Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

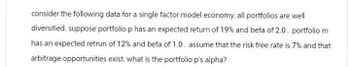

Transcribed Image Text:consider the following data for a single factor model economy. all portfolios are well

diversified. suppose portfolio p has an expected return of 19% and beta of 2.0. portfolio m

has an expected retrun of 12% and beta of 1.0. assume that the risk free rate is 7% and that

arbitrage opportunities exist. what is the portfolio p's alpha?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- According to CAPM, the expected rate of return of a portfolio with a beta of 1.0 and an alpha of 0 is:a. Between rM and rf .b. The risk-free rate, rf .c. β(rM − rf).d. The expected return on the market, rM.arrow_forwardConsider a single-index model economy. The index portfolio M has E(RM ) = 6%, σM = 18%.An individual asset i has an estimate of βi = 1.1 and σ2ei = 0.0225 using the single index modelRi = αi + βiRM + ei. The forecast of asset i’s return is E(ri) = 12%. rf = 4%. a) According to asset i’s return forecast, calculate αi. (b) Calculate the optimal weight of combining asset i and the index portfolio M . (c) Calculate the Sharpe ratio of the index portfolio M and the portfolio optimally combiningasset i and the index portfolio M .arrow_forwardConsider the multifactor model APT with three factors. Portfolio A has a beta of 0.8 on factor 1, a beta of 1.1 on factor 2, and a beta of 1.25 on factor 3. The risk premiums on the factor 1, factor 2, and factor 3 are 3%, 5%, and 2%, respectively. The risk-free rate of return is 3%. The expected return on portfolio A is __________ if no arbitrage opportunities exist. A. 23.0% B. 16.5% C. 13.4% D. 13.5%arrow_forward

- Consider an asset with a beta of 1.2, a risk-free rate of 4.3%, and a market return of 12%. What is the reward-to-risk ratio in equilibrium? What is the expected return on the asset?arrow_forwardConsider the information given in the Table 2A and complete Table 2B. From the completed Table 2B, use the information to graphically present the Security Market Line (SML). Compute the slope of thisline.Hints:i) When 100% money is invested in asset X (portfolio weight = 1), the beta of the portfolio is 0.85ii) Since the risk-free asset is, well, risk-free, its beta will be zeroarrow_forwardConsider the following information for four portfolios, the market, and the risk-free rate (RFR): Portfolio Return Beta SD A1 0.15 1.25 0.182 A2 0.1 0.9 0.223 A3 0.12 1.1 0.138 A4 0.08 0.8 0.125 Market 0.11 1 0.2 RFR 0.03 0 0 Refer to Exhibit 18.6. Calculate the Jensen alpha Measure for each portfolio. a. A1 = 0.014, A2 = -0.002, A3 = 0.002, A4 = -0.02 b. A1 = 0.002, A2 = -0.02, A3 = 0.002, A4 = -0.014 c. A1 = 0.02, A2 = -0.002, A3 = 0.002, A4 = -0.014 d. A1 = 0.03, A2 = -0.002, A3 = 0.02, A4 = -0.14 e. A1 = 0.02, A2 = -0.002, A3 = 0.02, A4 = -0.14arrow_forward

- Consider the following graph. According to Markowitz’ portfolio theory, which point on the graph represents optimal portfolio? C A B Darrow_forward* Consider the following portfolio II: long one call with exercise price E₁, long one put with exercise price E2, short one call with exercise price E, and short one put with exercise price E1+E2 E. Consider the case E₁ < E < E2 where E < 2 ⚫ (a) Write down the pay-off function A(S) for the portfolio II. • • (b) What is the value of the pay-off function when S < E₁? (c) What is the value of the pay-off function when E < S < E₂?arrow_forwardConsider the information given in the Table 2A and complete Table 2B. From the completed Table 2B, use the information to grpahically present the Security Market Line (SML). Compute the slope of this line.Hints: i) When 100% money is invested in asset X (portfolio weight = 1), the beta of the portfolio is 0.85ii) Since the risk-free asset is, well, risk-free, its beta will be zeroarrow_forward

- Consider the information given in the Table 2A and complete Table 2B. From the completed Table 2B, use the information to grpahically present the Security Market Line (SML). Compute the slope of this line. Hints: i) When 100% money is invested in asset X (portfolio weight = 1), the beta of the portfolio is 0.85ii) Since the risk-free asset is, well, risk-free, its beta will be zeroarrow_forwardSuppose that you use Arbitrage Pricing Theory (APT) to evaluate well-diversified portfolios. The three factor portfolios used in an APT model, portfolios 1, 2, and 3, have expected returns E(r1) = 5%, E(r2) = 3%, and E(r3) = 8%. Suppose further that the risk-free rate (λ0) is 2%. Calculate the total return on a well- diversified portfolio with its beta on the first factor, βA1 = 1.1, beta on the second factor, βA2 = .9, and beta on the third factor, βA3 = 1.2.arrow_forwardAssume that both portfolios A and B are well diversified, that E(rA) = 12%, and E(rB) = 9%. If the economy has only one factor, and βA = 1.2, whereas βB = .8, what must be the risk-free rate?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning