Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Subject:- Cost Account

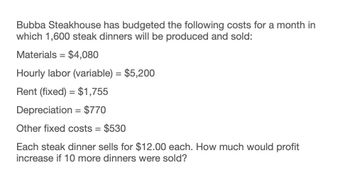

Transcribed Image Text:Bubba Steakhouse has budgeted the following costs for a month in

which 1,600 steak dinners will be produced and sold:

Materials = $4,080

Hourly labor (variable) = $5,200

Rent (fixed) $1,755

Depreciation = $770

Other fixed costs = $530

Each steak dinner sells for $12.00 each. How much would profit

increase if 10 more dinners were sold?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bubba Steakhouse has budgeted the following costs for a month in which 1,600 steak dinners will be produced and sold: Materials = $4,080 Hourly labor (variable) = $5,200 Rent (fixed) $1,755 Depreciation = $770 Other fixed costs = $530 Each steak dinner sells for $12.00 each. How much would profit increase if 10 more dinners were sold?arrow_forwardYou are selling a new line of T-shirts on the boardwalk. The selling price will be $25 per shirt The labor cost is $5 per shirt. Additionally, the cost of materials will be $10 per shirt. The administrative costs of operating the company are estimated to be $60,000 annually, and the sales and marketing expenses are $20,000 a year. What is the break-even in units and BEP in dollars? Formulas: Contribution Margin = Unit Selling Price-Unit Variable Cost Profit - Total Revenue - Total Cost or Profit - Quantity Sold (Selling Price per unit - Variable Cost per unit) - Fixed Cost Fixed Cost Break-even (quantity) = Unit Selling Price - Unit Variable Cost Break-even ($) = Break-even (quantity). X Quantity Sold Fixed Cost + Profit Desired Unit Selling Price - Unit Variable Cost Target Quantity for certain profit =arrow_forwardSuper Clinics offers one service that has the following annual cost and volume estimates: Variable cost per visit = $10 Annual direct fixed costs = $50,000 Allocation of overhead costs = $20,000 Expected volume = 1,000 visits What price per visit must be set if the clinic wants to make an annual profit of $10,000 on the full cost of the service?arrow_forward

- You need 1,000 units of product Y per month. You currently make product Y in-house at a cost of $7/unit, which consists of $2/unit of fixed costs and $5/unit of variable costs. An outside supplier has offered to manufacture product Y for you at a wholesale price of $2 per unit. If you outsource the production of Y to the outside supplier in the short term, your profit will: increase by $3,000 decrease by $2,000 remain the same decrease by $3,000 increase by $2,000arrow_forwardA manufacturer of sunglasses has a fixed cost of $50,000. This manufacturer expects to sell 5,000 pairs of sunglasses for $25.00. This price will give the manufacturer a 25 percent markup on price. Calculate the variable costs.arrow_forwardThe Chimes Clock Company sells a particular clock for $40. The variable costs are $23 per clock and the breakeven point is 230 clocks. The company expects to sell 280 clocks this year. If the company actually sells 430 clocks, what effect would the sale of additional 150 clocks have on operating income? Explain your answer. The sale of an additional 150 clocks would operating income by the amount of The total effect would amount toarrow_forward

- Green Corporation expects to sell 3,000 plants a month. Its operations manager estimated the following monthly costs: Variable costs P 7,500; Fixed costs 15,000. What sales price per plant does she need to achieve to begin making a profit if she sells the estimated number of plants per month? A. P7.51B. P7.50C. P5.00D. P2.50arrow_forwardLush Lawn, Incorporated produces and sells electric lawn trimmers for $150 each. The variable costs of each mower total $110 while total monthly fixed costs are $6,240. Current monthly sales are $51,000. The company is considering a proposal that will decrease the selling price by 10%, increase monthly fixed costs by 50%, and increase unit sales to 500 units per month. Required: a. Compute the company's current break-even point in units and dollars. b. What is the company's current margin of safety in units, dollars, and percentage? a. Break-even point a. Break-even sales b. Margin of safety b. Margin of safety in dollars b. Margin of safety in ratio units unit %arrow_forwardProLight plans to sell 1,600 white lights that enhance indoor plant growth next year with total budgeted sales of $48,000 and estimated profit of $8,000. Variable costs are projected to be $18.00 per unit. Customer A offers to pay $10,200 to buy 500 lights from ProLight. Total fixed costs are $12,000 per year. This offer does not affect ProLight’s other planned operations. How much is incremental profit associated with the offer from Customer A? $1,200 $10,200 $3,200 $7,000 $3,000arrow_forward

- Dogarrow_forwardLush Lawn, Incorporated produces and sells electric lawn trimmers for $180 each. The variable costs of each mower total $140 while total monthly fixed costs are $6,480. Current monthly sales are $54,000. The company is considering a proposal that will decrease the selling price by 10%, increase monthly fixed costs by 50%, and increase unit sales to 600 units per month. Required: a. Compute the company's current break-even point in units and dollars. b. What is the company's current margin of safety in units, dollars, and percentage? a. Break-even point a. Break-even sales b. Margin of safety b. Margin of safety in dollars b. Margin of safety in ratio units units %arrow_forwardFraming House, Inc. produces and sells picture frames. Variable costs are expected to be $15 per frame; fixed costs for the year are expected to total $170,000. The budgeted selling price is $23 per frame. The sales dollars required to make a before-tax profit (πB) of $21,000 for Framing House would be:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning