EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Need Answer for this Question

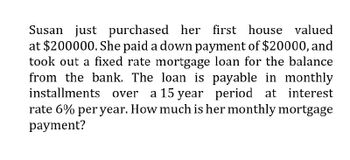

Transcribed Image Text:Susan just purchased her first house valued

at $200000. She paid a down payment of $20000, and

took out a fixed rate mortgage loan for the balance

from the bank. The loan is payable in monthly

installments over a 15 year period at interest

rate 6% per year. How much is her monthly mortgage

payment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Susan just purchased her first house valued at $200000. She paid a down payment of $20000, and took out a fixed rate mortgage loan for the balance from the bank. The loan is payable in monthly installments over a 15 year period at interest rate 6% per year. How much is her monthly mortgage payment?arrow_forwardTara has just bought a house for $930,000 with a 30% down payment and a 70% mortgage loan for 20 years at the interest rate of 2.19%, compounded monthly. She is scheduled to repay interest and principal every month over the loan period unless she sells the house at some point and fully pay off the loan. Question A Display here the formulae for calculating the Periodic (Annuity) Loan Payment, Interest Expense, Principal Repayment and Outstanding Loan Balance.arrow_forwardAmber received a 15 year loan of $245,000 to purchase a house. The interest rate on the loan was 5.70% compounded semi-annually. a. What is the size of the monthly loan payment? b. What is the balance of the loan at the end of year 4?c . By how much will the amortization period shorten if Amber makes an extra payment of $30,000 at the end of year 4?arrow_forward

- Cassandra received a 30 year loan of $320,000 to purchase a house. The interest rate on the loan was 3.70% compounded semi-annually. a. What is the size of the monthly loan payment? Round to the nearest cent b. What is the balance of the loan at the end of year 3? Round to the nearest cent c. By how much will the amortization period shorten if Cassandra makes an extra payment of $30,000 at the end of year 3? years and monthsmarrow_forwardWhen Sara Jean purchased her house 12 years ago, she took out a 30-year mortgage for $220,000. The mortgage has a fixed interest rate of 6% compounded monthly. (a) Compute Sara Jean’s monthly mortgage payments. (b) If Sarah Jean wants to pay off her mortgage today, for how much should she write a check? She made her most recent mortgage payment earlier today.arrow_forwardA borrower has a 30-year mortgage loan for $200,000 with an interest rate of 6% APR compounded monthly and level monthly payments. At the end of year 10, she unexpectedly won a lottery and received an after-tax cash of $10,000. She used that cash to pay down the principal of her mortgage loan and will keep paying the same monthly payment till she pays off the mortgage loan. How many more months will she has to payarrow_forward

- Jessica purchases a house for $323,000 and takes a mortgage for the full amount. Her mortgage charges 6.75% per year and interest is compounded monthly. She will repay the loan over 25 years with equal monthly payments. a) What is her monthly payment amount? b) How much of the 8th payment would be applied toward interest? c) How much would be the payoff amount if the mortgage is to be paid at the end of year 2 (i.e., before the 24th payment is made)?arrow_forwardA family needs to take out a 15-year home mortgage loan of $170,000 through a local bank. Annual interest rates for 15-year mortgages at the bank are 3.5% compounded monthly. (a) Compute the family's monthly mortgage payment under this loan. (b) How much interest will the family pay over the life of the loan?arrow_forwardSuppose Allison purchases a condominium and secures a loan of P13,400,000 for 30 years at an annual interest rate of 6.5%. a. Find the monthly mortgage payment. b. What is the total of the payments over the life of the loan? c. Find the amount of interest paid on the loan over the 30 yearsarrow_forward

- The Wade family is interested in buying a home. The family is applying for a $200,000 30-year mortgage. Under the terms of the mortgage, they will receive $200,000 today to help purchase their home. The loan will be fully amortized over the next 30 years. Current mortgage rates are 7.5%. Interest is compounded monthly and all payments are due at the end of the month. What is the monthly mortgage payment? $989.66 $1,047.50 $1,111.25 $1,398.43 $1,563.97arrow_forwardFind the monthly payment for each loan below. Remember to assume monthly compounding. 11. Sean and Sam purchase a house with a $20,000 down payment. The purchase price of the house was $475,000 and they financed the rest for 3.75% for 30 years. Their annual taxes will be $2856, and their annual insurance will be $1984. What will their monthly principal, interest, tax, and insurance (PITI) mortgage payment be?arrow_forwardJane took out a loan from the bank today for X. She plans to repay this loan by making payments of $520.00 per month for a certain amount of time. If the interest rate on the loan is 1.12 percent per month, she makes her first $520.00 payment later today, and she makes her final monthly payment of $520.00 in 7 months, then what is X, the amount of the loan? O An amount less than $3,501.00 or an anmount greater than $4,238.00 O An amount equal to or greater than $3,501.00 but less than $3,739.00 O An amount equal to or greater than $3,739.00 but less than $3,980.00 O An amount equal to or greater than $3,980.00 but less than $4,081.00 O An amount equal to or greater than $4,081.00 but less than $4,238.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you