EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

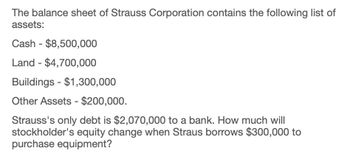

Transcribed Image Text:The balance sheet of Strauss Corporation contains the following list of

assets:

Cash $8,500,000

Land

-

$4,700,000

Buildings $1,300,000

Other Assets - $200,000.

Strauss's only debt is $2,070,000 to a bank. How much will

stockholder's equity change when Straus borrows $300,000 to

purchase equipment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You know the following information about the Davis National Bank: Total interest expenses $500.00 Total Noninterest income $100.00 Securities gains (losses) $50.00 Income taxes $80.00 Dividends to stockholders $40.00 Total interest income $800.00 Total noninterest expenses $150.00 Provision for loan losses $100.00 Given this information, what is the value of this firm's pretax net operating income?arrow_forwardWhat is Grey wood Corporation's long term debt on these financial accounting question?arrow_forwardThe liabilities and owners’ equity for Campbell Industries is found here. What percentage of the firm’s assets does the firm now finance using debt (liabilities)? If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm’s new debt ratio?arrow_forward

- We are given the following information for the Pettit Corporation. Sales (credit) Cash Inventory Current liabilities Asset turnover Current ratio Debt-to-assets ratio Receivables turnover $ 2,880,000 188,000 890,000 811,000 1.35 times 2.30 times a. Accounts receivable b. Marketable securities c. Fixed assets d. Long-term debt 40 % 5 times Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Lienser Fraktala TAMARA TANT RISHI TRITATE FAST JET PARETSTRANS I nemal osted or annemangen MANENBER HAGPAINT MANSION LARPURCO Calculate the following balance sheet items. (Do not round intermediate calculations. Round your final answers to the nearest whole number.)arrow_forwardRequired:1. How much is the net working capital of ABC Company?2. Is it positive or negative?arrow_forwardPlease explain step by steparrow_forward

- What is the cash coverage ratio of this financial accounting question?arrow_forwardNational Bank has the following balance sheet (in millions) and has no off-balance-sheet activities: a)What is leverage ratio? b)What is the Tier I capital ratio? c) What is the total risk-based capital ratio? d) In what capital category would the bank be placed?arrow_forwardf. ABC Bank has the following balance sheet (in millions) and has no off-balance-sheet exposure. Assets Liabilities and Equity Cash $20 Deposits $960 Treasury bills 40 Subordinated debt 25 Residential mortgages Common stock 45 Business loans 430 Retained earnings 40 Total assets $1,090 Total liabilities and equity $1.090 Total Risk Weighted Assets are $730. i) What is the Tier 1 risk-based capital ratio? ii) What is the Capital Adequacy Ratio (CAR)? iii) What is the Tier 1 leverage ratio?arrow_forward

- Balance Sheet You are evaluating the balance sheet for Cypress Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $670,000, Accounts receivable = $870,000, Inventory = $570,000, Accrued wages and taxes = $111,000, Accounts payable = $207,000, and Notes payable = $1,070,000. What is Cypress's net working capital? Multiple Choice $1,388,000 O $2,110,000 $722,000 O $3,498,000arrow_forwardWhat is cash coverage ratio? Please provide answer this financial accounting questionarrow_forwardZumbahlen Inc. has the following balance sheet information. How much total operating capital does the firm have? Cash $30.00 Accounts payable $40.00 Short-term investments 60 Accruals 64 Accounts receivable 25 Notes payable 45 Inventory 91 Gross fixed assets $200.00 Accumulated deprec. 50 Round your answer to the nearest whole number.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning