Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

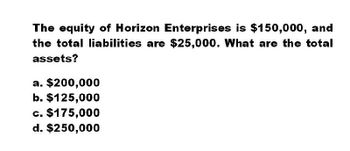

What are the total assets on these general accounting question?

Transcribed Image Text:The equity of Horizon Enterprises is $150,000, and

the total liabilities are $25,000. What are the total

assets?

a. $200,000

b. $125,000

c. $175,000

d. $250,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 1. If total assets is P 50,000 and 2/3 of which is total liabilities, how much is the equity? 2. If total assets is P 87,750 and it is 135% of equity, how much is the total liabilities? 3. If total liabilities is twice the amount of equity and equity is P 46,000, how much is the totalassets? 4. If equity is 4/5 of liabilities and total assets is P 90,000, how much is the total liabilities? 5. If total liabilities is 60% of assets, equity is what percent of liabilities? 6. If total assets is four times the amount of equity, total liabilities is what percent of assets? 7. If loss is P 56,000 and Income is 88,000, how much is the total expenses? 8. If total expenses is 120% of income, and income is P 85,000, how much is the profit or loss? 9. If beginning and ending equity is P 67,000 and P 88,000, respectively, how much is the total expenses if income is P 71,000, assuming there are no other transactions that affected equity? 10. Beginning total assets and total liabilities were P 40,000…arrow_forwardIf your total assets equal $50,000 and your total liabilities equal $15,000; your debt ratio is Group of answer choices 233%. 143%. 30%. 70%. 333%.arrow_forwardThe net income is $800,000, the stock market price is $20, the shares outstanding is 200,000, please calculate PE ratio.a. 5b. 0.2c. 4 d. 0.25arrow_forward

- Hummel Inc. has $30,000 in current assets and $15,000 in current liabilities. What is Hummels current ratio? a. 3 c. 1 b. 2 d. 0.5arrow_forwardIf current assets are $112,000 and current liabilities are $56,000, what is the current ratio? A. 200 percent B. 50 percent C. 2.0 D. $50,000arrow_forwardConsider the following data for the firms Acme and Apex: Equity ($ million) Debt ($ million) ROC Cost of Capital Acme 290 145 17% 9% Apex 1,450 483 15% 10% a. Calculate the economic value added for Acme and Apex (round to 2 decimal places). Economic value added for Acme $? million Economic value added for Apex $? million b. Calculate the economic value added per dollar of invested capital for Acme and Apex (round to 2 decimal places)? Economic value added for Acme per dollar Economic value added for Apex per dollararrow_forward

- 21. Kinsella Corporation's statement of financial position showed the following amounts: current liabilities, $75,000; total liabilities, $100,000; total assets, $200,000. What is the total long-term debt to total equity ratio? a.0.375 b.0.125 c.0.75 d.0.25arrow_forwardJordan Manufacturing reports the following capital structure: Current liabilities P100,000 ; Long-term debt 400,000 ; Deferred income taxes 10,000 ; Preferred stock 80,000 ; Common stock 100,000 ; Premium on common stock 180,000 ; Retained earnings 170,000. What is the debt ratio? A. 0.48 B. 0.49 C. 0.93 D. 0.96arrow_forwardSouthern Style Realty has total assets of S485, 390, net fixed assets of $250,000, current liabilities of S 23,456, and long-term liabilities of $148.000. What is the total debt ratio? Multiple Choice .30.35.69.53.68.arrow_forward

- Y3K, Incorporated, has sales of $5,000, total assets of $3,200, and a debt-equity ratio of 1.10. If its return on equity is 14 percent, what its net income? Multiple Choice о O $76.80 $448.00 $136.53 $700.00 ڈےarrow_forwardA company has the following balance sheet. What is its total net operating capital? (Round it to a whole dollar, if necessary) Cash $ 20 Accounts payable $ 45 Short-term investments 30 Accruals 50 Accounts receivable 50 Notes payable 10 Inventory 50 Current liabilities xxx Current assets xxx Long-term debt 70 Net fixed assets 100 Common equity 30 Retained earnings xx Total assets $xxx Total liab. & equity $xxxarrow_forwardA company has the following balance sheet. What is its total net operating capital? (Round it to a whole dollar, if necessary) Cash $ 20 Accounts payable $ 60 Short-term investments 30 Accruals 50 Accounts receivable 50 Notes payable 10 Inventory 80 Current liabilities xxx Current assets xxx Long-term debt 70 Net fixed assets 100 Common equity 30 Retained earnings xx Total assets $xxx Total liab. & equity $xxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College