EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

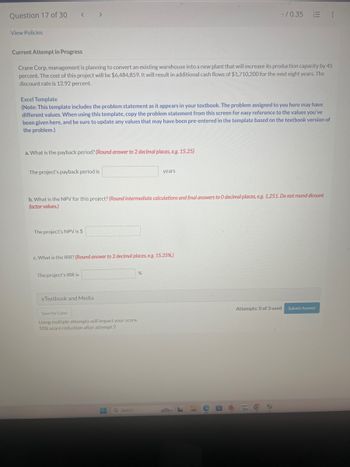

Transcribed Image Text:Question 17 of 30 < >

View Policies

-/0.35 :

Current Attempt in Progress

Crane Corp. management is planning to convert an existing warehouse into a new plant that will increase its production capacity by 45

percent. The cost of this project will be $6,484,859. It will result in additional cash flows of $1,710,200 for the next eight years. The

discount rate is 12.92 percent.

Excel Template

(Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have

different values. When using this template, copy the problem statement from this screen for easy reference to the values you've

been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of

the problem.)

a. What is the payback period? (Round answer to 2 decimal places, e.g. 15.25)

The project's payback period is

years

b. What is the NPV for this project? (Round intermediate calculations and final answers to O decimal places, e.g. 1,251. Do not round dicount

factor values.)

The project's NPV is $

c. What is the IRR? (Round answer to 2 decimal places, e.g. 15.25%.)

The project's IRR is

%

eTextbook and Media

Save for Later

Using multiple attempts will impact your score.

20% score reduction after attempt 2

Q Search

Attempts: 0 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forward19 es TB MC Qu. 14-36 (Algo) Moates Corporation has... Moates Corporation has provided the following data concerning an investment project that it is considering: $ 190,000 $ 120,000 per year 4 years 9% Initial investment Annual cash flow Expected life of the project Discount rate Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the project is closest to: Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Multiple Choice $190,000 $198,680 $(70,000)arrow_forwardAlpha industries is evaluating a project sokve this general accounting questionarrow_forward

- I need answer of this accounting questionsarrow_forward1/. The company ABC is considering two mutually exclusive investment programs which have a lifetime of two years. The cash flows of the two programs (in thousands of euros), as well as the corresponding probabilities of their realization are presented in the following tables: Year 0 Year 1 Cost Probability Cash Flow -400 Year 0 40% -700 60% Cost Probability Cash Flow 35% Year 1 65% TOPIC 1st INVESTMENT A 440 380 INVESTMENT B 480 Year 2 Potential Cash Flow 60% 40% 70% 30% 340 Chance Year 2 40% 60% 55% 45% 460 420 410 360 Cash Flow 490 480 380 330 AV. Consider, based on the criterion of Expected Net Present Value, which of the two investments would you choose, given that the weighted average cost of capital in the case of Investment A is estimated at 10%, Investment B at 8%, while the risk-free rate is 3%. B/. Let's say at the end of the first year a prospective buyer comes along and makes an offer to buy the investment you chose to implement in question a/. According to his offer, he…arrow_forwardJS er st un gs Sunland, Inc. management is considering purchasing a new machine at a cost of $4,370,000. They expect this equipment to produce cash flows of $791,390, $796,950, $866,730, $1,116,300, $1,212,360, and $1,300,900 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV is tA $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning