SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

correct ✅

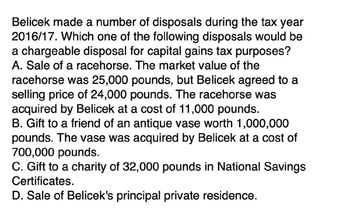

Transcribed Image Text:Belicek made a number of disposals during the tax year

2016/17. Which one of the following disposals would be

a chargeable disposal for capital gains tax purposes?

A. Sale of a racehorse. The market value of the

racehorse was 25,000 pounds, but Belicek agreed to a

selling price of 24,000 pounds. The racehorse was

acquired by Belicek at a cost of 11,000 pounds.

B. Gift to a friend of an antique vase worth 1,000,000

pounds. The vase was acquired by Belicek at a cost of

700,000 pounds.

C. Gift to a charity of 32,000 pounds in National Savings

Certificates.

D. Sale of Belicek's principal private residence.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hi expert please give me answer general accountingarrow_forwardOn August 15, 2021, Ms. Mones sold a 500-square meter residential house and lot for P3,000,000. The house was acquired in 2006 at P2,000,000. The Assessor's fair market values of the house and lot, respectively, wer P1,500,000 and P1,000,000. The zonal value of the lot was P5,000 per square meter. What is the capital gains tax? a.P150,000 b.P240,000 c.P180,000 d.P120,000arrow_forwardHaresharrow_forward

- Joaquin purchased a $235,000 crane for a construction business. The crane was sold for $175,000 after taking $115,000 of depreciation. Assume Joaquin is in the 35% tax rate bracket. Required: a. On what form would the gain or loss originally be reported? b. What is the amount of gain or loss on the sale? c. What amount of the gain or loss is subject to ordinary tax rates? Complete this question by entering your answers in the tabs below. Required a Required b Required c PS What is the amount of gain or loss on the sale?arrow_forwardMegha Nhon Corp., a vat registered taxpayer made the following acquisition of equipment from vat registered suppliers (net of vat) during 2021 and 2022: Date Purchase price Useful life (yrs) Oct. 1, 2021 2,000,000 6 Apr. 1, 2022 2,500,000 2 The equipment acquired on Oct. 2021 was sold on Apr. 2022. How much is the creditable input vat on Apr. 2022? P216,000 P324,000 P516,000 P300,000arrow_forwardsolution neededarrow_forward

- Craig and Karen Conder purchased a new home on May 1 of year 1 for $200,000. At the time of the purchase, it was estimated that the real property tax rate for the year would be 1 percent of the property's value. How much in property taxes on the new home are the Conders allowed to deduct under each of the following circumstances? Assume the Conders' itemized deductions exceed the standard deduction before considering property taxes and the property tax is the only deductible tax they pay during the year. Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. Required: The property tax estimate proves to be accurate. The seller and the Conders paid their share of the tax. The full property tax bill is paid to the taxing jurisdiction by the end of the year. The actual property tax bill was 1.05 percent of the property's value. The Conders paid their share of the estimated tax bill and the entire difference between the 1 percent estimate…arrow_forwardPlease need answer the general accounting questionarrow_forwardDuring the current year, Hom donates a sculpture that cost $1,000 to a museum for exhibition. The sculpture's fair market value was $1,700 on the date of the donation, and Hom's adjusted gross income is $40,000. Assume Hom held the sculpture for 4 months and the $700 ($1,700 − $1,000) of appreciation is a short-term capital gain. Calculate the amount of his itemized deduction for the contribution. Assume Hom held the sculpture for 2 years and the $700 appreciation is a long-term capital gain. Calculate the amount of his itemized deduction for the contribution.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT