Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Provide answer financial accounting

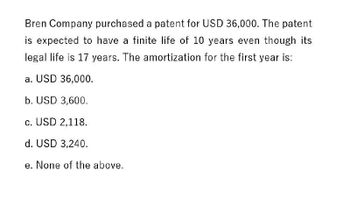

Transcribed Image Text:Bren Company purchased a patent for USD 36,000. The patent

is expected to have a finite life of 10 years even though its

legal life is 17 years. The amortization for the first year is:

a. USD 36,000.

b. USD 3,600.

c. USD 2,118.

d. USD 3,240.

e. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a seventeen-year remaining legal life was purchased for $850,000. The patent will be usable for another six years. B. A patent was acquired on a new tablet. The cost of the patent itself was only $12,000, but the market value of the patent is $150,000. The company expects to be able to use this patent for all twenty years of its life.arrow_forwardCP, Inc.. purchases a patent on January 1, 20X1, for $40,000 and the patent has an expected useful life of five years with no residual value. Assuming CP. uses the straight-line method, what is the carrying value of the patent on December 31, 20X2?arrow_forwardThe amortization expense (to the nearest dollar) properly recognized for 20X1 is:arrow_forward

- On January 1, 20X3, Enid Corporation purchased a patent from another company for $190,000. The estimated useful life of the patent is 10 years, and its remaining legal life is 15 years. The amortization expense for 20X3 is: Question 5 options: $12,667. $85,000. $68,000. $19,000.arrow_forwardOn January 1, Year 1, Stiller Company paid $192,000 to obtain a patent. Stiller expected to use the patent for 5 years before it became technologically obsolete. The remaining legal life of the patent was 8 years. Based on this information, what is the amount of amortization expense during Year 3 and the book value of the patent as of December 31, Year 3, respectively? Multiple Choice O $24,000 and $72,000 $24,000 and $120.000 $38,400 and $76,800 $38,400 and $115,200arrow_forwardBerry Co. purchases a patent on January 1, 2021, for $38,000 and the patent has an expected useful life of five years with no residual value. Assuming Berry Co. uses the straight-line method, what is the amortization expense for the year ended December 31, 2022? Multiple Choice $15,200. $0. $7,600. $38,000.arrow_forward

- On January 1, 20X3, Enid Corporation purchased a patent from another company for $190,000. The estimated useful life of the patent is 10 years, and its remaining legal life is 15 years. The amortization expense for 20X3 is: $12,667. $85,000. $68,000. $19,000.arrow_forwardABC Co. purchased a patent on January 1, 2018 for P300,000. The patent was being amortized over its remaining legal life of 15 years. During 2020, ABC Co. determined that the economic benefits of the patent would not last longer than 10 years from the date of acquisition. What amount should be charged to patent amortization expense for the year ended December 31 2020?a. 32,500b. 26,000c. 20,000 d. 17,333 e. answer not givenarrow_forwardSandhill Inc. purchased a patent on January 1, 2023 for $500000. Sandhill did not record amortization expense on the patent for 2023 and 2024. At the purchase date, the expected useful life of the patent was 10 years. At December 31, 2025, what should be recorded as the amortization expense? $0 because the value of the patent has not decreased $100000 O $50000 O $150000arrow_forward

- ABC Co. purchased a patent on January 1, 2018 for P300,00O. The patent was being amortized over its remaining legal life of 15 years. During 2020, ABC Co. determined that the economic benefits of the patent would not last longer than 10 years from the date of acquisition. What amount should be charged to patent amortization expense for the year ended December 31 2020? * 32,500 26,000 20,000 O 17,333 answer not givenarrow_forwardPlease give me answer general accountingarrow_forwardOn March 1, 2020, Tebow Company purchased a patent for $158,000 cash. Although the patent gives legal protection for 19 years, the patent will be used for only 2 years. Assume straight-line amortization. Amortization per unit (Cost Res. Value)/Time = Amortization per year Amortization per year X portion of year = Amortization Journalize a) the purchase of the patent, and b) the amortization expense of the patent as of December 31, 2020. Date a b Check All Parts Description Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College