Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

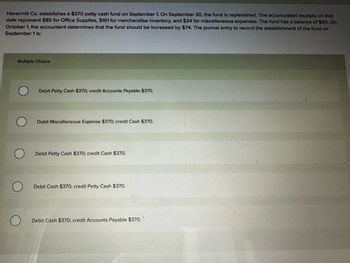

Transcribed Image Text:Havermill Co. establishes a $370 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that

date represent $85 for Office Supplies, $161 for merchandise Inventory, and $34 for miscellaneous expenses. The fund has a balance of $90. On

October 1, the accountant determines that the fund should be increased by $74. The journal entry to record the establishment of the fund on

September 1 is:

Multiple Choice

О

Debit Petty Cash $370; credit Accounts Payable $370.

O

Debit Miscellaneous Expense $370; credit Cash $370.

O

Debit Petty Cash $370; credit Cash $370.

Debit Cash $370; credit Petty Cash $370.

О

Debit Cash $370; credit Accounts Payable $370.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On June 1 French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries for the following transactions: A. On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $220. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $251, Supplies $88, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $20. D. On June 29, the company determined that the petty cash fund needed to be increased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $437.arrow_forwardOn May 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare journal entries for the following transactions: A. On July 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $80. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $251, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $93. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed replenishment as it was month-end. The following are the receipts: Auto Expense $114, Supplies $75, Postage Expense $50, Repairs and Maintenance Expense $121, Miscellaneous Expense $39. The cash on hand at this time was $603.arrow_forwardOn July 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare journal entries for the following transactions: A. On July 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $110. C. On June 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $93. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $14, Supplies $75, Postage Expense $150, Repairs and Maintenance Expense $121, Miscellaneous Expense $39. The cash on hand at this time was $603.arrow_forward

- Havermill Co. establishes a $390 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $87 for Repairs Expense, $165 for merchandise Inventory, and $36 for miscellaneous expenses. The fund has a balance of $102. On October 1, the accountant determines that the fund should be increased by $78. The Journal entry to record the reimbursement of the fund on September 30 includes a: Multiple Choice О Credit to Cash for $102. Credit to Cash for $390. Debit Petty Cash for $288. О Credit to Merchandise Inventory for $165. О Debit to Repairs Expense for $87.arrow_forwardHavermill Company establishes a $250 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $73 for Repairs Expense, $137 for merchandise inventory, and $22 for miscellaneous expenses. The fund has a balance of $18. On October 1, the accountant determines that the fund should be increased by $50. The journal entry to record the reimbursement of the fund on September 30 includes a: Multiple Choice Debit to Repairs Expense for $73. Credit to Merchandise Inventory for $137. Credit to Cash for $250. Debit Petty Cash for $232 Credit to Cash for $18.arrow_forwardHavermill Co. establishes a $320 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $80 for Office Supplies, $144 for merchandise Inventory, and $29 for miscellaneous expenses. The fund has a balance of $25. On October 1, the accountant determines that the fund should be increased by $50. The journal entry to record the increase in the fund balance on October 1 is: Multiple Choice Debit Petty Cash $370; credit Cash $370. Debit Petty Cash $50; credit Cash $50. O Debit Miscellaneous Expense $50; credit Cash $50. Debit Petty Cash $50; credit Accounts Payable $50. O Debit Cash $50; credit Petty Cash $50.arrow_forward

- Palmona Company establishes a $170 petty cash fund on January 1. On January 8, the fund shows $69 in cash along with receipts for the following expenditures: postage, $41; transportation-in, $14; delivery expenses, $16; and miscellaneous expenses, $30. Palmona uses the perpetual system in accounting for merchandise inventory. 1. Prepare the entry to establish the fund on January 1. 2. Prepare the entry to reimburse the fund on January 8 under two separate situations: a. To reimburse the fund. b. To reimburse the fund and increase it to $220. Hint. Make two entries. View transaction list Journal entry worksheetarrow_forwardPalmona Company establishes a $130 petty cash fund on January 1. On January 8, the fund shows $47 in cash along with receipts for the following expenditures: postage, $35; transportation-in, $11; delivery expenses, $13; and miscellaneous expenses, $24. Palmona uses the perpetual system in accounting for merchandise inventory. 1. Prepare the entry to establish the fund on January 1. 2. Prepare the entry to reimburse the fund on January 8 under two separate situations: a. To reimburse the fund. b. To reimburse the fund and increase it to $180. Hint: Make two entries. View transaction list Journal entry worksheet < 1 2 3 4 Record the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date January 01 General Journal Debit Creditarrow_forwardPalmona Company establishes a $180 petty cash fund on January 1. On January 8, the fund shows $83 in cash the following expenditures: postage, $38; transportation-in, $15; delivery expenses, $17; and miscellaneous ex uses the perpetual system in accounting for merchandise inventory. 1. Prepare the entry to establish the fund on January 1. 2. Prepare the entry to reimburse the fund on January 8 under two separate situations: a. To reimburse the fund. b. To reimburse the fund and increase it to $230. Hint. Make two entries. View transaction list Journal entry worksheet 1 2 3 4 Record the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date January 01 General Journal Debit Creditarrow_forward

- Journal entry worksheet 1 4 > Prepare the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journalarrow_forwardPalmona Co. establishes a $200 petty cash fund on January 1. On January 8, the fund shows $99 in cash along with receipts for the following expenditures: postage, $41; transportation-in, $14; delivery expenses, $16; and miscellaneous expenses, $30. Palmona uses the perpetual system in accounting for merchandise inventory. Prepare journal entries to (1) establish the fund on January 1, (2) reimburse it on January 8, and (3) both reimburse the fund and increase it to $250 on January 8, assuming no entry in part 2. Hint: Make two separate entries for part 3. View transaction list Journal entry worksheet 1 3 Prepare the journal entry to establish the petty cash fund. Note: Enter debits before credits. Date Jan 01 Record entry 4 General Journal Clear entry Debit Credit View general journal >arrow_forwardPalmona Company establishes a $180 petty cash fund on January 1. On January 8, the fund shows $85 in cash along with receipts for the following expenditures: postage, $41; transportation - in, $11; delivery expenses, $13; and miscellaneous expenses, $30. Palmona uses the perpetual system in accounting for merchandise inventory. Prepare the entry to establish the fund on January 1. Prepare the entry to reimburse the fund on January 8 under two separate situations: To reimburse the fund. To reimburse the fund and increase it to $230. Hint: Make two entriesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,