Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Beginning Inventory?

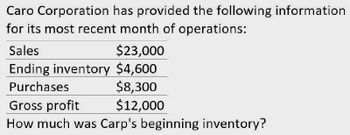

Transcribed Image Text:Caro Corporation has provided the following information

for its most recent month of operations:

Sales

$23,000

Ending inventory $4,600

Purchases

Gross profit

$8,300

$12,000

How much was Carp's beginning inventory?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Langstons purchased $3,100 of merchandise during the month, and its monthly income statement shows a cost of goods sold of $3,000. What was the beginning inventory if the ending inventory was $1,250?arrow_forwardLast year, Nikkola Company had net sales of 2,299,500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average inventory. 2. Calculate the inventory turnover ratio. 3. Calculate the inventory turnover in days. 4. CONCEPTUAL CONNECTION Based on these ratios, does Nikkola appear to be performing well or poorly?arrow_forwardLogo Gear purchased $2,250 worth of merchandise during the month, and its monthly income statement shows cost of goods sold of $2,000. What was the beginning inventory if the ending inventory was $1,000?arrow_forward

- Reid Company uses the periodic inventory system. On January 1, it had an inventory balance of 250,000. During the year, it made 613,000 of net purchases. At the end of the year, a physical inventory showed it had ending inventory of 140,000. Calculate Reid Companys cost of goods sold for the year.arrow_forwardAssume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the end of the year, with a cost value of $222,000. How will this affect your net income in the current year? How will it affect next years net income?arrow_forwardCarr Corporation has provided the following information for its most recent month of operation: sales $8,300; beginning inventory $1,150; ending inventory $2,150 and gross profit $5,450. How much were Carr's inventory purchases during the period? Multiple Choice O $9,450. $5,450. $3,850. $6,150.arrow_forward

- Landis Company is preparing its financial statements. Gross margin is normally 40% of sales. Information taken from the company's records revealed sales of $95,000; beginning inventory of $9,500 and purchases of $66,500. What is the estimated amount of ending inventory at the end of the period? Multiple Choice ο ο ο ο $30,400 $57,000 $38,000 $19,000arrow_forwardLandis Company is preparing its financial statements. Gross margin is normally 40% of sales. Information taken from the company's records revealed sales of $60,000; beginning inventory of $6,000 and purchases of $42,000. What is the estimated amount of ending inventory at the end of the period? Multiple Choice O O O $19,200 $36,000 $12,000 $24,000arrow_forwardThe 200X records of Thompson Company showed a beginning inventory of $6,000, cost of goods sold of $14,000, and ending inventory of $8,000. The cost of purchases for 200X was:$12,000$10,000$ 9,000$16,000 Question 2Post Company began the current month with $10,000 in inventory, then purchased inventory at a cost of $35,000. The inventory at the end of the month was $20,000. The cost of goods sold would be:$30,000$35,000$15,000$25,000 Question 3Following is the inventory activity for July:Beginning Balance 10 sweaters @ $12 each1-JulPurchased 5 sweaters at $14 each8-JulPurchased 8 sweaters at $17 each17-JulPurchased 6 sweaters at $20 each24-JulSold 12 sweaters for $30 eachWhat is the ending inventory $ amount using the FIFO method?$298$224$261 Question 4Following is the inventory activity for July: Beginning Balance 10 sweaters @ $12 each1-JulPurchased 5 sweaters at $14 each8-JulPurchased 8 sweaters at $17 each17-JulPurchased 6 sweaters at $20 each24-JulSold 12 sweaters for $30 each what…arrow_forward

- The following data are taken from the financial statements: Current Year Preceding Year Sales $3,600,000 $4,000,000 Cost of goods sold 2,000,000 2,700,000 Beginning inventory 372,000 352,000 Inventory, end of year 390,000 372,000 a. Determine for each year (1) the inventory turnover and (2) the number of days' sales in inventory. 1. The inventory turnover: (If required, round your answers to one decimal place.) Current Yearfill in the blank 1 Preceding Yearfill in the blank 2 2. The number of days' sales in inventory: Assume a 365-day year. (Round your intermediate calculation to whole number and final answers to two decimal places.) Current Yearfill in the blank 3 days Preceding Yearfill in the blank 4 days b. Comment on the favorable and unfavorable trends revealed by the data. Sales (decreased/increased) while gross profit (decreased/increased). The inventory turnover (declined/rose) and…arrow_forwardBlue Company has the following data for the year. Beginning inventory Net sales revenue $100,000 Net purchases $320,000 Normal gross profit rate $140,000 40% What is the estimated ending inventory? (Round your final answer to the nearest dollar.) O A. $240,000 O B. $192,000 O C. $112,000 O D. $48,000arrow_forwardThe following data are taken from the financial statements: Current Year Preceding Year Sales $3,600,000 $4,000,000 Cost of goods sold 2,000,000 2,700,000 Beginning inventory 372,000 352,000 Inventory, end of year 390,000 372,000 a. Determine for each year (1) the inventory turnover and (2) the number of days' sales in inventory. 1. The inventory turnover: (1f required, round your answers to one decimal place.) Current Year Preceding Year 2. The number of days' sales in inventory: Assume a 365-day year. (Round your intermediate calculation to whole number and final answers to two decimal places.) Current Year days Preceding Year days b. Comment on the favorable and unfavorable trends revealed by the data. v and the number of days' sales in inventory which are unfavorable trends Sales while gross profit The inventory turnoverarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College