Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General accounting

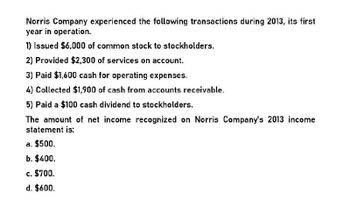

Transcribed Image Text:Norris Company experienced the following transactions during 2013, its first

year in operation.

1) Issued $6,000 of common stock to stockholders.

2) Provided $2,300 of services on account.

3) Paid $1,600 cash for operating expenses.

4) Collected $1,900 of cash from accounts receivable.

5) Paid a $100 cash dividend to stockholders.

The amount of net income recognized on Norris Company's 2013 income

statement is:

a. $500.

b. $400.

c. $700.

d. $600.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cece Company has provided the following data (ignore income taxes): 2016 revenues were $77,500.2016 net income was $33,900.Dividends declared and paid during 2016 totaled $5,700.Total assets at December 31, 2016 were $217,000.Total stockholders' equity at December 31, 2016 was $123,000. Retained earnings at December 31, 2016 were $83,000. Which of the following is correct? 2016 expenses were $37,900 Total liabilities at December 31, 2016 were $11,000. Retained earnings increased $28,200 during 2016. Common stock at December 31, 2016 was $206,000.arrow_forwardena Company has provided the following data (ignore income taxes): 2014 revenues were $76,000. 2014 expenses were $48,500. Dividends declared and paid during 2014 totaled $7,600. Total assets at December 31, 2014 were $184,000. Total liabilities at December 31, 2014 were $103,000. Common stock at December 31, 2014 was $26,000. Which of the following is correct?arrow_forwardMadrid Company has provided the following data (ignore income taxes): 2014 revenues were $80,500. 2014 net income was $34,500. Dividends declared and paid during 2014 totaled $6,300. Total assets at December 31, 2014 were $223,000. Total stockholders' equity at December 31, 2014 was $130,000. Retained earnings at December 31, 2014 were $85,000. Which of the following is not correct?arrow_forward

- Krogen Grocer's 2016 balance sheet shows average stockholders’ equity of $12,000 million, net operating profit after tax of $1,140million, net income of $380 million, and common shares issued of $1,916 million.The company has no preferred shares issued. Krogen Grocer’s return on common stockholders’ equity for the year is:arrow_forwardSmith Corporation is reviewing the following transactions for its year-ended December 31, 2015. For each item listed, indicate the: Name of the account to use. Whether it is current or long-term, asset or liability. The amount. On December 15, 2015 the company declared a $2.00 per share dividend on 40,000 shares of common stock outstanding, to be paid on January 5, 2013 Credit sales for year amounted to $10,000,000. Smith estimates its Allowance for Doubtful Accounts as 3% of credit sales. At December 31, bonds payable of $100,000,000 are outstanding. The bonds pay 12% interest every September 30 and mature in installments of $25,000,000 every September 30. Bonuses to key employees based on net income for 2015 are estimated to be $150,000. Included in long-term investments are 10-year U.S. Treasury bonds that mature March 31, 2016. The bonds were purchased November 20, 2015. The accounts receivable account includes $20,000 due in three years from employees. The property, plant,…arrow_forwardOriole Paper Mill, Inc., had, at the beginning of the current fiscal year, April 1, 2016, retained earnings of $ 322,525. During the year ended March 31, 2017, the company produced net income after taxes of $ 713,175 and paid out 41 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. (Round answers to 2 decimal places, e.g. 15.25. List items that increase retained earnings first.) Oriole Paper Mill, Inc.Retained Earnings for 2017arrow_forward

- Brisky Corporation had net sales of $2,400,000 and interest revenue of $31,000 during 2017. Expenses for 2017 were cost of goods sold $1,450,000, administrative expenses $212,000, selling expenses $280,000, and interest expense $45,000. Brisky’s tax rate is 30%. The corporation had 100,000 shares of common stock authorized and 70,000 shares issued and outstanding during 2017. Prepare a single-step income statement for the year ended December 31, 2017.arrow_forwardBrisky Corporation had net sales of $2,400,000 and interest revenue of $31,000 during 2017. Expenses for 2017 were cost of goods sold $1,450,000, administrative expenses $212,000, selling expenses $280,000, and interest expense $45,000. Brisky's tax rate is 30%. The corporation had 100,000 shares of common stock authorized and 70,000 shares issues and outstanding during 2017. Calculate Brisky's Earnings Per Share.arrow_forwardThe 2017 income statement of Marin Company showed net income of $555,200 and a gain from discontinued operations of $46,400. Marin had 40,000 shares of common stock outstanding all year. Prepare Marin’s income statement presentation of earnings per share. (Round answers to 2 decimal places, e.g. 15.25.)arrow_forward

- Brisky Corporation had net sales of $2,400,000 and interest revenue of $31,000 during 2017. Expenses for 2017 were cost of goods sold $1,450,000, administrative expenses $212,000, selling expenses $280,000, and interest expense $45,000. Brisky’s tax rate is 30%. The corporation had 100,000 shares of common stock authorized and 70,000 shares issued and outstanding during 2017. Prepare a condensed multiple-step income statement for Brisky Corporationarrow_forwardAn analyst compiled the following information for Universe, Inc., for the year ended December 31, 2016: • Net income was $850,000. • Depreciation expense was $200,000. • Interest paid was $100,000. • Income taxes paid were $50,000. • Common stock was sold for $100,000. • Preferred stock (8% annual dividend) was sold at par value of $125,000. • Common stock dividends of $25,000 were paid. • Preferred stock dividends of $10,000 were paid. • Equipment with a book value of $50,000 was sold for $100,000. Using the indirect method, what was Universe, Inc.’s net cash flow from operating activities for the year ended December 31, 2016? a. $1,000,000 b. $1,015,000 c. $1,040,000 d. $1,050,000arrow_forwardPresented below are the comparative incomes and retained earnings statements for Blue Inc. for the years 2017 and 2018. 2018 2017 Sales $353,000 $276,000 Cost of sales 195,000 150,000 Gross profit 158,000 126,000 Expenses 89,600 49,100 Net income $68,400 $76,900 Retained earnings (Jan. 1) $121,500 $69,900 Net income 68,400 76,900 Dividends (30,800 ) (25,300 ) Retained earnings (Dec. 31) $159,100 $121,500 The following additional information is provided: 1. In 2018, Blue Inc. decided to switch its depreciation method from sum-of-the-years’ digits to the straight-line method. The assets were purchased at the beginning of 2017 for $102,500 with an estimated useful life of 4 years and no salvage value. (The 2018 income statement contains depreciation…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning