Accounting (Text Only)

26th Edition

ISBN: 9781285743615

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:26.

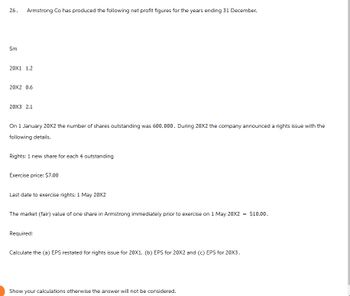

Armstrong Co has produced the following net profit figures for the years ending 31 December.

Sm

20X1 1.2

20X2 0.6

20X3 2.1

On 1 January 20X2 the number of shares outstanding was 600,000. During 20X2 the company announced a rights issue with the

following details.

Rights: 1 new share for each 4 outstanding

Exercise price: $7.00

Last date to exercise rights: 1 May 20X2

The market (fair) value of one share in Armstrong immediately prior to exercise on 1 May 20X2

Required:

Calculate the (a) EPS restated for rights issue for 20X1, (b) EPS for 20X2 and (c) EPS for 20X3.

Show your calculations otherwise the answer will not be considered.

= $10.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- BEPS - rights issue A company has 1,000,000 shares in issue at that start of the year. During the year, a rights issue of one new share for every four shares was made at a price of £5 per share. The pre-issue market price was £6.50 per share. The theoretical ex-rights price (TERP) is: Select one: O a. £5.00 b. £6.20 C. £5.30 O d. £6.00arrow_forwardAt 1 Jul 20X4 a company’s capital and share premium account of a company were as follows:Ordinary share capital $75,000(300,000 shares of 25c each)Share premium account $200,000In the year ended 30 June 20X5 the following event took place: 1.On 1 January 20X5 the company made a rights issue of 1 share for every 5 held at $1.20 per share2.On 1 April 20X5 the company made a bonus issue of 1 share for every 3 in issue at that time, using the share premium account to do so. What are the correct balance on the company’s capital and share premium account at 30 June 20X5?Ordinary share capital Share premium accountA $120,000 $227,000B $120,000 $137,000C $460,000 $287,000D $480,000 $137,000arrow_forwardmc attachedarrow_forward

- The YZA Corporation has 100,000 ordinary shares authorized, par value P10. As of the end of reporting period, 60,000 of the shares are outstanding. Required: Compute the earnings per share assuming the company has a profit of: A. P10,000 B. P70,000 C. P90,000 D. P150,000 E. P180,000arrow_forward. Journal entries using the Cost and Equity Method of accounting for the for the following transtation : On 1/2/18 the Xylo Corp. purchased 8000 shares of ABC Co. Common Stock At $20 per share. ABC Co. has 40000 shares of Common Stock outstanding. On 10/31/18 Xylo Corp. received a $1.50 per share dividend from ABC Co. On 12/30/18 ABC Company announced earnings of for the year at $200000. Prepare the calculations and Journal Entries, in good form, if the Investment is classified as Available for sale Part A. The Cost Method. Part B The Equity Method of accounting is applicable.arrow_forwardUsing the following information for the year ended 30 June, prepare the Retained Earnings Account for Kramer Ltd. Retained earnings as at 1 July $450,000 Transfer from Dividend Equalisation Reserve $200,000 Operating Profit (before income tax expenses $270,000) $900,000 Create a provision for dividend of 15 cents per share. There are 7,500,000 shares issuearrow_forward

- At the beginning ofcurrent year, Juan Company was organized with 100,000 authorized shares of P100 par value. The following transactions occurred during the year: January 15 Sold 30,000 shares at PI50 per share February 14 Issued 2,000 shares for legal services with a fair value of P250,000. The shares on this date are quoted at P140 per share 27 Purchased 5,000 treasury shares at a cost of P120 per March share October 31 Issued P5,000,000 convertible bonds at 120. The bonds are quoted at 98 without the conversion feature. November 5 Declared a 2-for-1 share split when the market value of the share was Pl160. December 15 Sold 20,000 shares at P75 per share. December 31 Net income for the year was P2,000,000. What is the total shareholders' equity at year-end?arrow_forwardhow does it calculate the 500000 in 20x1 and 400000 in 20x0 in profit attribitable to ordinary sahreholders column?arrow_forwardAt 1 January 20X8 Artichoke had 5 million $1 equity shares in issue. On 1 June 20X8 it made a 1 for 5 rights issue at a price of $1.50. The market price of the shares on the last day of quotation with rights was $1.80. Total earnings for the year ended 31 December 20X8 was $7.6 million. What was EPS for the year?arrow_forward

- The issued share capital of a company consists of 3,360,000 ordinary shares of £1 each. Half way through its financial year the company made a rights issue of 2 for 6 at an exercise price of £1.58 a share. The market value of the company's shares was £2.04 a share just before the rights issue.. The company reported a net profit after taxation for the year of £2,016,000. The market value of each ordinary share at the end of the year was £2.31. The theoretical ex-rights value per share is £1.93, and the adjustment factor is 1.059740. The weighted average number of shares issued for the year is 4,020,364. Calculate, correct to the nearest whole number, the earnings per share which would be reported in the company's income statement for the year.arrow_forwardEntity A has 200,000 ordinary shares outstanding on January 1, 20x1. Entity A offers rights issue to its existing shareholders that enable them to acquire 1 ordinary share at a subscription price of P120 for every 5 rights held. The rights are exercised on May 1, 20x1. The market price of one ordinary share immediately before exercise is P180. Entity A reported profit after tax of P2,700,000 in 20x1. What is the basic earnings per share in 20x1? * O 12.58 O 12.67 O 11.71 O 11.67arrow_forwardVirma Corporation sold to a subscriber 500 shares of its P30 par value common stock at P32 per share receiving a 30% down payment. In recording this transaction, A. Ordinary share will be credited in the amount of P15,000 B. Ordinary share will be credited in the amount of P16,000 C. Subscribed share capital will be credited in the amount of P15,000 D. Share premium will be credited in the amount of P4,500 Leon Corporation sold 500 shares of its P40 par value preferred stock for cash at P50 per share. In recording this transaction, there would be a A. Credit to preference share capital for P25,000 B. Credit to preference share capital for P20,000 C. Credit to subscribed preference share capital for P20,000 D. Credit to share capital in excess of stated value for P5,000 Luningning Corporation sold for cash 400 shares of preferred stock with a par value of P50 per share at P56 per share. Also, 600 shares of common stock with no…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,