SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

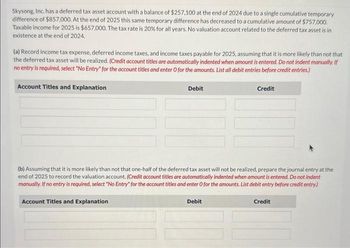

Transcribed Image Text:Skysong, Inc. has a deferred tax asset account with a balance of $257,100 at the end of 2024 due to a single cumulative temporary

difference of $857,000. At the end of 2025 this same temporary difference has decreased to a cumulative amount of $757,000.

Taxable income for 2025 is $657,000. The tax rate is 20% for all years. No valuation account related to the deferred tax asset is in

existence at the end of 2024.

(a) Record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming that it is more likely than not that

the deferred tax asset will be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Debit

Credit

(b) Assuming that it is more likely than not that one-half of the deferred tax asset will not be realized, prepare the journal entry at the

end of 2025 to record the valuation account. (Credit account titles are automatically indented when amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial reporting purposes, the asset has a 4-year life with no residual value and is depreciated by the straight-line method beginning in 2019. For tax purposes, the asset is depreciated under MACRS using a 5-year recovery period. Prior to 2019, Conley had no deferred tax liability or asset. The difference between depreciation for financial reporting purposes and income tax purposes is the only temporary difference between pretax financial income and taxable income. The current income tax rate is 30%, and no change in the tax rate has been enacted for future years. In 2019 and 2020, taxable income will be higher or lower than financial income by what amount?arrow_forwardPrior to and during 2019, Shadrach Company reported tax depreciation at an amount higher than the amount of financial depreciation, resulting in a book value of the depreciable assets of 24,500 for financial reporting purposes and of 20,000 for tax purposes at the end of 2019. In addition, Shadrach recognized a 3,500 estimated liability for legal expenses in the financial statements during 2019; it expects to pay this liability (and deduct it for tax purposes) in 2023. The current tax rate is 30%, no change in the tax rate has been enacted, and the company expects to be profitable in future years. What is the amount of the net deferred tax liability at the end of 2019? a. 300 b. 450 c. 1,050 d. 1,350arrow_forwardBrooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and taxable income for 2020. The prior period adjustment was the result of an error in calculating bad debt expense for 2019. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. When the company applies intraperiod income tax allocation, the prior period adjustment will be shown on the: a. income statement at 12,000 b. income statement at 8,400 (net of 3,600 income taxes) c. retained earnings statement at 12,000 d. retained earnings statement at 8,400 (net of 3,600 income taxes)arrow_forward

- Wildhorse, Inc. has a deferred tax asset account with a balance of $262,200 at the end of 2024 due to a single cumulative temporary difference of $874,000. At the end of 2025 this same temporary difference has decreased to a cumulative amount of $774,000. Taxable income for 2025 is $674,000. The tax rate is 20% for all years. No valuation account related to the deferred tax asset is in existence at the end of 2024. (a) Record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming that it is more likely than not that the deferred tax asset will be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forwardBramble, Inc has a deferred tax asset account with a balance of $260,400 at the end of 2024 due to a single cumulative temporary difference of $868,000. At the end of 2025 this same temporary difference has decreased to a cumulative amount of $768,000. Taxable income for 2025 is $668,000. The tax rate is 20% for all years. No valuation account related to the deferred tax asset is in existence at the end of 2024. (a) Record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming that it is more likely than not that the deferred tax asset will be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Income Tax Expense Income Tax Payable Deferred Tax Liability Debit 113600 20000 Credit 123600 (b) Assuming that it is more likely than…arrow_forwardTeal Corp. has a deferred tax asset account with a balance of $78,400 at the end of 2024 due to a single cumulative temporary difference of $392,000. At the end of 2025, this same temporary difference has increased to a cumulative amount of $478,000. Taxable income for 2025 is $884,000. The tax rate is 20% for all years. No valuation account related to the deferred tax asset is in existence at the end of 2024. (a) Record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming that it is more likely than not that the deferred tax asset will be realized. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (b) Assuming that it is more likely than not that $17,200 of the deferred tax asset will not be realized, prepare the journal…arrow_forward

- Bramble Corp. has a deferred tax asset account with a balance of $68,600 at the end of 2024 due to a single cumulative temporary difference of $343,000. At the end of 2025, this same temporary difference has increased to a cumulative amount of $463,000. Taxable income for 2025 is $824,000. The tax rate is 20% for all years. No valuation account related to the deferred tax asset is in existence at the end of 2024. (a) Record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming that it is more likely than not that the deferred tax asset will be realized. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardManjiarrow_forwardMarin Corp. has a deferred tax asset account with a balance of $80,800 at the end of 2024 due to a single cumulative temporary difference of $404,000. At the end of 2025, this same temporary difference has increased to a cumulative amount of $430,000. Taxable income for 2025 is $801,000. The tax rate is 20% for all years. No valuation account related to the deferred tax asset is in existence at the end of 2024. (a) Record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming that it is more likely than not that the deferred tax asset will be realized. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (b) Assuming that it is more likely than not that $5,200 of the deferred tax asset will not be realized, prepare the journal…arrow_forward

- Cheyenne Corp. has a deferred tax asset account with a balance of $78,400 at the end of 2024 due to a single cumulative temporary difference of $392,000. At the end of 2025, this same temporary difference has increased to a cumulative amount of $482,500. Taxable income for 2025 is $791,900. The tax rate is 20% for all years. At the end of 2024, Cheyenne Corp. had a valuation account related to its deferred tax asset of $47,000. (a) Record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming that it is more likely than not that the deferred tax asset will be realized in full. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation (To record income tax expense) (To adjust allowance account) Debit Creditarrow_forwardCallaway Corp. has a deferred tax asset account with a balance of $150,000 at the end of 2017 due to a single cumulative temporary difference of $375,000. At the end of 2018, this same temporary difference has increased to a cumulative amount of $500,000. Taxable income for 2018 is $850,000. The tax rate is 40% for all years.Instructions(a) Record income tax expense, deferred income taxes, and income taxes payable for 2018, assuming that it is probable that the deferred tax asset will be realized.(b) Assuming that it is probable that $30,000 of the deferred tax asset will not be realized, prepare the journal entry at the end of 2018 to recognize this probability.arrow_forwardBrown Corp has a deferred tax asset account with balance of $80,000 at the end of 2019 due to a single cumulative temporary difference of $350,000. At the end of 2020, this same temporary difference has increased to cumulative amount of $410,000. Taxable income for 2020 is $800,000. The tax rate is 25% for all years. No valuation account related to the deferred tax asset is in existence at the end of 2019. What one of the following is correct about the journal entry to record Brown's 2020 income tax expense? Group of answer choices Dr. Deferred tax asset $15,000 Dr. Deferred tax liability $25,000 Dr. Income tax expense $200,000 Cr. Tax payable $112,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning