EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Accounting question

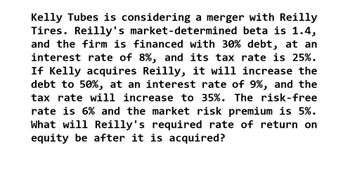

Transcribed Image Text:Kelly Tubes is considering a merger with Reilly

Tires. Reilly's market-determined beta is 1.4,

and the firm is financed with 30% debt, at an

interest rate of 8%, and its tax rate is 25%.

If Kelly acquires Reilly, it will increase the

debt to 50%, at an interest rate of 9%, and the

tax rate will increase to 35%. The risk-free

rate is 6% and the market risk premium is 5%.

What will Reilly's required rate of return on

equity be after it is acquired?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- give answer general accounting.arrow_forwardFrontLier Company is planning to acquire Stint Corp. The additional pre-tax income from the acquisition will be $150,000 in the first year, but it will increase by 5% in future years. Because of diversification, the beta of FronLier will decrease from 1.20 to 0.9. Currently the return on the market is 11% and the riskless rate is 6%. What is the maximum price that FrontLier should pay for Stint Corp? The tax rate of FrontLier is 30%. O 1,870,000 1,872,500 1,875,000 O 1,909,091arrow_forward3. Holland Auto Parts is considering a merger with Workman Car Parts. Workman's market-determined beta is 0.9, and the firm currently is financed with 20% debt, at an interest rate of 8%, and its tax rate is 25%. If Holland acquires Workman, it will increase the debt to 60%, at an interest rate of 9%, and the tax rate will increase to 35%. The risk-free rate is 6% and the market risk premium is 4%. What will Workman's required rate of return on equity be after it is acquired?arrow_forward

- Piedmont Hotels is an all-equity company. Its stock has a beta of .88. The market risk premium is 7.5 percent and the risk-free rate is 3.9 percent. The company is considering a project that is considers riskier that its current operations so it wants to apply an adjustment of 2.3 percent to the project's discount rate. What should the firm set as the required rate of return for the project?arrow_forwardNot-So-Swift Meat Processors is considering building a new meat processing facility in Omaha, NE. Not-So-Swift has 75 million common shares outstanding with the market price at $25/share. Assume rf = 6½%, β = 0.95, and the market risk premium at 8.4%. Estimate Not-So-Swift’s required return on its equity investment in the new facility.arrow_forwardAxon Industries needs to raise $22.41M for a new investment project. If the firm issues one-year debt, it may haveto pay an interest rate of 9.44 %, although Axon's managers believe that 5.51 % would be a fair rate given the level of risk. If the firm issues equity, they believe the equity may be underpriced by 11.26 %. What is the cost to current shareholders of financing the project out of Equity? NOTE: Provide your answers in Millions. E.G. for 100M you must enter 100.0000, for 20M you must enter 20.0000, etc.arrow_forward

- piedmont hotels is an all-equity company. its stock has a beta of 1.23. the market risk premium is 6.9 percent and the risk-free rate is 2.7 percent. the company is considering a project that it considers riskier than its current operations so it wants to apply an adjustment of 1.9 percent to the project's discount rate. what should the firm set as the required rate of return for the project?arrow_forwardA group of investors is intent on purchasing a publicly traded company and wants to estimate the highest price they can reasonably justify paying. The target company's equity beta is 1.20 and its debt-to-firm value ratio, measured using market values, is 60 percent. The investors plan to improve the target's cash flows and sell it for 12 times free cash flow in year five. Projected free cash flows and selling price are as follows. Year Free cash flows Selling price Total free cash flows ($ millions) 1 $ 31 2 $ 46 3 4 859 $ 51 $ 56 $ 31 $ 46 $51 $ 56 $ 56 $672 $ 728 To finance the purchase, the investors have negotiated a $460 million, five-year loan at 8 percent interest to be repaid in five equal payments at the end of each year, plus interest on the declining balance. This will be the only interest-bearing debt outstanding after the acquisition. Tax rate Selected Additional Information 40 percent Risk-free interest rate Market risk premium a. Estimate the target firm's asset beta 3…arrow_forwardA group of investors is intent on purchasing a publicly traded company and wants to estimate the highest price they can reasonably justify paying. The target company’s equity beta is 1.20 and its debt-to-firm value ratio, measured using market values, is 60 percent. The investors plan to improve the target’s cash flows and sell it for 12 times free cash flow in year five. Projected free cash flows and selling price are as follows. ($ millions) Year 1 2 3 4 5 Free cash flows $38 $53 $58 $63 $ 63 Selling price $ 756 Total free cash flows $38 $53 $58 $63 $ 819 To finance the purchase, the investors have negotiated a $530 million, five-year loan at 8 percent interest to be repaid in five equal payments at the end of each year, plus interest on the declining balance. This will be the only interest-bearing debt outstanding after the acquisition. Selected Additional Information Tax rate 40 percent Risk-free interest rate 3 percent Market risk…arrow_forward

- A group of investors is intent on purchasing a publicly traded company and wants to estimate the highest price they can reasonably justify paying. The target company’s equity beta is 1.20 and its debt-to-firm value ratio, measured using market values, is 60 percent. The investors plan to improve the target’s cash flows and sell it for 12 times free cash flow in year five. Projected free cash flows and selling price are as follows. ($ millions) Year 1 2 3 4 5 Free cash flows $38 $53 $58 $63 $ 63 Selling price $ 756 Total free cash flows $38 $53 $58 $63 $ 819 To finance the purchase, the investors have negotiated a $530 million, five-year loan at 8 percent interest to be repaid in five equal payments at the end of each year, plus interest on the declining balance. This will be the only interest-bearing debt outstanding after the acquisition. Selected Additional Information Tax rate 40 percent Risk-free interest rate 3 percent Market risk…arrow_forwardA group of investors is intent on purchasing a publicly traded company and wants to estimate the highest price they can reasonably justify paying. The target company’s equity beta is 1.20 and its debt-to-firm value ratio, measured using market values, is 60 percent. The investors plan to improve the target’s cash flows and sell it for 12 times free cash flow in year five. Projected free cash flows and selling price are as follows. ($ millions) Year 1 2 3 4 5 Free cash flows $33 $48 $53 $58 $ 58 Selling price $ 696 Total free cash flows $33 $48 $53 $58 $ 754 To finance the purchase, the investors have negotiated a $480 million, five-year loan at 8 percent interest to be repaid in five equal payments at the end of each year, plus interest on the declining balance. This will be the only interest-bearing debt outstanding after the acquisition. Selected Additional Information Tax rate 40 percent Risk-free interest rate 3 percent Market risk…arrow_forwardWentworth Industries is 100 percent equity financed. Its current beta is 1.1. The expected market rate of return is 16 percent and the risk-free rate is 11 percent. Round your answers to two decimal places. Calculate Wentworth’s cost of equity. % If Wentworth changes its capital structure to 20 percent debt, it estimates that its beta will increase to 1.3. The after-tax cost of debt will be 10 percent. Should Wentworth make the capital structure change? Based on the weighted cost of capital of %, the capital structure changed.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT