FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answer the question don't use

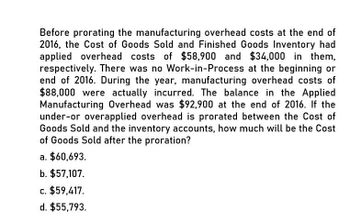

Transcribed Image Text:Before prorating the manufacturing overhead costs at the end of

2016, the Cost of Goods Sold and Finished Goods Inventory had

applied overhead costs of $58,900 and $34,000 in them,

respectively. There was no Work-in-Process at the beginning or

end of 2016. During the year, manufacturing overhead costs of

$88,000 were actually incurred. The balance in the Applied

Manufacturing Overhead was $92,900 at the end of 2016. If the

under-or overapplied overhead is prorated between the Cost of

Goods Sold and the inventory accounts, how much will be the Cost

of Goods Sold after the proration?

a. $60,693.

b. $57,107.

c. $59,417.

d. $55,793.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Before prorating the manufacturing overhead costs at the end of 2020, the Cost of Goods Sold and Finished Goods Inventory accounts had applied overhead costs of $59,000 and $35,000 in them, respectively. There was no Work-in-Process at the beginning or end of 2020. During the year, manufacturing overhead costs of $89,000 were actually incurred. The balance in the Applied Manufacturing Overhead was $94,000 at the end of 2020. If the under or overapplied overhead is prorated between Cost of Goods Sold and the inventory accounts, how much will be allocated to the Finished Goods Inventory? (Rounded to the nearest whole dollar.)arrow_forwardIn december. ...accounting questionarrow_forwardIn December 2016, Custom Mfg. established its predetermined overhead rate for jobs produced during 2017 by using the following cost predictions: overhead costs, $750,000, and direct materials costs, $625,000. At year-end 2017, the company's records show that actual overhead costs for the year are $830,000. Actual direct material cost had been assigned to jobs as follows. Jobs completed and soldi Jobs in finished goods inventory Jobs in work in process inventory Total actual direct materials cost 1. Determine the predetermined overhead rate for 2017. 2&3. Enter the overhead costs incurred and the amounts applied during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplied. 4. Prepare the adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. View transaction list Req 1 Req 2 and 3 Prepare the adjusting entry to allocate any over- or…arrow_forward

- Need helparrow_forwardPlease solve this MCQs At the beginning of the year, manufacturing overhead for the year was estimated to be $267,500. At the end of the year, actual direct labor-hours for the year were 22,100 hours, the actual manufacturing overhead for the year was $262,500, and manufacturing overhead for the year was overapplied by $13,750. If the predetermined overhead rate is based on direct labor-hours, then the estimated direct labor-hours at the beginning of the year used to calculate the predetermined overhead rate was: 22,100 direct labor-hours. 21,000 direct labor-hours. 21,400 direct labor-hours. 19,900 direct labor-hours.arrow_forwardNeed help with this accounting questionarrow_forward

- Calculate the predetermined overhead rate for 2017, assuming Lott Company estimates total manufacturing overhead costs of $907,200, direct labor costs of $756,000, and direct labor hours of 21,600 for the year. (Round answer to the nearest whole percent, e.g. 25%.) Predetermined overhead ratearrow_forwardFinancial accountingarrow_forwardDuring March 2020, Polaro Corporation recorded P40,200 of costs related to factory overhead. overhead application rate is based on direct labor hours. The preset formula for overhead application estimated that P40,900 would be incurred, and 5,000 direct labor hours would be worked. During March, 5,250 hours were actually worked. Use this information to determine the amount of factory overhead that was (over) or under applied. (Round answers to the nearest whole dollar. Enter as a positive number if under applied. Enter as a negative number if over applied.)arrow_forward

- In December 2014, Custom Mfg. established its predetermined overhead rate for jobs produced during year 2015 by using the following cost predictions: overhead costs, $400,000, and direct labor costs, $200,000. At year-end 2015, the company’s records show that actual overhead costs for the year are $1,049,200. Actual direct labor cost had been assigned to jobs as follows. Jobs completed and sold $ 400,000 Jobs in finished goods inventory 74,000 Jobs in work in process inventory 46,000 Total actual direct labor cost $ 520,000 4. Required information 1. Determine the predetermined overhead rate for year 2015.arrow_forwardBaltimore Manufacturing had a Work in Process balance of $64,000 on January 1, 2018. The year-end balance of Work in Process was $51,000 and the Cost of Goods Manufactured was $500,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2018.arrow_forwardStrong Company applies overhead based on machine hours. At the beginning of 2018, the company estimated that manufacturing overhead would be OMR 120,000, and machine hours would total 15,000. By 2018 year-end, actual overhead totaled OMR 140,000, and actual machine hours were 20,000. On the basis of this information, the 2018 predetermined overhead rate was:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education