EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

pls provide correct answer

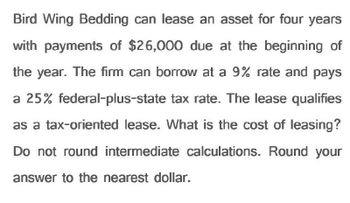

Transcribed Image Text:Bird Wing Bedding can lease an asset for four years

with payments of $26,000 due at the beginning of

the year. The firm can borrow at a 9% rate and pays

a 25% federal-plus-state tax rate. The lease qualifies

as a tax-oriented lease. What is the cost of leasing?

Do not round intermediate calculations. Round your

answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bird Wing Bedding can lease an asset for 4 years with payments of $16,000 due at the beginning of the year. The firm can borrow at a 6% rate and pays a 25% federal-plus-state tax rate. The lease qualifies as a tax-oriented lease. What is the cost of leasing?arrow_forwardNeed answerarrow_forwardPlease correct answer and don't used hand raitingarrow_forward

- provide correct answer pleaserarrow_forwardNeed helparrow_forwardDomebo Corporation has entered into a 8 year lease for a piece of equipment. The annual payment under the lease will be $3,200, with payments being made at the beginning of each year. If the discount rate is 14%, the present value of the lease payments is closest to (Ignore income taxes.): Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. (Round your intermediate calculations to 3 decimal places.)arrow_forward

- domebo Corporation has entered into a 7 year lease for a piece of equipment. The annual payment under the lease will be $3,400, with payments being made at the beginning of each year. If the discount rate is 14%, the present value of the lease payments is closest to (Ignore income taxes.): Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. (Round your intermediate calculations to 3 decimal places.)arrow_forwardDomebo Corporation has entered into a 8 year lease for a piece of equipment. The annual payment under the lease will be $3,200, with payments being made at the beginning of each year. If the discount rate is 14%, the present value of the lease payments is closest to (Ignore income taxes.): view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided.Round your intermediate calculations to 3 decimal places.arrow_forwardMcGee Leasing leased a car to a customer. McGee will receive $300 a month,at the end of each month, for 36 months. Use the PV function in Excel® to calculate the asnwers to the following questions1. What is the present value of the lease if the annual interest rate in the lease is 18%?2. What is the present value of the lease if the car can likely be sold for $6,000 at the end ofthree years?arrow_forward

- Munabhaiarrow_forwardNorthwest Bank has been asked to purchase and lease to Fafner Construction equipment that costs $1,500,000. The lease will run for eight years. If Northwest seeks a minimum return of 10 percent, what will be the required lease payment? Assume there is no residual value. Use Appendix D to answer the question. Round your answer to the nearest cent. $arrow_forwardshow how to calculate on a baII plusarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT