhat is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (SDi), covariance (COVij), and asset weight (Wi) are as shown below? Asset (A) E(R₂) = 25% SDA = 18% WA = 0.75 COVA, B = -0.0009 Select one: A. 13.65% B. 20 U ODN 20.0% C. 18.64% D. 22.5% Asset (B) E(R₂) = 15% SDB = 11% WB = 0.25arrow_forwardUSE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Asset (A) Asset (B) E(RA)=10% E(RB) = 15% (σA)=8% (GB) = 9.5% WA = 0.25 WB = 0.75 COVA.B = 0.006 What is the standard deviation of this portfolio? O 13.75% O 8.79% O 12.5% O 7.72%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education