Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

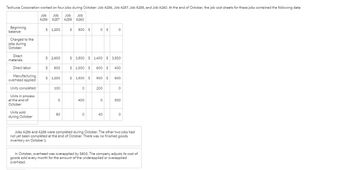

Transcribed Image Text:Techuxia Corporation worked on four jobs during October: Job A256, Job A257, Job A258, and Job A260. At the end of October, the job cost sheets for these jobs contained the following data:

Job Job

Job

Beginning

balance

Charged to the

jobs during

October:

Job

A256 A257 A258 A260

$ 1,200

$ 500 $

0 $

0

Direct

$ 2,600

$ 3,500 $1,400 $ 3,500

materials

Direct labor

$ 800

$ 1,000 $ 600 $

400

Manufacturing

overhead applied

$ 1,200

$ 1,500 $

900 $

600

Units completed

100

0

200

0

Units in process

at the end of

°

400

0

500

October

Units sold

during October

80

°

40

°

Jobs A256 and A258 were completed during October. The other two jobs had

not yet been completed at the end of October. There was no finished goods

inventory on October 1.

In October, overhead was overapplied by $800. The company adjusts its cost of

goods sold every month for the amount of the underapplied or overapplied

overhead.

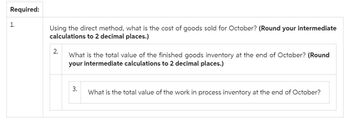

Transcribed Image Text:Required:

1.

Using the direct method, what is the cost of goods sold for October? (Round your intermediate

calculations to 2 decimal places.)

2.

What is the total value of the finished goods inventory at the end of October? (Round

your intermediate calculations to 2 decimal places.)

3.

What is the total value of the work in process inventory at the end of October?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Channel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forwardJob costs At the end of May, Bergan Company had completed Jobs 200 and 305. Job 200 is for 2,390 units, and Job 305 is for 2,053 units. Using the data from BE 16-1, BE 16-2, and BE 16-4, determine (A) the balance on the job cost sheets for Jobs 200 and 305 at the end of May, and (B) the cost per unit for Jobs 200 and 305 at the end of May.arrow_forwardLorrimer Company has a job-order cost system. The following debits (credits) appeared in the Work-in-Process account for the month of June. During the month of June, direct labor totaled 30,000 and 24,000 of overhead was applied to production. Finished Goods was debited 100,000 during June. Lorrimer Company applies overhead at a predetermined rate of 80% of direct labor cost. Job number 83, the only job still in process at the end of June, has been charged with manufacturing overhead of 3,400. What was the amount of direct materials charged to Job number 83? a. 3,400 b. 4,250 c. 8,350 d. 7,580arrow_forward

- K company production was working on Job 1 and Job 2 during the month. Of the $780 in direct materials. $375 in materials was requested for Job 1. Direct labor cost, including payroll taxes, are $23 per hour, and employees worked 18 hours on Job 1 and 29 hours on Job 2. Overhead is applied at the rate of $20 per direct labor hours. Prepare job order cost sheets for each job.arrow_forwardCycle Specialists manufactures goods on a job order basis. During the month of June, three jobs were started in process. (There was no work in process at the beginning of the month.) Jobs Sprinters and Trekkers were completed and sold, on account, during the month (selling prices: Sprinters, 22,000; Trekkers, 27,000); Job Roadsters was still in process at the end of June. The following data came from the job cost sheets for each job. The factory overhead includes a total of 1,200 of indirect materials and 900 of indirect labor. Prepare journal entries to record the following: a. Materials used. b. Factory wages and salaries earned. c. Factory Overhead transferred to Work in Process d. Jobs completed. e. Jobs sold.arrow_forwardOn August 1, Cairle Companys work-in-process inventory consisted of three jobs with the following costs: During August, four more jobs were started. Information on costs added to the seven jobs during the month is as follows: Before the end of August, Jobs 70, 72, 73, and 75 were completed. On August 31, Jobs 72 and 75 were sold. Required: 1. Calculate the predetermined overhead rate based on direct labor cost. 2. Calculate the ending balance for each job as of August 31. 3. Calculate the ending balance of Work in Process as of August 31. 4. Calculate the cost of goods sold for August. 5. Assuming that Cairle prices its jobs at cost plus 20 percent, calculate Cairles sales revenue for August.arrow_forward

- Luna Manufacturing Inc. completed Job 2525 on May 31, and there were no jobs in process in the plant. Prior to June 1, the predetermined overhead application rate for June was computed from the following data, based on an estimate of 5,000 direct labor hours: The factory has one production department and uses the direct labor hour method to apply factory overhead. Three jobs are started during the month, and postings are made daily to the job cost sheets from the materials requisitions and labor-time records. The following schedule shows the jobs and amounts posted to the job cost sheets: The factory overhead control account was debited during the month for actual factory overhead expenses of 27,000. On June 11, Job 2526 was completed and delivered to the customer using a mark-on percentage of 50% on manufacturing cost. On June 24, Job 2527 was completed and transferred to Finished Goods. On June 30, Job 2528 was still in process. Required: 1. Prepare job cost sheets for Jobs 2526, 2527, and 2528, including factory overhead applied when the job was completed or at the end of the month for partially completed jobs. 2. Prepare journal entries as of June 30 for the following: a. Applying factory overhead to production. b. Closing the applied factory overhead account. c. Closing the factory overhead account. d. Transferring the cost of the completed jobs to finished goods. e. Recording the cost of the sale and the sale of Job 2526.arrow_forwardEntry for factory labor costs The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: The direct labor rate earned per hour by the three employees is as follows: The process improvement category includes training, quality improvement, and other indirect tasks. A. Journalize the entry to record the factory labor costs for the week. B. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained incomplete at the end of the week. How would the direct labor costs for all three jobs be reflected on the financial statements at the end of the week?arrow_forwardA company has the following transactions during the week. Purchase of $3,000 raw materials inventory Assignment of $700 of raw materials inventory to Job 7 Payroll for 10 hours and $3,000 is assigned to Job 7 Factory depreciation of $1,750 Overhead applied at the rate of $200 per hour What is the cost assigned to Job 7 at the end of the week?arrow_forward

- Bangor Products Co. obtained the following information from its records for April: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for April: a. The gross profit or loss for each job completed and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forwardA company has the following transactions during the week. Purchase of $1,000 raw materials inventory Assignment of $500 of raw materials inventory to Job 5 Payroll for 20 hours with $1,000 assigned to Job 5 Factory utility bills of $750 Overhead applied at the rate of $10 per hour What is the cost assigned to Job 5 at the end of the week?arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning