EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting Question

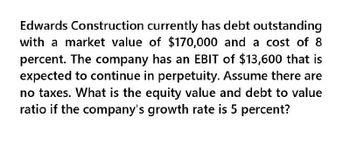

Transcribed Image Text:Edwards Construction currently has debt outstanding

with a market value of $170,000 and a cost of 8

percent. The company has an EBIT of $13,600 that is

expected to continue in perpetuity. Assume there are

no taxes. What is the equity value and debt to value

ratio if the company's growth rate is 5 percent?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Edwards Construction currently has debt outstanding with a market value of $75,000. The company has a WACC of 9 percent and has EBIT of $8,750 in the next year. The tax rate is 20%. What is the debt-to-value ratio if the EBIT’s growth rate is 5%? a. 42.86% b. 39.33% c. 96.42% d. 32.45%arrow_forwardICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 9 years to maturity that is quoted at 107 percent of face value. The issue makes semiannual payments and has an embedded cost of 6.6 percent annually. What is the company's pretax cost of debt? If the tax rate is 24 percent, what is the aftertax cost of debt? Pretax cost of debt: __________% Aftertax cost of debt: __________%arrow_forwardSee Financial question attached.arrow_forward

- What is the value of equity and debt?arrow_forwardBruce & Co. expects its EBIT to be $100,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Given the above information; a) Complete the table given below for varying levels of debt below by using a mix of the given information and using your own computations. EBIT $100,000.00 Cost of debts 11% cost of equity when unlevered 18% Tax rate 31% Debts $0 $10,000.00 $20,000.00 $30,000.00 Cost of Equity when levered Equity D/E Vu VL WACC b) Plot the results from the table into the following two graphs:i) Value of the firm vis-à-vis- Total debtii) Cost of capital of the firm vis-à-vis D/E ratio.iii) Which MM propositions have you demonstrated?arrow_forwardBruce & Co. expects its EBIT to be $100,000 every year forever. The firm can borrow at 11 percent. Bruce currently has no debt, and its cost of equity is 18 percent. The tax rate is 31 percent. Given the above information; a) Complete the table given below for varying levels of debt below by using a mix of the given information and using your own computations. EBIT $100,000.00 Cost of debts 11% cost of equity when unlevered 18% Tax rate 31% Debts $0 $10,000.00 $20,000.00 $30,000.00 Cost of Equity when levered Equity D/E Vu VL WACC b) Plot the results from the table into the following two graphs:i) Value of the firm vis-à-vis- Total debtii) Cost of capital of the firm vis-à-vis D/E ratio.iii) Which MM propositions have you demonstrated? Please show the graphs.arrow_forward

- Company Y has a target debt ratio of 55%. Currently its debt ratio is 60% and it expects to revert to the target ratio in the near future. The company has a market cost of equity of 20%. While it has no bonds, it has interest payments of R1 000 000 on liabilities of R10 000 000. Assume the tax rate is 27%. What is the WACC for the company? a. 6.36% b. 14.05% c. 13.02% d. 9.10%arrow_forwardCompany Y has a target debt ratio of 55%. Currently its debt ratio is 60% and it expects to revert to the target ratio in the near future. The company has a market cost of equity of 20%. While it has no bonds, it has interest payments of R1 000 000 on liabilities of R10 000 000. Assume the tax rate is 28%. What is the WACC for the company? Ⓒa. 6.36% b. 9.00% c. 12.33% d. 12.96%arrow_forwardKirk Construction has an outstanding debt with a market value of $75,000. The company's Weighted Average Cost of Capital (WACC) is 10%. Its upcoming Earnings Before Interest and Taxes (EBIT) is $10,000 (t-1). The EBIT is expected to grow by 5% per year indefinitely. The tax rate is 20%. What is the equity value of Kirk Construction? $85,000 $155,000 $160,000 $125,000arrow_forward

- Bruce & Co. expects its EBIT to be $100,000 every year forever. The firm canborrow at 11 percent. Bruce currently has no debt, and its cost of equity is18 percent. The tax rate is 31 percent.Given the above information;a) Complete the table given below for varying levels of debt below by usinga mix of the given information and using your own computations.EBIT $100,000Cost of debt 11%Cost of equity when unlevered 18%Tax rate 31%Debt $0 $10,000 $20,000 $30,000Cost of Equity when leveredEquityD/EVuVLWACCb) Plot the results from the table into the following two graphs:i) Value of the firm vis-à-vis- Total debtii) Cost of capital of the firm vis-à-vis D/E ratio.iii) Which MM propositions have you demonstrated?arrow_forwardICU Window, inc, is trying to determine its cost of debt. The firm has a debt issue outstanding with 8 years to maturity that is quoted at 106.5 percent of face value. The issue makes semiannual payments and has an embedded cost of 6.4 percent annually. What is ICU's pretax cost of debt? If the tax rate is 23 percent, what is the aftertax cost of debt?arrow_forwardNobleford Inc. is trying to determine its cost of debt. The firm has a debt issue outstanding with 23 years to maturity that is quoted at 97% of face value. The issue makes semiannual payments and has an embedded cost of 5% annually. Assume the par value of the bond is $1,000. What is the company’s pre-tax cost of debt? If the tax rate is 35%, what is the after-tax cost of debt?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT