Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

not use ai please

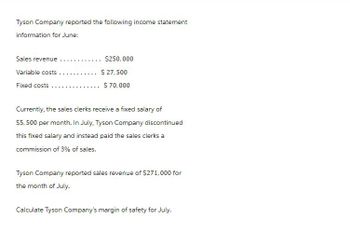

Transcribed Image Text:Tyson Company reported the following income statement

information for June:

Sales revenue

Variable costs

Fixed costs.

... $250,000

$ 27,500

$ 70,000

Currently, the sales clerks receive a fixed salary of

$5,500 per month. In July, Tyson Company discontinued

this fixed salary and instead paid the sales clerks a

commission of 3% of sales.

Tyson Company reported sales revenue of $271,000 for

the month of July.

Calculate Tyson Company's margin of safety for July.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- West Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forwardBradshaw Company reported sales of 5,000,000 in 20X1. At the end of the fiscal year (June 30, 20X1), the following quality costs were reported: Required: 1. Prepare a quality cost report. 2. Prepare a graph (pie chart or bar graph) that shows the relative distribution of quality costs, and comment on the distribution. 3. Assuming sales of 5,000,000, by how much would profits increase if quality improves so that quality costs are only 3% of sales?arrow_forward

- Pattison Products, Inc., began operations in October and manufactured 40,000 units during the month with the following unit costs: Fixed overhead per unit = 280,000/40,000 units produced = 7. Total fixed factory overhead is 280,000 per month. During October, 38,400 units were sold at a price of 24, and fixed marketing and administrative expenses were 130,500. Required: 1. Calculate the cost of each unit using absorption costing. 2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing? 3. Prepare an absorption-costing income statement for Pattison Products, Inc., for the month of October. 4. What if November production was 40,000 units, costs were stable, and sales were 41,000 units? What is the cost of ending inventory? What is operating income for November?arrow_forwardUse the following information for Brief Exercise: Morning Smiles Coffee Company manufactures Stoneware French Press coffee makers and sold 8,000 coffee makers during the month of March at a total cost of 612,500. Each coffee maker sold at a price of 100. Morning Smiles also incurred two types of selling costs: commissions equal to 5% of the sales price and other selling expense of 45,000. Administrative expense totaled 47,500. 2-33 Income Statement Percentages Refer to the information for Morning Smiles Coffee Company on the previous page. Required: Prepare an income statement for Morning Smiles for the month of March and calculate the percentage of sales revenue represented by each line of the income statement. (Note: Round answers to one decimal place.)arrow_forwardPresented here is the income statement for Fairchild Co. for March: Sales $ 81,500 Cost of goods sold 43,000 Gross profit $ 38,500 Operating expenses 31,000 Operating income $ 7,500 Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 34%.Required: Rearrange the preceding income statement to the contribution margin format. Calculate operating income if sales volume increases by 10%. Calculate the amount of revenue required for Fairchild to break even. rev: 10_17_2020_QC_CS-236193arrow_forward

- Presented here is the income statement for Big Sky Incorporated for the month of February: Sales $ 60,000 Cost of goods sold 51,900 Gross profit $ 8, 100 Operating expenses 15,200 Operating loss $ (7,100) Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 19%. Required: Rearrange the preceding income statement to the contribution margin format. If sales increase by 10%, what will be the firm's operating income (or loss)? Calculate the amount of revenue required for Big Sky to break even.arrow_forwardGeneral accountingarrow_forwardDuring August, Tyson Company sold 5,400 units and reported the following income statement: Sales revenue Variable costs Fixed costs Net income $216,000 $ 70,200 $ 86,400 $ 59,400 Calculate the number of units that Tyson Company needed to sell during August in order to earn a target profit equal to 30% of sales. 5,760arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning