Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

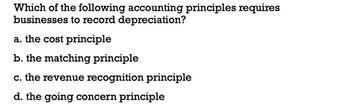

Transcribed Image Text:Which of the following accounting principles requires

businesses to record depreciation?

a. the cost principle

b. the matching principle

c. the revenue recognition principle

d. the going concern principle

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Describe the revenue recognition principle. Give specifics.arrow_forwardExplain when revenue may be recognized and give an example.arrow_forwardThe concept that states assets should be recorded at their original cost is known as the: i. Matching Principle ii. Consistency Principle iii. Cost Principle iv. Revenue Recognition Principlearrow_forward

- How does the revenue-expense approach differ from the asset-liability approach fordefining accounting elements?arrow_forwardI want accurate answer ☑arrow_forwardWhat is the purpose of recognizing depreciation on the financial statements? Is it designed to report PPE at fair value on the balance sheet?arrow_forward

- The concept that states assets should be recorded at their original cost is known as the: a) Matching Principle b) Cost Principle c) Consistency Principle d) Revenue Recognition Principlearrow_forwardAccounting depreciation can be broken into two categories. How?arrow_forwardEXPLAIN THE CONCEPT OF REVENUE RECOGNITION. WHAT ARE THE CRITERIA THAT MUST BE MET BEFORE REVENUE CAN RECOGNIZED? BEarrow_forward

- Which one of the following disclousures is required by generally accepted accounting principle? a. Depreciation expense for each major class of asset b. Balances of major classes of depreciable assets, by nature or function c. Accumulated depreciation on each depreciable asset d. An explanation of why the depreciation method used was selected by managementarrow_forwardIdentify the accounting issues related to asset impairment.arrow_forwardWhat contra account is used when recording and reporting the effects of depreciation? Why is it used?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub