Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

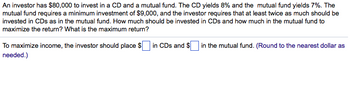

Transcribed Image Text:An investor has $80,000 to invest in a CD and a mutual fund. The CD yields 8% and the mutual fund yields 7%. The

mutual fund requires a minimum investment of $9,000, and the investor requires that at least twice as much should be

invested in CDs as in the mutual fund. How much should be invested in CDs and how much in the mutual fund to

maximize the return? What is the maximum return?

To maximize income, the investor should place $ in CDs and $ in the mutual fund. (Round to the nearest dollar as

needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A mutual fund manager expects her portfolio to earn a rate of return of 11% this year. The beta of her portfolio is 0.9. The rate of return available on risk-free assets is 4% and you expect the rate of return on the market portfolio to be 14%. a. What expected rate of return would you demand before you would be willing to invest in this mutual fund? Note: Do not round intermediate calculations. Enter your answer as a whole percent. b. Is this fund attractive to you? a. "Expected rate of return b. Is this fund attractive to you? %arrow_forwardIf you have a 5.75% back-load charge and you invest $4,000, how much of this money will be invested in the mutual fund? Amount invested in the mutual fund:arrow_forwardSuppose that we make contributions to a fund of $125 today and $750 in twoyears for a return of $1000 in one year. First write the Net Present Value as a function of the discount factor ν. Secondly, use the NPV to calculate the yield rate of this investment (select the larger value for i. Finally, explain whether or not this is a good investment for us. Please show all workarrow_forward

- 1. Suppose there is a mutual fund and each consumer buys a share in it for her endowment at t = 0. The mutual fund | maximises the wealth of its shareholders when choosing IF, the investment in the long term technology. At t =1, the mutual fund pays dividend d to each of its shareholders. At t = 1, the shares can be traded at price p". a. Set up the mutual fund's optimisation problem and derive and interpret the first order condition. What happens when R increases and why? b. What is the optimal consumption profile cf, c and the optimal investment IF? | c. Calculate (i.e. derive an expression for) d and p".arrow_forwardConsider the following information for the Alachua Retirement Fund, with a total investment of $4 million. The market required rate of returnis 12%, and the risk-free rate is 6%. What is its required rate of return? Stock Investment Beta A $500,000 1.2 B 500,000 -0.4 C 1,000,000 1.5 D 2,000,000 0.8 Total 4,000,000 Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardSuppose at the start of the year, a no-load mutual fund has a net value of RM27.15 per share. During the year, it pays its shareholders a capital gain and dividend distribution of RM1.12 per share and finishes the year with NAV of RM30.34. Required: a. b. If at the end of the year, the fund is selling is selling at 5% discount, what is the rate of return? C. What is the return to an investor who holds 2000 shares of this fund in his retirement account? d. Differentiate between open end and closed end funds. Assume at the end of year, the company change its policy and charge. 12b-1 fees of 2%, What is the rate of return?arrow_forward

- Suppose you have some money to invest-for simplicity, $1-and you are planning to put a fraction w into a stock market mutual fund and the rest, 1 w, into a bond mutual fund. Suppose that $1 invested in a stock fund yields R after 1 year and that $1 invested in a bond fund yields Rp. suppose that R, is random with mean 0.08 (8%) and standard deviation 0.07, and suppose that R, is random with mean 0.05 (5%) and standard deviation 0.04. The correlation between R and R, is 0.25. If you place a fraction w of your money in the stock fund and the rest, 1 - w, in the bond fund, then the return on your investment is R=wR, +(1-w)Rb Suppose that w=0.51. Compute the mean and standard deviation of R. The mean is. (Round your response to three decimal places.) The standard deviation is. (Round your response to three decimal places.)arrow_forwardYour broker has suggested that you diversify your investments by splitting your portfolio among mutual funds, municipal bond funds, stocks, and precious metals. They suggest three good mutual funds, five municipal bond funds, five stocks, and three precious metals (gold, silver, and platinum). How many different portfolios can you create if the portfolio is to contain one of each type of investment?arrow_forwardAs a wealthy individual investor, you are planning to invest your $2 million in a fund of funds which invests in 2 different hedge funds, namely hedge fund A and B. The incentive fees are 20% for all funds including the fund of funds. The incentive fee is applicable when a fund earns a positive return. Let’s assume that funds A and B generate 10% and -15% gross returns, respectively. Given the information above, please fill out the below table. You can copy and paste the table to the answer section and fill it out there. You may want to show your calculations in the space below the table. Fund A Fund B Fund of Funds Start of year (millions) $1.00 $1.00 $2.00 End of year (millions) $ $ $ Gross rate of return % % % Incentive fee (millions) $ $ $ End of year, net of fee $ $ $ Net rate of return % % %arrow_forward

- e6arrow_forwardThe Closed Fund is a closed-end investment company with a portfolio currently worth $245 million. It has liabilities of $12 million and 17 million shares outstanding. a. What is the NAV of the fund? (Round your answer to 2 decimal places.) b. If the fund sells for $10 per share, what is its premium or discount as a percent of net asset value? (Input the amount as a positive value. Round your answer to 2 decimal places.)arrow_forwardConsider a borrow-and-invest strategy in which you use $1 million of your own money and borrow another $1 million (at the t-bill rate) to invest $2 million in a market index fund. If the risk free interest rate is 5.52 percent and the expected rate of return on the market index fund is 12.68 percent, what is the risk premium on this borrow-and-invest strategy?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education