FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:×

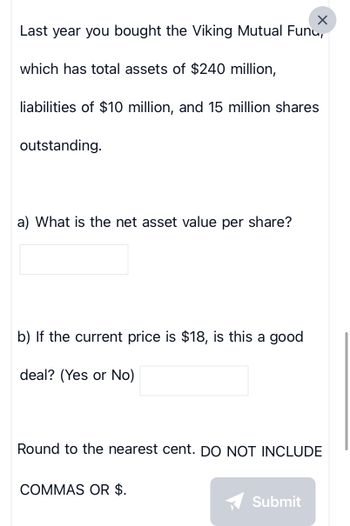

Last year you bought the Viking Mutual Fund,

which has total assets of $240 million,

liabilities of $10 million, and 15 million shares

outstanding.

a) What is the net asset value per share?

b) If the current price is $18, is this a good

deal? (Yes or No)

Round to the nearest cent. DO NOT INCLUDE

COMMAS OR $.

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In you cash account, you buy 100 shares of XYZ Corporation at a price of $10 per share. Two months later, XYZ pays a dividend $0.21 per share. You sell all 100 shares of XYZ three months later at a price of $12 per share. What is your total return on this trade in dollar amount?arrow_forwarddon't provide handwritten solution.arrow_forwardAbel, Inc. just paid a dividend of $3.0 per share and you think they will continue to pay $3.0 per year indefinitely. If the appropriate discount rate is 11%, how much should the price of a share be? (Answer to the nearest penny.)arrow_forward

- 7. You invest $7,873 in stock and receive $102, $123, $121, and $155 in dividends over the following 4 years. At the end of the 4 years, you sell the stock for $11,900. What was the IRR on this investment? Review Only Click the icon to see the Worked Solution (Calculator Use). Click the icon to see the Worked Solution (Spreadsheet Use). The IRR on this investment is %. (Round to the nearest whole percent.)arrow_forwardWeston Corporation just paid a dividend of $3.75 a share (i.e., Do $3.75). The dividend is expected to grow 11% a year for the next 3 years and then at 4% a year thereafter. What is the expected dividend per share for each of the next 5 years? Do not round intermediate calculations. Round your answers to the nearest cent. D1 = $ D2 = $ D3 $ %D D4 = $ D5 = $ %24 I| ||arrow_forwardA closed-end investment company has a net asset value of $12.75. A year ago the shares sold for a 24 percent discount but that discount has narrowed (that is, declined) to 12 percent. If the company distributed $1.05 a share, what was the return on an investment in the shares before considering commissions on the purchase? Round your answer to two decimal places. %arrow_forward

- Weston Corporation just paid a dividend of $2.75 a share (i.e., D0 = $2.75). The dividend is expected to grow 9% a year for the next 3 years and then at 5% a year thereafter. What is the expected dividend per share for each of the next 5 years? Do not round intermediate calculations. Round your answers to the nearest cent. D1 = $ D2 = $ D3 = $ D4 = $ D5 = $arrow_forwardWeston Corporation just paid a dividend of $3.5 a share (l.e., Do = $3.5). The dividend is expected to grow 12% a year for the next 3 years and then at 3% a year thereafter. What is the expected dividend per share for each of the next 5 years? Do not round Intermediate calculations. Round your answers to the nearest cent. D1 $ D₂ = $ D3=$ D4=$ Ds = $arrow_forwardWeston Corporation just paid a dividend of $2.5 a share (i.e., Do = $2.5). The dividend is expected to grow 12% a year for the next 3 years and then at 4% a year thereafter. What is the expected dividend per share for each of the next 5 years? Do not round intermediate calculations. Round your answers to the nearest cent. D₁ = $ D₂ = $ D3 = $ D4 = $ D5 = $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education