Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Sunrise healthcare center has a contact

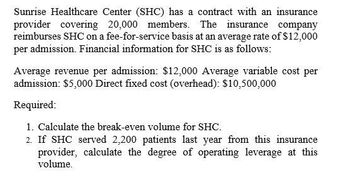

Transcribed Image Text:Sunrise Healthcare Center (SHC) has a contract with an insurance

provider covering 20,000 members. The insurance company

reimburses SHC on a fee-for-service basis at an average rate of $12,000

per admission. Financial information for SHC is as follows:

Average revenue per admission: $12,000 Average variable cost per

admission: $5,000 Direct fixed cost (overhead): $10,500,000

Required:

1. Calculate the break-even volume for SHC.

2. If SHC served 2,200 patients last year from this insurance

provider, calculate the degree of operating leverage at this

volume.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The NYU hospital has an arrangement with Queens College to provide hospital care to the QC’s members at a specific rate per member, per month. In April the QC paid the hospital $500,000 per agreement for patients treated in March. Based on pre-established billing rates, the hospital would have billed the QC $600,000. How much revenue should NYU recognized? $0 $500,000 $600, which is correctarrow_forwardVIP-MD is a health maintenance organization (HMO) located in North Carolina. Unlike the traditional fee-for-service model that determines the payment according to the actual services used or costs incurred, VIP-MD receives a fixed, prepaid amount from subscribers. The per member, per month rate (PMPM) is determined by estimating the health care cost per enrollee within a geographic location. The average health care coverage in North Carolina costs $376 per month, which is the same amount irrespective of the subscriber’s age. Because individuals are demanding quality care at reasonable rates, VIP-MD must contain its costs to remain competitive. A major competitor, National Physicians, entered the North Carolina market early in the current year with a monthly premium of $333. VIP-MD wants to maintain its current market penetration and hopes to increase its enrollees in the current year. The latest data on the number of enrollees and the associated costs follow: Age Enrollment in…arrow_forwardA healthcare provider offers a single service to its patients, and the patients are covered by only two different third parties. Payer 1, Medicare, represents 50% of the patients and pays a fixed fee of $325 per patient. Payer 2, a Commercial Insurer, represents 45% of the patients and pays 80% of the provider's gross charge. The remaining patients are Charity Care patients who do not pay for their services. The provider treats 3,200 patients per month. The fixed costs of the provider each month is $87,000, and their variable cost per patient is $330. The provider desires to set its gross charge per patient to achieve a profit, or net income, of $97,000 for the month. a. Set up an Algebraic expression, with "p" being the gross charge (price) of the service to each patient being seen in the month, to solve this problem. Show this expression on your spreadsheet. b. Solve the problem finding the Gross Price to be charged to achieve the profit target. c. How many charity patients does the…arrow_forward

- Do fast answer of this general accounting questionarrow_forwardPrydain Pharmaceuticals is reviewing its employee healthcare program. Currently, the company pays a fixed fee of$300 per month for each employee, regardless of the number or dollar amount of medical claims filed. Anotherhealth-care provider has offered to charge the company$100 per month per employee and $30 per claim filed. Athird insurer charges $200 per month per employee and$10 per claim filed. Which health-care program should Prydain join? How would the average number of claimsfiled per employee per month affect your decision?arrow_forwardBounce Back Insurance Company carries three major lines of insurance: auto, workers' compensation, and homeowners. The company has prepared the following report: Bounce Back Insurance CompanyProduct Profitability ReportFor the Year Ended December 31 Auto Workers' Compensation Homeowners Premium revenue $5,800,000 $6,250,000 $8,200,000 Estimated claims (4,060,000) (4,375,000) (5,740,000) Underwriting income $1,740,000 $1,875,000 $2,460,000 Underwriting income as a percent of premium revenue 30% 30% 30% Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows: Activity Activity…arrow_forward

- Compute and record workers' compensation insurance premiums for Fairlawn Manufacturing as follows: 1. The firm estimates that its office employees will earn $57,000 next year and its factory employees will earn $184,000. The firm pays the following rates for workers' compensation insurance: $0.50 per $100 of wages for the office employees and $4.00 per $100 of wages for the factory employees. Compute the estimated premiums for 20X1. In the general journal, record the payment of the estimated premium. Date the entry as January 12, 20X1. 2. On January 3, 20X2, an audit of the firm's payroll records for 20X1 showed that the firm had actually paid wages of $59,000 to its office employees and $187,000 to its factory employees. Compute the actual premium for the year and the balance due to the insurance company or the credit due to the firm. In the general journal, record the entry to adjust the Workers' Compensation Insurance Expense as of the end of 20X1. Date the entry December 31, 20X.…arrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. ناقة Gross Pay through Gross Pay for August 31 $5,200 2,700 132,100 September $ 2,400 2,800 8,700 Exercise 9-9 (Algo) Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Complete this question by entering your answers in the tabs below. Payroll Taxes Expense General Journal Assuming situation (a), compute the payroll taxes expense. Note: Round your answers to 2 decimal places. Employer Payroll taxes September earnings subject to tax Tax Rate Tax…arrow_forwardRequired Information Use the following Information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, Its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 pald to its employee. b. C. Gross Pay through August 31 $ 6,300 2,600 133,200 Exercise 9-8 (Algo) Payroll-related journal entries LO P2 Assuming situation (a), prepare the employer's September 30 Journal entry to record salary expense and its related payroll liabilities for this employee. The employee's federal income taxes withheld by the employer are $90 for this pay period. Complete this question by entering your answers in the tabs below. Taxes to be Withheld From Gross Pay Gross Pay for September $ 1,800 2,700 9,800 General Journal The employee's federal income taxes withheld by the employer are $90…arrow_forward

- Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0,6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee Gross Pay through August 31 $ 5,700 3,200 132,600 Gross Pay for September $1,800 3,300 9,200 Exercise 9-9 (Algo) Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Complete this question by entering your answers in the tabs below. Payroll Taxes General Expense Journal Assuming situation (a), compute the payroll taxes expense. Note: Round your answers to 2 decimal places.arrow_forwardDelaware Medical Center operates a general hospital. The medical center also rents space and beds to separately owned entities rendering specialized services, such as Pediatrics and Psychiatric Care. Delaware charges each separate entity for common services, such as patients' meals and laundry, and for administrative services, such as billings and collections. Space and bed rentals are fixed charges for the year, based on bed capacity rented to each entity. Delaware Medical Center charged the following costs to Pediatrics for the year ended June 30, 20x1: Dietary Janitorial Laundry Laboratory Pharmacy Repairs and maintenance General and administrative Rent Billings and collections. Total Annual Patient Days Up to 22,000 22,001 to 26,000 26,001 to 29, 200 Aides 20 25 31 Patient Days (variable) $ 580,000 270,000 440,000 320,000 Nurses 10 14 16 220,000 $1,830,000 During the year ended June 30, 20x1, Pediatrics charged each patient an average of $300 per day, had a capacity of 50 beds, and…arrow_forwardDelaware Medical Center operates a general hospital. The medical center also rents space and beds to separately owned entities rendering specialized services, such as Pediatrics and Psychiatric Care. Delaware charges each separate entity for common services, such as patients’ meals and laundry, and for administrative services, such as billings and collections. Space and bed rentals are fixed charges for the year, based on bed capacity rented to each entity. Delaware Medical Center charged the following costs to Pediatrics for the year ended June 30, 20x1: Patient Days (variable) Bed Capacity (fixed) Dietary $ 540,000 — Janitorial — $ 71,000 Laundry 240,000 — Laboratory 400,000 — Pharmacy 320,000 — Repairs and maintenance — 33,000 General and administrative — 1,320,000 Rent — 1,570,000 Billings and collections 230,000 — Total $ 1,730,000 $ 2,994,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College