Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide answer this accounting question

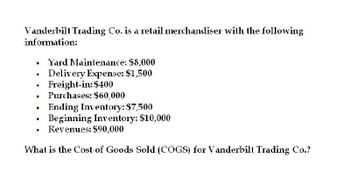

Transcribed Image Text:Vanderbilt Trading Co. is a retail merchandiser with the following

information:

• Yard Maintenance: $8,000

•

•

Delivery Expense: $1,500

Freight-in: $400

Purchases: $60,000

•

•

Ending Inventory: $7,500

Beginning Inventory: $10,000

•

.

Revenues: $90,000

What is the Cost of Goods Sold (COGS) for Vanderbilt Trading Co.?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Based on the given information below of FDNACCT Co., how much is the cost of goods available for sale? Sales = P85,000 Merchandise Inventory, 1/1 = P20,000 Merchandise Inventory, 12/31 = P26,000 Purchases = P55,000 Purchase Discounts = P1,000 Purchase Returns & Allowances = P2,000 Freight in = P3,000 Selling Expenses = P4,500 Administrative Expenses = P3,800arrow_forwardGeneral Accounting Question please solve this onearrow_forwardHow much is the cost of goods sold for the period???arrow_forward

- The following accounts of Rex Company are as follows: Sales P480,000; Cost of goods sold P300,000; Sales discounts P20,000; Sales returns and allowances P15,000; Purchase discounts P5,000; Purchase returns and allowances P7,000; Selling Expenses P40,000; General & Administrative expense P45,000; Interest income P5,000. What is the income from operations? P20,000 P55,000 P60,000 P190,000arrow_forwardQuestion: Compute the Cost of Goods Sold for a retail merchandiser with the below information: Yard maintenance $9,000 Delivery Expense $2,050 Freight-in $550 Purchases $45,000 Ending Inventory $5,000 Beginning Inventory $8,000 Revenues $72,000arrow_forward??arrow_forward

- 1) Listen The following information is available for Dennehy Company: $390,000 Sales Revenue Freight-in $30,000 Ending Inventory 37,500 Purchase Returns and 15,000 Allowances Purchases 270,000 Beginning Inventory 45,000 Dennehy's cost of goods sold is O a) $292,500. O b) $262,500. O c) $345,000. d) $285,000.arrow_forwardPlease provide answer of all requiredarrow_forwardGiven the information above, gross margin is? Given the information above, and assuming that Lindsey's total operating expenses (exclusive of the cost of goods sold) are $40,000, pretax income is?arrow_forward

- Funky Dance sold inventory for $250,000, terms 1/10, n/30. Cost of goods sold was $168,000. How much sales revenue will Funky Dance report from the sale? (Assume the company records sales at the net amount.) O A. $247,500 B. $250,000 C. $82,000 OD. $168,000arrow_forwardFunky Dance sold inventory for $250,000, terms 1/10, n/30. Cost of goods sold was $168,000. How much sales revenue will Funky Dance report from the sale? (Assume the company records sales at the net amount.) O A. $247,500 B. $250,000 C. $82,000 O D. $168,000arrow_forwardSmith company sold inventory that cost $5000 for $9000 cash. Freight cost was $600 paid in cash.The Freight term was FOB destination. Based on this information, what would the net income/ gross margin be?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning