FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

answer in text form please (without image)

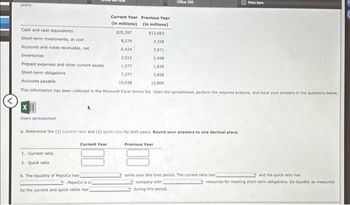

Transcribed Image Text:years:

Cash and cash equivalents

Short-term investments, at cost

Accounts and notes receivable, net

Inventories

Prepaid expenses and other current assets

Short-term obligations

Accounts payable

Current Year Previous Year

(in millions)

(in millions)

$25,397

$12,083

8,274

3,328

6,424

7,071

2,512

2,498

1,577

1,839

7,277

3,058

15,038

12,800

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

X

Open spreadsheet

a. Determine the (1) current ratio and (2) quick ratio for both years. Round your answers to one decimal place.

1. Current ratio

2. Quick ratio

b. The liquidity of PepsiCo has

Current Year

Office 365

PepsiCo is a

by the current and quick ratios has)

Previous Year

Print tem

some over this time period. The current ratio has

company with 2

during this period.

and the quick ratio has

resources for meeting short-term obligations. Its liquidity as measured

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please see imagesarrow_forwardExplain how the E-R diagrams is used to prepare database tables. Also, include explanation of cardinalities.arrow_forwardSelect the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forward

- Required information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forwardhow do you calculat mpg in excel?arrow_forwardAll blanks need to be filled please and thank you, it's incomplete as of now.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education