FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hii expert please provide correct answer general Accounting question

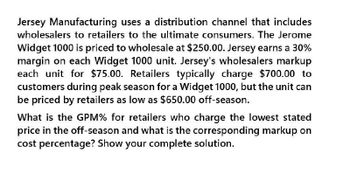

Transcribed Image Text:Jersey Manufacturing uses a distribution channel that includes

wholesalers to retailers to the ultimate consumers. The Jerome

Widget 1000 is priced to wholesale at $250.00. Jersey earns a 30%

margin on each Widget 1000 unit. Jersey's wholesalers markup

each unit for $75.00. Retailers typically charge $700.00 to

customers during peak season for a Widget 1000, but the unit can

be priced by retailers as low as $650.00 off-season.

What is the GPM% for retailers who charge the lowest stated

price in the off-season and what is the corresponding markup on

cost percentage? Show your complete solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Marquette has an opportunity to sell its product through an online retailer. To begin selling through this online platform, they are required to ship 2,000 units to the retailers’ order fulfillment warehouse. The other condition of this offer is that they pay a one-time vendor marketing fee of $5,000. To get the units to the fulfillment warehouse by the deadline Marquette will need to pay for expedited shipping at a cost of $10 per unit. What is the minimum price Marquette should charge the retailer for this initial order of 2,000 units? (Show all supporting calculations). (NOTE: ignore taxes or other costs not specifically mentioned in the questions.)arrow_forwardThe I-75 Carpet Discount Store has an annual demand of 10,000 yards of Super Shag carpet. The annual carrying cost for a yard of this carpet is $0.75, and the ordering cost is $150. The carpet manufacturer normally charges the store $8 per yard for the carpet; however, the manufacturer has offered a discount price of $6.50 per yard if the store will order 5,000 yards. How much should the store order, and what will be the total annual inventory cost for that order quantity?arrow_forwardWok Around the Clock, Inc., sells specialty woks. In the current year it expects to incur $840,000 in variable costs and $120,000 in fixed costs to make and sell 10,000 woks at $100 each.If Wok Around the Clock accepts a special order from Hard Wok Cafe to purchase 1,000 woks at $80 each, how much would it make or lose on this special order?arrow_forward

- Nonearrow_forwardJansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling 44,000 shelves for $32 each. Curate Furniture approached Jansen about buying 1,200 shelves for bookshelves it is building and is willing to pay $26 for each shelf. No packaging will be required for the bulk order. Jansen usually packages shelves for Home Depot at a price of $1.50 per shelf. The $1.50 per shelf cost is included in the unit variable cost of $27, with annual fixed costs of $320,000. However, the $1.50 packaging cost will not apply in this case. The fixed costs will be unaffected by the special order and the company has the capacity to accept the order. Based on this information, what would be the profit if Jensen accepts the special order?arrow_forwardI want to this question answer general accountingarrow_forward

- Sammy Co. currently sells 1,000 units of product M for P2 each. Variable costs are P1.50. A discount store has offered P1.70 per unit for 400 units of product M. The managers believe that if they accept the special order, they will lose some sales at the regular price. Determine the number of units they could lose before the order become unprofitablearrow_forwardHicom Goods is a distributor of videotapes. View Mart is a local retail outlet which sells blank and recorded videos. View Mart purchases tapes from Hicom Goods at £3.00 per tape; tapes are shipped in packages of 20. Hicom Goods pays all incoming freight, and View Mart does not inspect the tapes due to Hicom Goods' reputation for high quality. Annual demand is 104,000 tapes at a rate of 4,000 tapes per week. View Mart earns 20% on its cash investments. The purchase-order lead time is two weeks. The following cost data are available: Relevant ordering costs per purchase order Carrying costs per package per year: Relevant insurance, materials handling, breakage, etc., per year £90.50 £4.50 What is the required annual return on investment per package? a. £60.00 b. £2.50 C. £12.00 d. £0.60arrow_forwardPerfect Fit Jeans Co. sells blue jeans wholesale to major retailers across the country. Each pair of jeans has a selling price of 50 with 40 in variable costs of goods sold. The company has fixed manufacturing costs of 1500000 and fixed marketing costs of 300000. Sales commissions are paid to the wholesale sales reps at 5% of revenues. The company has an income tax rate of 20%. (include formulas) How many jeans must Perfect Fit sell in order to break even? How many jeans must the company sell in order to reach A target operating income of$520,000? A net income of$520,000? How many jeans would Perfect Fit have to sell to earn the net income in requirement above if (Consider each requirement independently.) The contribution margin per unit increases by 20% The selling price is increased to $52.00. The company outsources manufacturing to an overseas company, increasing variable costs per unit by $3.00 and saving 70% of fixed manufacturing costs.arrow_forward

- Charlotte sells widgets that cost $50 each to purchase and prepare for sale. Annual sales are 10,000 widgets, carrying costs are 15% of inventory costs, and Charlotte incurs a cost of $25 each time an order is placed. (a) What is the EOQ? (b) What will be the total inventory costs if the EOQ amount is ordered? (c) Suppose that Charlotte's supplier decides to offer a 3% cash discount if products are ordered in increments of 1250. How many widgest should Charlotte order each time an order is placed to minimize total inventory costs?arrow_forwardGeneral accountingarrow_forwardNUBD Co. currently sells 1,000 units of product M for P2 each. Variable costs are P1.50. A discount store has offered P1.70 per unit for 400 units of product M. The managers believe that if they accept the special order, they will lose some sales at the regular price. Determine the number of units they could lose before the order become unprofitablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education