Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

ANSWER THIS GENERAL ACCOUNTING QUESTION

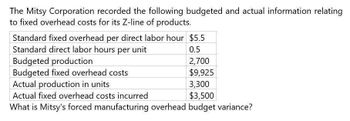

Transcribed Image Text:The Mitsy Corporation recorded the following budgeted and actual information relating

to fixed overhead costs for its Z-line of products.

Standard fixed overhead per direct labor hour $5.5

Standard direct labor hours per unit

Budgeted production

Budgeted fixed overhead costs

Actual production in units

Actual fixed overhead costs incurred

0.5

2,700

$9,925

3,300

$3,500

What is Mitsy's forced manufacturing overhead budget variance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Georgia Gasket Co. budgets 8,000 direct labor hours for the year. The total overhead budget is expected to amount to 20,000. The standard cost for a unit of the companys product estimates the variable overhead as follows: The actual data for the period follow: Using the four-variance method, calculate the overhead variances. (Hint: First compute the budgeted fixed overhead rate.)arrow_forwardABC Inc. spent a total of $48,000 on factory overhead. Of this, $28,000 was fixed overhead. ABC Inc. had budgeted $27,000 for fixed overhead. Actual machine hours were 5.000. Standard hours for units made were 4,800. The standard variable overhead rate was $4.10. What is the variable overhead rate variance?arrow_forwardCalculating amount of factory overhead applied to work in process The overhead application rate for a company is 2.50 per unit, made up of 1.00 for fixed overhead and 1.50 for variable overhead. Normal capacity is 10,000 units. In one month, there was an unfavorable flexible budget variance of 200. Actual overhead for the month was 27,000. What was the amount of the budgeted overhead for the actual level of production?arrow_forward

- Refer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forwardPreparing a performance report Use the flexible budget prepared in P7-6 for the 31,000-unit level and the actual operating results listed below for the 31,000-unit level. Required: 1. Prepare a performance report. 2. List the major reasons why the actual operating income at 31,000 units differs from the master budget operating income at 30,000 units in Figure 7-12. 3. Given the level at which the company operated, how was its cost control? Item Direct materials: Direct labor:arrow_forwardUsing High-Low to Calculate Predicted Total Variable Cost and Total Cost for Budgeted Output Refer to the information for Pizza Vesuvio on the previous page. Assume that this information was used to construct the following formula for monthly labor cost. TotalLaborCost=5,237+(7.40EmployeeHours) Required: Assume that 675 employee hours are budgeted for the month of September. Use the total labor cost formula for the following calculations: 1. Calculate total variable labor cost for September. 2. Calculate total labor cost for September.arrow_forward

- The Perry Corporation recorded the following budgeted and actual information relating to fixed overhead costs for its Z−Line of products: Standard fixed overhead per direct labor hour $4.50 Standard direct labor hours per unit 0.75 Budgeted production 3,400 Budgeted fixed overhead costs $11,475.00 Actual production in units 3,700 Actual fixed overhead costs incurred $3,200.00 What is Perry's fixed manufacturing overhead volume variance?arrow_forwardThe Illustrative Corporation recorded the following budgeted and actual information relating to fixed overhead costs for its Z-Line of products Standard fixed overhead per direct labor hour Standard direct labor hours per unit Budgeted production Budgeted fixed overhead costs $3 0.75 3,400 $7.650.00 Actual production in units Actual fixed overhead costs incurred What is Illustrative's fixed manufacturing overhead volume variance? A. $2.025.00 favorable OB. $4.950.00 favorable OC. $2,025.00 unfavorable D. $4.950.00 unfavorable 4,300 $2.700.00arrow_forwardThe following information relating to a company's overhead costs is available. Budgeted fixed overhead rate per machine hour Actual variable overhead Budgeted variable overhead rate per machine hour Actual fixed overhead Budgeted hours allowed for actual output achieved Based on this information, the total overhead variance is: Multiple Choice O O $69,000 favorable. $112,000 favorable. $43,000 unfavorable. $112,000 unfavorable. $43,000 favorable. $ 1.50 $ 99,000 $ 4.00 $ 20,000 42,000arrow_forward

- Please help me with show all calculation thankuarrow_forwardAssume that a company uses a standard cost system and applies overhead to production based on direct labor-hours. It provided the following information for its most recent year: Total budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours Actual direct labor-hours Standard direct labor-hours allowed for the actual output What is the fixed overhead volume variance? Multiple Choice O $20,000 U $20,000 F $9,000 U $9,000 F $ 300,000 $ 276,000 60,000 56,000 58, 200arrow_forwardNeed answer the questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning