Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answers this question general Accounting

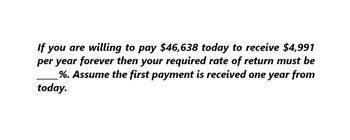

Transcribed Image Text:If you are willing to pay $46,638 today to receive $4,991

per year forever then your required rate of return must be

%. Assume the first payment is received one year from

today.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose you inherit a perpetuity that pays $4,000 each year. Assuming the first payment will occur one year from now and the cost of capital is 10% APR with daily compounding, what is the value of this perpetuity today? Assume 365 days in a year.arrow_forwardSuppose that you will receive annual payments of $16,500 for a period of 10 years. The first payment will be made 6 years from now. If the interest rate is 7%, what is the present value of this stream of payments?arrow_forwardIf you decide to deposit $480 every year for the next 6 years, with first deposit to be made one year from today and all deposits to be made at the end of each year, in an account that pays 4.62% APR with annual compounding, how much is this account worth in today's dollars?arrow_forward

- You plan to invest $2,000 per year into a retirement account. If you earn a compound annual rate of return of 5%, how many years will it take you to reach a balance of $500,000?arrow_forwardYou are offered the choice of two annuities. A: Receive $100 every year for the next ten years. The first payment starts one year from today. B: Receive $204 every two years for the next ten years. The first payment starts two years from today. Without calculating the present values of the annuities, explain how you can obtain the rate of interest per annum that would make you indifferent between the two annuities.arrow_forwardYou will receive a cash payment of $6.4 in 4 years. If the relevant interest rate is 16.4%, how much is it worth today? Answer:arrow_forward

- You are told that if you invest $11,100 per year for 19 years (all payments made at the beginning ofeach year) you will have accumulated $375,000 at the end of the period. What annual rate of return is theinvestment offeringarrow_forwardSuppose you invest $385 at the end of each of the next eight years. (a) If your opportunity cost rate is 7 % compounded annually, how much will your investment be worth after the last $385 payment is made? (b) What will be the ending amount if the payments are made at the beginning of each year?arrow_forwardAssume you will be paid $100 next year and every year after, and the interest rate is 2%. Calculate the present value of this infinite future payment of $100arrow_forward

- You intend to make the annual maximum contribution of $6,000 to your Roth IRA (individual retirement account) at the end of each year for the next 30 years. If you can earn 10 percent on your contributions, how much will you have at the end of the thirtieth year? Include the follwing variables to help you solve the problem: m Nper (or N) =n*m Rate (or I/Y)=i/m PV PMT FVarrow_forwardYou are going to receive a payment of $80 at the end of each year for the next 12 years. If you invest each of those amounts at the same interest rate, then what annual compound interest rate must you earn in th order to have $1,930.65 at the end of the 12 year?arrow_forwardCompute the present value of a perpetuity that pays $6,744 annually given a required rate of return of 9 percent per annum. Round your answer to 2 decimal places; record your answer without commas and without a dollar sign. Answer Question 4 Assume that you deposit $3,956 each year for the next 15 years into an account that pays 20 percent per annum. The first deposit will occur one year from today (that is, at t = 1) and the last deposit will occur 15 years from today (that is, at t = 15). How much money will be in the account 15 years from today? Round your answer to 2 decimal places; record your answer without commas and without a dollar sign.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT