Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

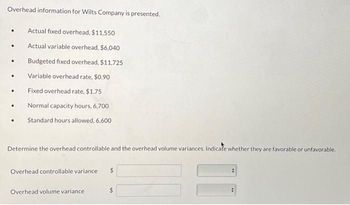

Transcribed Image Text:Overhead information for Wilts Company is presented.

•

Actual fixed overhead, $11,550

•

Actual variable overhead, $6,040

Budgeted fixed overhead, $11,725

.

Variable overhead rate, $0.90

.

Fixed overhead rate, $1.75

•

Normal capacity hours, 6,700

Standard hours allowed, 6.600

Determine the overhead controllable and the overhead volume variances. Indicate whether they are favorable or unfavorable.

Overhead controllable variance

Overhead volume variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Required information (The following information applies to the questions displayed below.] Mosaic Company applies overhead using machine hours and shows the following information. Actual hours of machine use Standard hours of machine use (for actual production) Actual variable overhead rate per machine hour Standard variable overhead rate per machine hour 5,500 hours 6,000 hours $5.10 Compute the variable overhead variance and identify it as favorable or unfavorable. Actual Cost Standard Costarrow_forwardRequired:1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned toeach product.2. Calculate the predetermined departmental overhead rates and calculate the overheadassigned to each product.3. Using departmental rates, compute the applied overhead for the year. What is the under- oroverapplied overhead for the firm?4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement3, assuming it is not material in amount. What additional information would you need ifthe variance is material to make the appropriate journal entry?arrow_forwardMosaic Company applies overhead using machine hours and reports the following information. Compute the total variable overhead cost variance and classify it as favorable or unfavorable. Actual machine hours used . 4,700 hours Standard machine hours (for actual production) 5,000 hours Actual variable overhead rate per hour $4.15 Standard variable overhead rate per hour . $4.00arrow_forward

- At the end of the period, the factory overhead account has a credit balance of 10,000. (a) Is the total factory cost variance favorable or unfavorable? (b) Are the controllable and volume variances favorable or unfavorable?arrow_forwardRath Company showed the following information for the year: Required: 1. Calculate the standard direct labor hours for actual production. 2. Calculate the applied variable overhead. 3. Calculate the total variable overhead variance.arrow_forwardRequirement 1. Record Brookman's direct labor journal entry (use Wages Payable). Journalize the incurrence and assignment of direct labor costs, including the related variances. (Prepare a single compound journal entry. Record debits first, then credits. Select the explanations on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit - X Data Table AC x AQ SC x AQ SC x SQ $13.00 per DLHr $16.00 per DLHR $16.00 per DLHr 1,650 DLHF 1,650 DLHR 1.200 DLHr $21,450 $26.400 $19,200 Requirements 1. Record Brookman's direct labor journal entry (use Wages Payable). 2. Explain what management will do with this variance information. Cost Efficiency Variance Variance $4.950 F S7,200 U Print Done Print Donearrow_forward

- Please do not give solution in image format thankuarrow_forwardBlaze Corporation allocates overhead on the basis of DLH and the standard amount per allocation base is 2 DLH per unit. For March, the company planned production of 10,000 units (80% of its production capacity of 12,500 units) and prepared the following budget. The company actually operated at 90% capacity (11,250 units) in March and incurred actual total overhead costs of $129,230. 80% Operating Levels Overhead Budget Production in units 10,000 Budgeted variable overhead Budgeted fixed overhead $ 58,000 $ 68,000 1. Compute the standard overhead rate. Hint. Standard allocation base at 80% capacity is 20,000 DLH, computed as 10,000 units × 2.00 DLH per unit. 2. Compute the total overhead variance. 3. Compute the overhead controllable variance. 4. Compute the overhead volume variance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the standard overhead rate. Hint: Standard allocation base at 80% capacity is 20,000…arrow_forwardFixed Overhead Spending and Volume Variances, Columnar and Formula Approaches Branch Company provided the following information: Standard fixed overhead rate (SFOR) per direct labor hour $5.00 Actual fixed overhead $305,000 BFOH $300,000 Actual production in units 16,000 Standard hours allowed for actual units produced (SH) 64,000 Required Enter amounts as positive numbers and select Favorable (F) or Unfavorable(U). 1. Using the columnar approach, calculate the fixed overhead spending and volume variances. (1) (2) (3) fill in the blank 4 fill in the blank 5 fill in the blank 6 fill in the blank 7 fill in the blank 9 Spending Volume 2. Using the formula approach, calculate the fixed overhead spending variance. $fill in the blank 11 3. Using the formula approach, calculate the fixed overhead volume variance. $fill in the blank 13 4. Calculate the total fixed overhead variance. $fill in the blank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning