Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ded

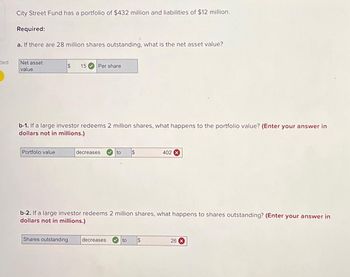

City Street Fund has a portfolio of $432 million and liabilities of $12 million.

Required:

a. If there are 28 million shares outstanding, what is the net asset value?

Net asset

value

$ 15 Per share

b-1. If a large investor redeems 2 million shares, what happens to the portfolio value? (Enter your ansv er in

dollars not in millions.)

Portfolio value

decreases

to

Shares outstanding decreases

b-2. If a large investor redeems 2 million shares, what happens to shares outstanding? (Enter your answer in

dollars not in millions.)

402 X

to $

26 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Required: A hedge fund with $0.7 billion of assets charges a management fee of 3% and an incentive fee of 20% of returns over a money market rate, which currently is 6%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: (Enter your answers in millions rounded to 1 decimal place.) Required: A hedge fund with $0.7 billion of assets charges a management fee of 3% and an incentive fee of 20% of retums over a money market rate, which currently is 6%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: (Enter your answers in millions rounded to 1 decimal place.) Required: A hedge fund with $0.7 billion of assets charges a management fee of 3% and an incentive fee of 20% of returns over a money market rate, which currently is 6%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: (Enter your answers in millions rounded to…arrow_forwardA pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 4%. The characteristics of the risky funds are as follows: Stock fund (S) Exp. Return Bond fund (B) 0.43 15% O 1.00 0.70 11% The correlation between the fund returns is 0.2. Solve numerically for the Sharpe Ratio of the optimal risky portfolio. 0.66 Std. Deviation 0.85 26% 12%arrow_forwardThe Closed Fund is a closed-end investment company with a portfolio currently worth $245 million. It has liabilities of $12 million and 17 million shares outstanding. a. What is the NAV of the fund? (Round your answer to 2 decimal places.) b. If the fund sells for $10 per share, what is its premium or discount as a percent of net asset value? (Input the amount as a positive value. Round your answer to 2 decimal places.)arrow_forward

- As an individual investor, you have three funds to invest into. The first is an equity fund, the second is a corporate bond fund, and the third is a T-bill money-market fund (your risk-free asset). Fund Expected rate of return Risk (Standard deviation) Equity fund 16% 32% Corporate bond fund 12% 18% T-bill money market fund 2% Correlation between equity fund and bond fund returns is 0.4. Find the Expected return of the minimum variance portfolio formed from Equity and Bond fundsarrow_forwardConsider two asset classes: Stocks and Bonds. You estimate the following parameters for these two asset class funds. correlation matrix b/n Stocks and Bonds E(r ) sd(r) Stocks Bonds Stocks 19% 28% 10.5 Bonds 10% 8% 0.5 1 Consider a $80,000 portfolio consisting of $60,000 in Stocks and $20,000 in Bonds. So, the portfolio is 75% in Stocks and 25% in Bonds. Given the expected return on the portfolio is 16.75%, and the standard deviation of the portfolio return is 22.07%, what is the 2.5% value at risk (note: the 95% confidence interval lower limit on the portfolio value is the value of the portfolio at this level of loss)? (use 2 decimals without $, so a loss of -$10.00 is -10.00) Answer:Question 2 - 21205.76 Feedback The correct answer is: -21908.92 expainarrow_forwardHi! I'm having difficulty comparing the choices between raising a large amount of cash in the capitaal market verses the bond market. I have to make a decision as to what is best and why, all while considering ethical implications of financial reporting and how it relates to acquiring additional investors and accessing markets for additional capital. Consider the impact on the following on your choice: The company’s existing capital structure The company’s current market capitalization The company’s weighted average cost of capital The company’s degree of operating, financial and combined leveragearrow_forward

- Required: A hedge fund with $1.8 billion of assets charges a management fee of 3% and an incentive fee of 20% of returns over a money market rate, which currently is 6%. Calculate total fees, both in dollars and as a percent of assets under management, for portfolio returns of: (Enter your answers in millions rounded to 1 decimal place.) Portfolio Rate of Return (%) a. -1 b. 0 c. 6 d. 12 Total Fee ($ million) Total Fee (%)arrow_forwardThe composition of the Fingroup Fund portfolio is as follows: Price $ 35 34 26 25 Stock A B C D Shares 200,000 288,000 406,000 660,000 The fund has not borrowed any funds, but its accrued management fee with the portfolio manager currently totals $46,000. There are 5.2 million shares outstanding. What is the net asset value of the fund? (Round your answer to 2 decimal places.) Net asset valuearrow_forwardSuppose you are the money manager of a $5.08 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta $ 440,000 A B C D 0.75 If the market's required rate of return is 10% and the risk-free rate is 6%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. 500,000 1,140,000 3,000,000 1.50 (0.50 ) 1.25arrow_forward

- An investor has $80,000 to invest in a CD and a mutual fund. The CD yields 8% and the mutual fund yields 7%. The mutual fund requires a minimum investment of $9,000, and the investor requires that at least twice as much should be invested in CDs as in the mutual fund. How much should be invested in CDs and how much in the mutual fund to maximize the return? What is the maximum return? To maximize income, the investor should place $ in CDs and $ in the mutual fund. (Round to the nearest dollar as needed.)arrow_forwardSuppose you own a mutual fund which has 13,000,000 shares outstanding. If its total assets are $42,000,000 and its liabilities are $5,000,000, find the net asset value (in $) of the fund. Round to the nearest cent. $arrow_forward10. A mutual fund has total assets of P680M and total liabilities of P38M. If the company has 545,000 outstanding shares and you plan to invest money worth P1.5M, how many shares .8 should you receive?ulev sosts diiw llid yauaROTTIysb-00thlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education