FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

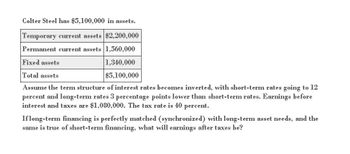

Colter Steel has $5,100,000 in assets.... Please answer the financial accounting question

Transcribed Image Text:Colter Steel has $5,100,000 in assets.

Temporary current assets $2,200,000

Permanent current assets 1,560,000

Fixed assets

Total assets

1,340,000

$5,100,000

Assume the term structure of interest rates becomes inverted, with short-term rates going to 12

percent and long-term rates 3 percentage points lower than short-term rates. Earnings before

interest and taxes are $1,080,000. The tax rate is 40 percent.

If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the

same is true of short-term financing, what will earnings after taxes be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Colter Steel has $5,250,000 in assets. Temporary current assets. Permanent current assets Fixed assets Total assets $ 2,500,000 1,575,000. 1,175,000 $ 5,250,000 Assume short-term interest rates are 10 percent and long-term rates are 4 percentage points lower than short-term rates. Earnings before interest and taxes are $1,110,000. The tax rate is 40 percent. If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the same is true of short-term financing. what will earnings after taxes be? Earnings after taxesarrow_forwardNighthawk Steel, a manufacturer of specialized tools, has $5,040,000 in assets. Temporary current assets Permanent current assets Capital assets Total assets $1,180,000 1,680,000 2,180,000 $5,040,000 Short-term rates are 5 percent. Long-term rates are 7.5 percent. (Note that long-term rates imply a return to any equity). Earnings before interest and taxes are $1,050,000. The tax rate is 25 percent. Assume the term structure of interest rates becomes inverted, with short-term rates going to 10 percent and long-term rates 5 percentage points lower than short-term rates. If long-term financing is perfectly matched (hedged) with long-term asset needs, and the same is true of short-term financing, what will earnings be after taxes? For an example of perfectly hedged plans. see Figure 6-8 Earning after taxesarrow_forwardNighthawk Steel, a manufacturer of specialized tools, has $5,220,000 in assets. Temporary current assets Permanent current assets Capital assets Total assets $1,240,000 1,740,000 2,240,000 $5,220,000 Short-term rates are 4 percent. Long-term rates are 6.5 percent. (Note that long-term rates imply a return to any equity). Ear before interest and taxes are $1,080,000. The tax rate is 25 percent. Assume the term structure of interest rates becomes imm with short-term rates going to 9 percent and long-term rates 4.5 percentage points lower than short-term rates. If long-term financing is perfectly matched (hedged) with long-term asset needs, and the same is true of short-term financing, earnings be after taxes? Eor an example of perfectly hedged plans see Figure 6-8. Earning after taxes $arrow_forward

- Nighthawk Steel, a manufacturer of specialized tools, has $5,220,000 in assets. Temporary current assets Permanent current assets Capital assets Total assets $1,240,000 1,740,000 2,240,000 $5,220,000 Short-term rates are 4 percent. Long-term rates are 6.5 percent. (Note that long-term rates imply a return to any equity). Ear before interest and taxes are $1,080,000. The tax rate is 25 percent. Assume the term structure of interest rates becomes im with short-term rates going to 9 percent and long-term rates 4.5 percentage points lower than short-term rates. If long-term financing is perfectly matched (hedged) with long-term asset needs, and the same is true of short-term financing earnings be after taxes? For an example of perfectly hedged plans, see Figure 6-8. Earning after taxes $arrow_forwardCrystal Oil has $9 million in accounts payable, $1.8 in saleries and taxes payable, and $10.4 in other current liabilities. If Crystal Oil had a cost of sales of $54 million and selling, general, and admisitrative expenses of $18 million, what is the length of its payables deferal period? *show work* A) 10.47 days B) 73.02 days C) 54.75 days D) 45.63arrow_forwardNighthawk Steel, a manufacturer of specialized tools, has $4,200,000 in assets. Temporary current assets Permanent current assets Capital assets Total assets $1,000,000 2,000,000 1,200,000 $4,200,000 Short-term rates are 4 percent. Long-term rates are 6.5 percent. (Note that long-term rates imply a return to any equity). Earnings before interest and taxes are $860,000. The tax rate is 25 percent. Assume the term structure of interest rates becomes inverted, with short-term rates going to 9 percent and long-term rates 4.5 percentage points lower than short-term rates If long-term financing is perfectly matched (hedged) with long-term asset needs, and the same is true of short-term financing, what will earnings be after taxes? For an example of perfectly hedged planssee Figure 6-8. Earning after taxes $ 459,000.00 Oarrow_forward

- Colter Steel has $4,200,000 in assets. The temporary current assets are in place for nine months and reduce to zero for three months. Temporary current assets Permanent current assets Capital assets Total assets $1,000,000 2,000,000 1,200,000 $4,200,000 Short-term rates are 8 percent. Long-term rates are 13 percent. (Note that long-term rates imply a return to any equity). Earnings before interest and taxes are $996,000. The tax rate is 30 percent. If long-term financing is perfectly matched (synchronized) with long-term asset needs, and the same is true of short-term financing, what will earnings after taxes be? For an example of perfectly hedged plans, see Figure 6-8 Earning after taxes Checarrow_forwardVikram bhaiarrow_forwardLever Age pays an 9% rate of interest on $9.70 million of outstanding debt with face value $9.7 million. The firm's EBIT was $2.3 million. a. What is its times interest earned? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Times interest earned 0.03 X b. If depreciation is $170,000, what is its cash coverage ratio? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Cash coverage ratio 0.03 Xarrow_forward

- Ques in financearrow_forwardOceania Bank has financial assets of $730 and equity of $328.5. If the duration of assets is 6.52 years and the duration of all liabilities is 1.39 years, what is the leverage - adjusted duration gap? A. 5.7555 years B. 5.8945 years C. 5.1799 years D. 6.4840 years E. Cannot be determinedarrow_forwardEagle Bank has the following interest-sensitive assets and interest-sensitive liabilities. Amount maturing in Amount maturing in 30 days (million) 570 330 116 Interest-sensitive assets Loans Securities 30 days (million) 810 63 Interest rate on interest-sensitive assets is 5% Interest rate on interest-sensitive liabilities is 3% Interest-sensitive liabilities Savings deposits Time deposits Money market The interest rate is expected to rise 1% (for both interest-sensitive assets and liabilities) 30 days later. Will Eagle Bank benefit from the interest rate rise? Explain your answer. Show your calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education