Fundamentals of Financial Management, Concise Edition (with Thomson ONE - Business School Edition, 1 term (6 months) Printed Access Card) (MindTap Course List)

8th Edition

ISBN: 9781285065137

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide solution this financial accounting question

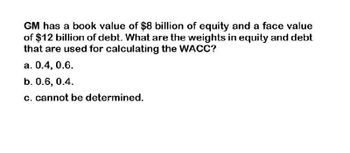

Transcribed Image Text:GM has a book value of $8 billion of equity and a face value

of $12 billion of debt. What are the weights in equity and debt

that are used for calculating the WACC?

a. 0.4, 0.6.

b. 0.6, 0.4.

c. cannot be determined.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial Accountingarrow_forwardA firm has a debt-to-equity ratio of 0.60 and a market-to-book ratio of 4.0. What is the ratio of the book value of debt to the market value of equity? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardwhat is the debt to equity ratio if the WACC is0.083 the cost of debt is 0.055 and the cost of equity is 0.15 what is the weight of debt what is the weight of equityarrow_forward

- Assume Lavender Corporation has a market value of $4 billion of equity and a market value of $19.8 billion of debt. What are the weights in equity and debt that are used for calculating the WACC?arrow_forwardAndyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.7. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Assets Liabilities & Equity $1,100 Debt $480 Equity $620 The debt weight for the WACC calculation is %. (Round to two decimal places.) The equity weight for the WACC calculation is %. (Round to two decimal places.)arrow_forwardAa 145.arrow_forward

- How do you determine the mix (percentages or weights) of debt vs equity from the Debt to Equity (D/E) Ratio? For example, if a company has a D/E Ratio = .667, what is the percentage of debt, of equity? For example, if a company has a D/E Ratio = 1, what is the percentage of debt, of equity? For example, if a company has a D/E Ratio = 1.5, what is the percentage of debt, of equity?arrow_forwardAndyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.4. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Liabilities & Equity Assets $1,030 Debt Equity $500 $530 The debt weight for the WACC calculation is %. (Round to two decimal places.)arrow_forwardA firm has a debt-to-equity ratio of 0.5 and a market-to-book ratio of 2. What is the ratio of the book value of debt to the market value of equity? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Book debt-to-market equity ratioarrow_forward

- Mobius, Incorporated, has a total debt ratio of .61. a. What is its debt-equity ratio? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What is its equity multiplier? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardFinancial Accounting Question please answerarrow_forwardMobius, Incorporated, has a total debt ratio of .10. A) What is the debt-equity ratio? Note: Do not round intermediate calculations and round your answer to 2 decimal places. B) What is its equity multiplier? Note: Do not round intermediate calculations and round your answer to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning