Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

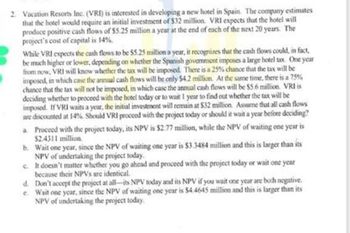

Transcribed Image Text:2. Vacation Resorts Inc. (VRI) is interested in developing a new hotel in Spain. The company estimates

that the hotel would require an initial investment of $32 million. VRI expects that the hotel will

prodoce positive cash flows of $5.25 million a year at the end of each of the next 20 years. The

project's cost of capital is 14%.

While VRI expects the cash flows to be $5.25 million a year, it recognizes that the cash flows could, in fact,

be much higher or lower, depending on whether the Spanish government imposes a large hotel tax. One year

from now, VRI will know whether the tax will be imposed. There is a 25% chance that the tax will be

imposed, in which case the annual cash flows will be only $4.2 million. At the same time, there is a 75%

chance that the tax will not be imposed, in which case the annual cash flows will be $5.6 million. VRI is

deciding whether to proceed with the hotel today or to wait I year to find out whether the tax will be

imposed. If VRI waits a year, the initial investment will remain at $32 million. Assume that all cash flows

are discounted at 14% Should VRI proceed with the project today or should it wait a year before deciding?

a Proceed with the project today, its NPV is 52.77 million, while the NPV of waiting one year is

$2.4311 million.

b.

Wait one year, since the NPV of waiting one year is $3.3484 million and this is larger than its

NPV of undertaking the project today.

c.

It doesn't matter whether you go ahead and proceed with the project today or wait one year

because their NPVs are identical.

d.

Don't accept the project at all-its NPV today and its NPV if you wait one year are boch negative.

e. Wait one year, since the NPV of waiting one year is $4.4645 million and this is larger than its

NPV of undertaking the project today.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- YOU ARE A FINANCIAL ANALYST FOR A COMPANY THAT IS CONSIDERING A NEW PROJECT. IF THE PROJECT IS ACCEPTED, IT WILL USE A FRACTION OF A STORAGE FACILITY THAT THE COMPANY ALREADY OWNS BUT CURRENTLY DOES NOT USE. THE PROJECT IS EXPECTED TO LAST 10 YEARS, AND THE ANNUAL DISCOUNT RATE IS 10% (COMPOUNDED ANNUALLY). YOU RESEARCH THE POSSIBILITIES, AND FIND THAT THE ENTIRE STORAGE FACILITY CAN BE SOLD FOR €100,000 AND A SMALLER (BUT BIG ENOUGH) FACILITY CAN BE ACQUIRED FOR €40,000. THE BOOK VALUE OF THE EXISTING FACILITY IS €60,000, AND BOTH THE EXISITING AND THE NEW FACILITIES (IF IT IS ACQUIRED) WOULD BE DEPRECIATED STRAIGHT LINE OVER 10 YEARS (DOWN TO A ZERO BOOK VALUE). THE CORPORATE TAX RATE IS 40%. DISCUSS WHAT IS THE OPPORTUNITY COST OF USING THE EXISTING STORAGE CAPACITY?arrow_forwardGreen & Company is considering investing in a robotics manufacturing line. Installation of the line will cost an estimated $15.7 million. This amount must be paid immediately even though construction will take three years to complete (years 0, 1, and 2). Year 3 will be spent testing the production line and, hence, it will not yield any positive cash flows. If the operation is very successful, the company can expect after-tax cash savings of $10.7 million per year in each of years 4 through 7. After reviewing the use of these systems with the management of other companies, Green's controller has concluded that the operation will most probably result in annual savings of $7.9 million per year for each of years 4 through 7. However, it is entirely possible that the savings could be as low as $3.7 million per year for each of years 4 through 7. The company uses a 12 percent discount rate. Use Exhibit A.8. Required: Compute the NPV under the three scenarios. Note: Round PV factor to 3…arrow_forwardCisco is considering the development of a wireless home networking appliance, called HomeNet. The company expects to sell 300000 units per year over the project's life at an expected wholesale price of 170. Actual production will be outsourced at a cost of 93 per unit. Additionally, the company will spend $21000 in interest expense each year towards financing the project. In year 1, the firm must increase its accounts receivable by $854000, which will return to regular levels at the end of the project. The company spent $285000 last year on software to develop the router. $101.8 million of new equipment will be purchased and then depreciated using the straight-line method over a 10-year life. They expect the market value of the equipment to depreciate at 2.8% per year. The project is expected to end in year 7. The current tax rate is 21%. Use this rate for both income tax rate and the capital gains rate. The WACC for the company is 12.4%.áWhat is the NPV of the project? $21,604,034.24…arrow_forward

- Fargo Inc. is considering a project that will require an initial investment of $1.5 million. The project will provide incremental cash inflows of $600,000 for the next five years. If the required return on the project is 15%, what is its discounted payback? If the company’s investment cutoff threshold is three years, should the project be given the go-ahead? Select one: a. 3 years and 4.55 months; yes b. 3 years and 4.55 months; no c. 4 years and 11.55 months; yes d. 4 years and 11.55 months; no e. 5 years and 1 month; noarrow_forwardThe private firm TranspCom needs to invest $300 million to a freeway construction and management project on year 2, and $50 million less than previous year each year from year 3 through year 6. What is the present worth of all these potential investments? (Suppose the annual rate of return is 12%)arrow_forwardBerra, Inc. is currently considering a seven-year project that has an initial outlay or cost of $120,000. The future cash inflows from its project for years 1 through 7 are the same at $30,000. Berra has a discount rate of 11%. Because of capital rationing (shortage of funds for financing), Berra wants to compute the profitability index (PI) for each project. What is the PI for Berra's current project?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education