Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

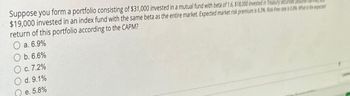

Transcribed Image Text:Suppose you form a portfolio consisting of $31,000 invested in a mutual fund with beta of 1.6, $18,000 invested in Treasury securities

$19,000 invested in an index fund with the same beta as the entire market. Expected market risk premium is 6.3%. Risk-free rate is 0.8% What is the exped

return of this portfolio according to the CAPM?

O a. 6.9%

Ob. 6.6%

O c. 7.2%

d. 9.1%

e. 5.8%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A portrollo consists of assets with the following expected returns: Technology stocks Pharmaceutical stocks Utility stocks Savings account a. What is the expected return on the portfolio if the investor spends an equal amount on each asset? Round your answer to two decimal places. % 26% 16 9 4 b. What is the expected return on the portfolio if the investor puts 53 percent of available funds in technology stocks, 15 percent in pharmaceutical stocks, 14 percent in utility stocks, and 18 percent in the savings account? Round your answer to two decimal places. %arrow_forwardAn investor's portfolio consists of the following stocks: B. C. Required: A. Stock NCB BNS JBG GRACE LASD HBN % of Portfolio Beta 35 1.05 15 0.45 10 0.9 10 0.95 23 d 1.6 7 $0.7 Expected Return 21% * 10% 15% 18% 25% 9% d The current risk free rate of return is 6.5% and the expected return on the market portfolio is f 16%. to sastava 128 hodan) ditane H puo abuso gurILA be HOME D q now to Compute the expected return of the portfolio and the portfolio beta. Tynaquros ort vd bomenstem of dou Compute the required rate of return for the NCB stock using the Capital Asset Pricing Model (CAPM). bell (0 simo 15710 zib sh Explain the difference between diversifiable and non-diversifiable risks using examples.arrow_forwardAssume that you have just received information from your investment advisor that your portfolio has reached a value of $1,250,000. Your portfolio consists of three stocks, as follows: Stock Amount Invested % of Total Beta A $250,000 20% 1.12 B $400,000 32% .85 C $600,000 48% .55 Total: $1,250,000 100% Calculate the beta of this investment portfolio. Assume that the expected market return ( r m ) is 9 percent and the expected risk- free rate ( RF ) is 2 percent. What is the expected return ( r j ) for this investment portfolio?arrow_forward

- (c)) Discuss the following graphic, which shows the relationship between expected return and portfolio weights. The portfolio is comprised of a debt security D and an equity security E. What would the portfolio strategy be when Wp = 2 and ba WE = -1? 38 (33) -0.5 Expected Return 13% 8% Debt Fund 0 (ebenso) esenicut adol leu@ ledol (loorba (ognerloxel) Ismet tametnl Equity Fund 1.0 0 OC) becida nieu to 2.0 w (stocks) AB -1.0 68 XO.YOUTS RO w (bonds)=1-w (stocks) 15 V10 anollesup Figure 7.3 Portfolio expected return as a function of investment proportions la 21101TOarrow_forwardYou are holding a portfolio with the following investments and betas: Stock Dollar investment Beta А $250,000 1.25 B 200,000 1.70 с 400,000 0.85 D 150,000 -0.25 Total investment $1,000,000 The market's required return is 10% and the risk-free rate is 3%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places. %arrow_forwardRisk-free rate is 7%, expected return on the market portfolio is 12%. Identify the correct equation for Security Market Line (SML): a. r = 5% + b(7%) b. r = 7% + b (12%) c. r = 7% + b (5%) d. r = 5% + b (12%)arrow_forward

- Question 1: Assume that you manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 27%. The T-bill rate is 7%. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. Stock A Stock B Stock C 1. Calculate the client expected return on the complete portfolio 2. Calculate the reward-to-variability ratio (Sharpe ratio): Part B A three-asset portfolio has the following characteristics: Expected Return Asset X Y Z 15% 10 6 Standard Deviation What is the expected return on this three-asset portfolio? 27% 33% 40% 22% 8 3 Weight 0.50 0.40 0.10arrow_forward1. What is your expected portfolio return of an investment portfolio with a 60/40 allocation of stocks and bonds, respectively, if you expect long term equities to return 8%, and long term bonds to return 2%? 5.6% 6.2% 4.8% 5.1% 2. You are looking into developing your first investment portfolio. After assessing your risk tolerance, you believe that an 90/10 allocation of stocks and bonds, respectively, is where you want to begin. You believe that 7% is what stocks will return over the next ten years, and 4% is what you expect to return in your bond portfolio. If you invest $300/month for the next ten years, what will your portfolio be worth? $51,077 $47,579 $52,843 $44,880arrow_forwardQuantitative Problem: You are holding a portfolio with the following investments and betas: Stock Dollar investment Beta A $300,000 1.2 B 200,000 1.6 C 400,000 0.75 D 100,000 -0.35 Total investment $1,000,000 The market's required return is 11% and the risk-free rate is 4%. What is the portfolio's required return? Do not round intermediate calculations. Round your answer to three decimal places.arrow_forward

- Consider following information on a risky portfolio, risk-free asset and the market index. What is the Sharpe ratio of the market index? Risky portfolio Risk-free asset Market index Average return 8.2% 2% 6% Std. Dev. 26% 20% Residual std. dev. 10% Alpha 1.4% Beta 1.2arrow_forwardConsider following information on a risky portfolio, risk-free asset and the market index. What is the M2 of the risky portfolio? Risky portfolio Risk-free asset Market index Average return 8.2% 2% 6% Std. Dev. 26% 20% Residual std. dev. 10% Alpha 1.4% Betaarrow_forwardConsider the information on the market, the risk-free asset, and a mutual fund. You want to build a two-asset portfolio comprising the market portfolio and the risk-free asset such that your portfolio beta is the same as the mutual fund. What is the portfolio weight on the market in your portfolio? Mutual Fund Market Risk Free E(k) 11.1% 8.5% 2.0% Beta 1.4 1 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education