EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

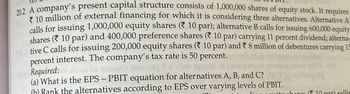

Transcribed Image Text:20.2 A company's present capital structure consists of 1,000,000 shares of equity stock. It requires

*10 million of external financing for which it is considering three alternatives. Alternative A

calls for issuing 1,000,000 equity shares (* 10 par); alternative B calls for issuing 600,000 equity

shares (10 par) and 400,000 preference shares (10 par) carrying 11 percent dividend; alterna-

tive C calls for issuing 200,000 equity shares (10 par) and 8 million of debentures carrying 15

percent interest. The company's tax rate is 50 percent.

Required:

(a) What is the EPS - PBIT equation for alternatives A, B, and C?

(b) Rank the alternatives according to EPS over varying levels of PBIT.

itu charos (10 par) sellin

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions. Source of Capital Target Market ProportionsLong Term Debt 25%Preferred Stock 15%Common Stock 60%Total Firm Value 100% Debt: The firm can sell a 10-year, RM1,000 par value, 6% bond for RM945.Preferred Stock: The firm has determined it can issue preferred stock at RM70 per share par value. The stock will pay a RM8 annual dividend.Common Stock: A firm's common stock is currently selling for RM19 per share.The dividend expected to be paid at the end of the coming year is RM1.85. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was RM1.50. Additionally, the firm's marginal tax rate is 35%.Determine the weighted average cost of capital for the firm.arrow_forwardProvide answerarrow_forwardPlease see image to answer question.arrow_forward

- F1 paese help......arrow_forwardGive true answerarrow_forwardsuppose that the Matrix corporation has $120 million of assets, all financed with equity, and that the form has 6 million shares of stock outstanding valued at $40 per share, suppose that management has identified investment opportunities requiring $60 million of new funds and can raise the funds in one of the following three ways: Financing package 1: Issue $60 million equity (3,000,000) shares of stocks at $40 per share) • Financing package 2: Issue $30 million equity (1,500,000) shares of stocks at $40 per share), and borrow $30 million with an annual interest rate 8% • Financing package 3: Borrow $60 million with an interest of 8%. a. Complete the following table for each financing package after the financing capital structure is completed: - Debt Equity No. of Shares Debt-equity ratio Debt-to- Financing package Assets Asset ratio 23 b. Suppose the Matrix Corporation has $27 million of operating earings. Show that the firm's return on assets is 15% c. compute the earnings per share…arrow_forward

- Provide answer the questionarrow_forwardQuestion1: Cybernauts, Ltd., is a new firm that wishes to finance an expansion program and determine its capital structure. It can issue 20 percent debt or 18 percent preferred stock. The total capitalization of the firm will be $6 million, and common stock can be sold at $25 per share. The company is expected to have a 50 percent tax rate. Four possible capital structures being considered are as follows: Plan Debt Preferred Common 1 20% 20% 60% 2 35 25 40 3 50 0 50 4 40 25 25 What would be the earnings per share for the four alternatives if earnings before interest and taxes are at $1.5 million?arrow_forward3. W&N (Pty) Ltd is considering two capital structures. The key information is shown in the following table. Assume a 40% tax rate. Structure B Source of Capital Structure A Long-term debt R75,000 @ 16% coupon rate Preferred stock R10,000 with an 18% dividend R50,000 @ 15% coupon rate R15,000 with an 18% annual dividend Common stock 8,000 shares 10,000 shares a) Calculate two EBIT-EPS co-ordinates for each of the structures. Use EBIT of R40,000 and R60,000 (when making comparisons R30,000 and R50,000 apply to both structure A and B). Find their associated EPS values. /4/ /3/ b) Plot the two capital structures on a set of EBIT-EPS axes. (Please label your graph). /3/ c) Indicate over what EBIT range, if any, each structure is preferred. d) Discuss the leverage and risk aspects of each structure. /3/ e) Which structure would you recommend if the firm expects its EBIT to be R35,000. Explain. /3/ 4. Jane is 22 years old and is planning for her retirement at age 62 (ie first payment at 63).…arrow_forward

- 3. Find the number of shares offeredarrow_forwardPart II: Problem solving (30 points): A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions: Source of Capital Long-term debt Preferred stock Common stock equity Target Market Proportions 30% 5 65 Debt: The firm can sell a 20-year, $1,000 par value, 9 percent bond for $980. A flotation cost of 2 percent of the face value would be required. Preferred Stock: The firm has determined it can issue preferred stock at $65 per share par value. The stock will pay an $8.00 annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock: The firm's common stock is currently selling for $40 per share. The dividend expected to be paid at the end of the coming year is $5.07. Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.45. It is expected that to sell, a new common stock issue must be underpriced at $1 per share and the firm…arrow_forwardC. Levered plan Firm value? is…..arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning